Trending

The Nifty 50 Index opened with a gap down at 17,525 with 52 points and closed at 17,604 on Wednesday, August 24, 2022. A total gain of 27 points (0.16%) is achieved. The nearest support and resistance in the next trading session will be 17,390 and 17,717 respectively. The leading sectors were Nifty Realty (1.81%), Nifty Media (1.74%) and Nifty Private Bank (1.59%).

To know better about the market you can check the video provided above that contains Nifty 50 option chain analysis data.

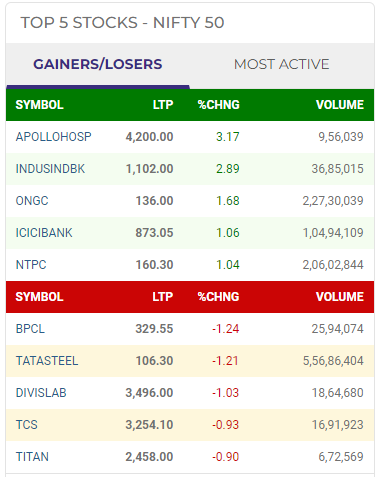

The top Indian stocks that saw a bullish performance as per NSE are:

The Indian stocks that saw a bearish performance along with the Nifty 50 index are:

The Nifty 50 witnessed a Gap down opening based on last day’s data and global cues, yet it was volatile in both the sessions today. After opening at 17,525, Nifty came down and took support at 17,500. The market moved sideways and Nifty gained 17,600. As per the option chain analysis of Nifty 50, it can be seen that the market is moving sideways as option writers are sitting at both sides. As the market is indecisive, it is recommended to step aside from the market for sometime. Tomorrow, the expiry may be volatile and experience a good move for either side. However, the US market and global cues will be playing an important role for tomorrow’s Nifty 50 market.

Investing decisions should be precise and correct as that involves huge sums of money. So if you have to consider a good investment advisor, then you can surely count on Sahil Patel. He has been in the investing business for the last 5 years and will surely help you in your investment decisions.

News Magnify is a digitally focused media company committed to strengthening communities. We touch people’s lives globally by creating engaging content initiating people-first access in news, business, stocks, technology, lifestyle, health, finance, travel, food and entertainment. Despite your identity and location, you can entirely rely on us to achieve updated information on the global happenings.

Looks like you are using an ad-blocking browser extension. We request you to whitelist our website on the ad-blocking extension and refresh your browser to view the content.