Technical Analysis Tools

Technical Analysis Tools That Every Stock Trader Must Have!

- Stocks

Sahil Patil

Sahil Patil- November 26, 2022

- 0

- 13 minutes read

Stock trading is an activity that not everyone can undertake as it requires several skills and an immense amount of patience. Due to wrong practices or decisions, one can risk all their possessions at once in the stock market. Every country and its stock market indices require a special kind of approach and strategy though the fundamentals remain the same. This is why when trading stocks is considered in India then one should have a bunch of tools to make decisions and should especially have technical analysis tools. This is why this article will talk about five technical analysis tools that a stock trader in India must have.

What Is Technical Analysis? Why Are Tools For It Needed?

Technical analysis refers to the act of scrutinising the ways in which supply and demand of any security would impact price fluctuations, the volume traded, and the volatility that it is subject to. It works on the assumption that the previous price changes and historical achievements affect the way any security would perform in the future. In addition, the best trading practices and the rules in different stock exchanges are considered while making such an analysis.

Technical analysis tools are extremely important as they provide several indicators and metrics that are essential for stock trading. They are used to ascertain short-term trading signs that can be used to maximise profits in case one is struggling with trading stocks. However, to use these stock analysis tools properly one must be an experienced trader so that they can understand what these tools are indicating to him. This way they would be able to make better decisions.

Technical Analysis Tools To Use In The Indian Stock Market

Here are some of the technical analysis tools for Indian stocks that you should use. Some can be used by beginners as well, however, mostly we would recommend experienced traders use them for effective results.

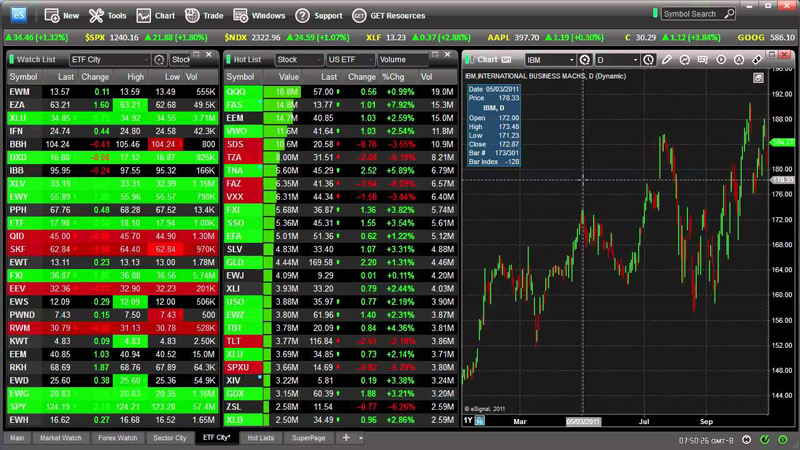

1. eSignal

eSignal is one of the stock analysis tools that suit the Indian stock market well. Stock traders can use this one to build custom indicators. It uses the users’ data from its platform as a base that the programmers behind it use to form indicators. This windows application uses javascript as its scripting language making it simpler to be reformed whenever needed. One of the stock analysis fundamentals is that the trader should be using reliable tools.

This is where eSignal emerges as one of the best technical analysis tools that people can choose. It provides real-time market data along with indicators and even relevant news updates. It is pretty affordable to use as well. In addition, it hosts over 100 indices on its platforms giving one access to several stock and future options including forex trading and ETFs. The platform has its staff working 24×7 for the entire year, which means that any time you face a trouble someone would be available to solve that as soon as possible.

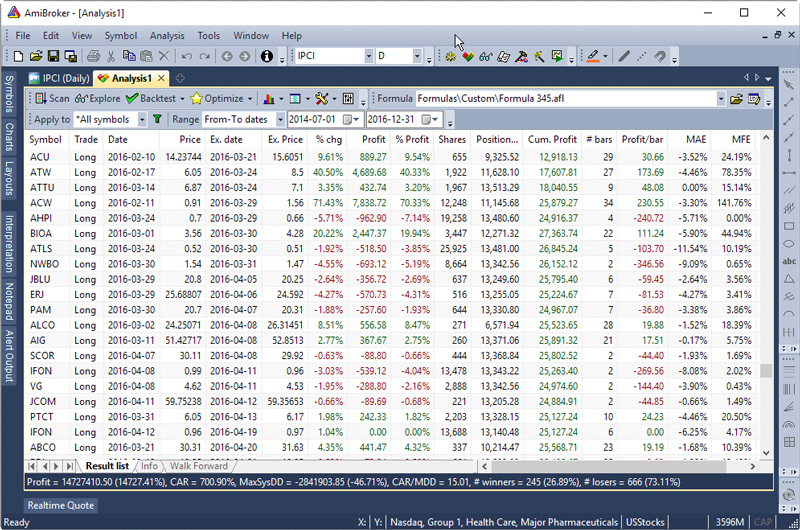

2. AmiBroker India

AmiBroker is one of the most famous stock analysis tools in India. It enables a host of features that you can use to elevate your stock trading experience. It provides things like indicators, back-testing, and a formula language. You can even build your own indigenous trading system by implementing simple codes. It aids in charting and screening stocks. The software is available in India and many other countries and thus is based on high-end technology and harnesses scripts that allow one to use the best of its features.

The products that it offers are AmiQuote and AFL Code Wizard both of which retail for $99. AmiQuote combines stock quotes from different quotes that are accessible via the Internet. This is useful in analysing the actual stock quote at that very moment. Also, one can earn through the small differences in quotes that are prevalent on different trading platforms. In case you want to code and build your own trading system but are having issues coding then you can use AFL Code Wizard, which converts English sentences into code.

3. NinjaTrader

NinjaTrader is one of the best technical analysis tools that are free to use as they do not charge any platform fees. In addition, they allow a demo or stimulated trading experience for those who are new to the domain. One of the important stock analysis fundamentals is that one should not jump into the ocean of stock trading abruptly as becoming a technical analysis trader is not a joke. Therefore, if you are thinking of trading stocks, you can first try the demo version which is absolutely devoid of any costs.

The software, however, cannot be used directly for the Indian stock market as NSE or BSE are not connected to it. However, people can add custom instruments to the platform to obtain technical analysis for it. The steps that one of the consumer care executives wrote in the past for adding custom instruments are:

- From the NinjaTrader Control Center window select the menu Tools > Instrument Manager.

- Press the “New” button.

- Enter instrument-specific information and select the appropriate exchange (add Default exchange for equities in addition to the actual exchange).

- Fill in any relevant information under the “Misc” tab such as symbol mapping for your target connectivity provider.

- Press the “OK” button.

4. MetaStock

MetaStock has been offering technical analysis tools for the last 30 years. It operates in various countries and has been launched by Thomson Reuters Corporation. It provides a line of trading software that can be used for analysing trends ongoing in the Indian stock market and other futures in the world. The software provides information about ‘buy’ and ‘sell’ trading signals based on market trends so that a trader can make an optimum decision.

It is one of the technical analysis tools for Indian stocks that offer a variety of products that people can count on. They offer data on stocks, future options, and even forex. Some stock analysis tools for stock exchanges offered by MetaStock that can be used by Indian traders are:

- BSE India Currency and Interest Rate Derivatives Level 1 (For Residents)

- BSE India Currency and Interest Rate Derivatives Level 1 (For Non-Residents)

- BSE India Index and Equity Derivatives L1 (For Residents)

- BSE India Index and Equity Derivatives L1

- BSE India Indices (For Residents)

- BSE India Indices

- BSE Ltd

- BSE Ltd (Resident)

- National Stock Exchange of India (For Non-Residents)

- National Stock Exchange of India (For Residents)

- National Stock Exchange of India Derivatives (For Non-Residents)

- National Stock Exchange of India Equities (Residents)

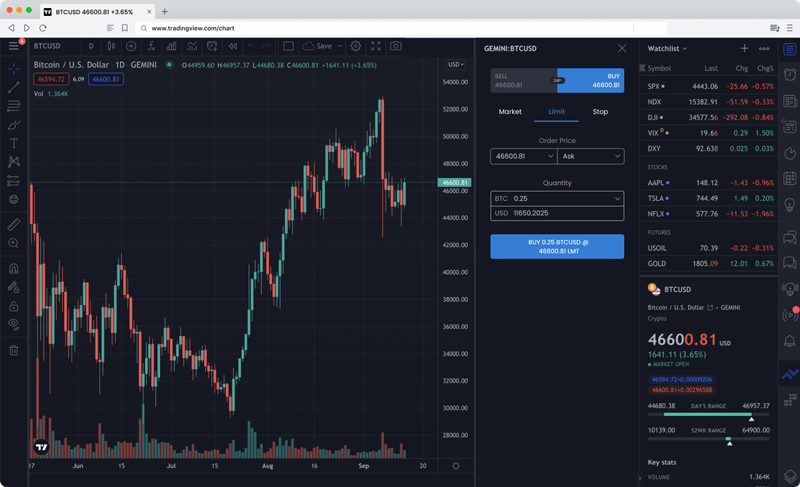

5. TradingView

TradingView is one of the most common technical analysis tools providers in the world. Though the tools are not that advanced they can still help in decision-making both for beginner and expert traders. It enables charting stocks free of cost, which can be a key indicator for trading decisions. In addition, there are three main meters on which the analysis on this site is based. They are Summary, Oscillator, and Moving Average meters, which can aid you in becoming a competent technical analysis trader.

The Summary combines values and indications from both the oscillator and moving averages metres. The MA meter considers the moving average data of different time periods and indicates whether the security is a buy, sell, or hold. If the price of the security in question is higher than the MA value, then it would indicate a buy as the trend would be upwards. The Oscillator meter considers the price volatility and provides data on different ratios and indicators that are used to perform optimum trading activities.

The Ending!

The list of technical analysis tools for Indian stocks has ended but the opportunities for you to make profits from them have still not ceased. Do read up further on these tools and software to choose the one that best suits you. In addition, keep in mind the stock analysis fundamentals during decision-making. Not enough of those fundamentals have been noted here, therefore, research on it further so that you can become an efficient technical analysis trader. Also, we hope that your trading experience is seamless!