Russia Ukraine Conflict: Important Impact On World Finance

- Business Finance

Andrey Ivanov

Andrey Ivanov- February 25, 2022

- 0

- 11 minutes read

Markets at the moment are dominated by headlines around Russia and Ukraine. Now of course any kind of conflict can arise with a terrible humanitarian impact. So let us hope that can be avoided but by looking at precedence from the past we can gauge what could happen to markets if this does escalate. But also which markets could be affected and what the transmission mechanism could be for those markets to be impacted. So here is the Russia Ukraine conflict explained in a bit more detail.

The Russian equity market peaked in October 2021 and if we track single country exchange traded funds since then you can see that it is the country that has decreased the most. Russian equity is down by nearly 30% at the time of writing this. But that is certainly not true of all nations. For instance, one can see that three of the nations like South Africa, Taiwan, and the UK have rallied. But if this conflict does increase into a full out war then we would anticipate fluctuations would spill out further into wider equity markets.

History: Impact Of War On Finances

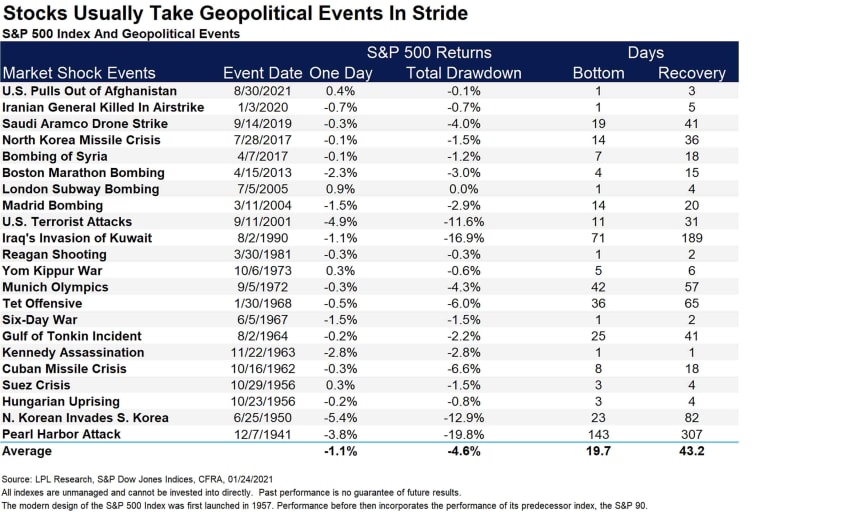

It would be helpful to have a look at the historical conflict to see how they impacted markets in the last scenarios, and some journalists picked up on this table which was published by Keith Lerner. Now what this does is to track the S&P 500 for 1 month, 3 months, 6 months, and 12 months after a given military event.

So it began with Pearl Harbor in 1941 and it traveled through the Iraq war in 2003. But what is truly remarkable is that if we look at the average response to those events they are generally positive. In fact, only three of those events still had a negative effect on markets after a 12 months period. Those are the Suez Canal Crisis in 1956, the Arab Oil Embargo in 1973, and 9/11. So what is it about those events which implied that they were longer lasting than the rest?

According to Lindsey Bell, chief markets and money strategist for Ally Invest,

"Geopolitics rattling markets is nothing new. It's typical that the immediate reaction to geopolitical events is the most dramatic. The good news is that the impact tends to be short-lived, only lasting anywhere from one to three months."

Fast And Slow Response In Russia Ukraine Conflict

It is important to decompose the response to these events into a quick component and also a slow component.

The fast component is described nicely with the example of Pearl Harbor. In this case, it can be seen that the equity share market fell in response to that shock but it only fell for nearly three months and then very quickly recovered. That is the fall in risk appetite which happens to be fairly short lived which is a reply to these scary headlines from the latest Russia Ukraine conflict.

The thing about fear is that if it does not continually get fed by new headlines eventually it dissipates. The Arab Oil Embargo also started with an initial shock which caused markets to fall very sharply and following that there was a slight recovery. But then there was a secondary effect and that was a very negative effect on the United State’s economy because of the greater oil prices that followed that Embargo. Now that made inflations spike and it had very long lasting effects, negative effects on the US economy.

So whenever we witness one of those conflicts, we have got to think about that slow response because that is what is really going to the portfolio of investors.

Russia Ukraine Conflict: Oil And Natural Gas Takes The Spotlight

If the Russia Ukraine conflict is going to create disruptions, it pays to look at what Russia is exporting and where those exports are going. Russia in 2019 exports products and the vast majority of them are energy products. So that includes crude petroleum, refined petroleum, and also coal products. They also exported many industrial metals like Iron, Aluminum, Copper, and also nickel, and also some precious metals like Gold and Platinum.

And if the export destination is tracked by country, Europe dominates their exports. So if there is a disruption, it will be primarily Europe that is affected. Again countries in Asia would also be affected. If we have a look at Russia’s share of total world oil production in 2020 then we can see that it made up 11% of supply. So this is certainly a major player and a disruption that would have big impacts on prices across the globe.

In this Russia Ukraine conflict from a strategic point of view, Russia’s natural gas exports are probably even more crucial compared to their oil exports. That is because they have made up more than 40% of the imports of natural gas in the EU. That is why they have created the Nord Stream 2 pipelines along with the north steam 1 pipeline along the bottom of the baltic and that side stepped Ukraine. So this can increase the supply of natural gas from Russia to Europe.

Now the United States is not too keen on that as it supplies liquified natural gas as it sees Russia as a competitor in servicing that demand from Europe. In fact, in 2019 it branded its liquefied natural gas as freedom gas. Of course, that was the butt of many jokes at the time but the point is they wanted to create a strategic alternative created by an ally of Europe rather than a potential adversary. In contrast to the UK, it is much less heavily dependent on Russian natural gas. In 2020 it only made up nearly 5% of the UK supply. The vast majority arrived from Norway and nearly a fifth of the UK supply arrived from Qatar. Even though the freedom gas of the United States did make up nearly 11% of the supply.

So if the Russian supply was cut out, certainly from the point of view of the UK, we could probably fill the gap.

Russia Ukraine Conflict: Sanctions And Inflation

Another transmission mechanism to markets would be indirect and it would be through the sanctions imposed against Russia. Now, the idea behind sanctions is that it makes it too expensive to even contemplate the prospect of war but of course that comes at a cost not just to Russia but also its trading partner. So one of the suggestions from the US was that they would ban Russia from using the Swift network. Now, this is similar to gmail but for the payment system between banks and they did not really think this through as many European banks have lent money to Russian companies and would not be able to receive payments if they were locked out of Swift and that is what the chair of the Financial Stability Board is saying. Basically, they do not switch Russia off from the Swift network.

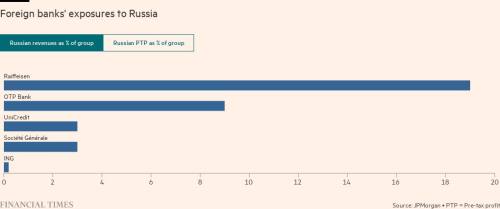

So here are five European banks which have such exposure. These are the banks that have lent money to Russian companies and which would want their money back. And if the Swift network was switched off they presumably could not receive those payments. But what is also worrying is that these banks would form a transmission mechanism from Russia to European banks. And that in turn can create a problem for the European economy. Fortunately, the number of banks is fairly small even though the ECB has asked all banks in the Euro area to declare exactly what exposure they have so that there might be some surprises in store there.

But the latest iteration of sanctions is more targeted. It focuses on individuals mostly oligarchs, but also the primary banks in Russia. So that would be Spur banks, VTB, and Gazprom bank. So by restricting the ability of these banks and people to do business in the West that would effectively be a very high cost for Russia to enter this Russia Ukraine conflict.

Russia also produces very specialized metal exports. For instance, it produces 35% of the global supply for Palladium, and Palladium is used in catalytic converters in cars. It also produces 9% of the platinum supply globally. And again that is also used in catalytic converters. So if these supplies were to be cut that would have an upward price pressure on products like cars and that is one sector where we have seen high inflation in developed markets. And that is probably not a cost that politicians would be willing to pay.

Final Verdict

In Russia Ukraine conflict summary 2022 then, we think the direct effect on the United States earnings but also earnings in other developed markets will be fairly negligible. However, the indirect effect through inflation could be prominent. That is because Russian exports are at the core of this inflationary spike that we have witnessed recently which arrived from energy products but also from used trucks and cars and if the catalytic converters increase in price that would affect the value of new cars as well and that could make t5he inflation situation even worse. And we are not sure about the price that the politicians would be very happy to pay or the markets would be very comfortable with. So that could cause the equity markets to de-rate as it can cause inflation to remain higher for longer.