Go Colors IPO: Will Its Subscription Benefit You Now?

- IPO Stocks

Yaseer Rashid

Yaseer Rashid- November 19, 2021

- 0

- 26 minutes read

The Go Colors IPO status is that it is currently running. Go Fashion operates one of the largest women apparel brands “Go Colors” that focuses on the manufacture of the bottom wears. The IPO has been live for subscription since the 17th of November 2021 and will be available till the 22nd of November, 2021. The Go Colors IPO allotment date is on the 25th of November, 2021.

As per the Go Colors IPO news, the current Go Fashion IPO has been fixed at the price band (Go Colors Share Price) of INR 655-690 having Go Colors IPO Lot Size of 21 shares at the upper end of the price band of INR 1013.6 crores. The Go Fashion IPO is inclusive of a fresh issue of INR 125 crores equity shares, while the offer for sale is up to 12,878,389 shares worth INR 888.6 crores by the existing shareholders and promoters.

Go Colors IPO Grey Market Premium

The GMP or the Grey Market Premium is referred to as the performance of the IPO shares or IPO applications in the unlisted market prior to the listing of the Indian Bourses such as Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). The Go Colors premium on the Grey Market (Go Colors IPO Grey Market Price) on the 16th of November 2021 was over INR 500.

Under the OFS, the VKS Family Trust and the PKS Family trust is going to sell INR 7.45 lakh shares each. The Sequoia Capital India Investments is going to offload 74.98 shares. Simultaneously, the Dynamic India Fund S4 US I is going to disinvest INR 5.76 lakh shares while the India Advantage Fund S4 I is going to sell up to INR 33.11 lakh shares.

As per the company Go Colors, 75% of the issue has been set aside for the Qualified Institutional Buyers (QIB), 15% for the Non Institutional Buyers (NIIs) and the rest 10% for the retail investors. The generated funds will be used for opening 120 exclusive new brand outlets for helping the working capital requirements and for the general corporate purposes.

E-Tail Industry Overview

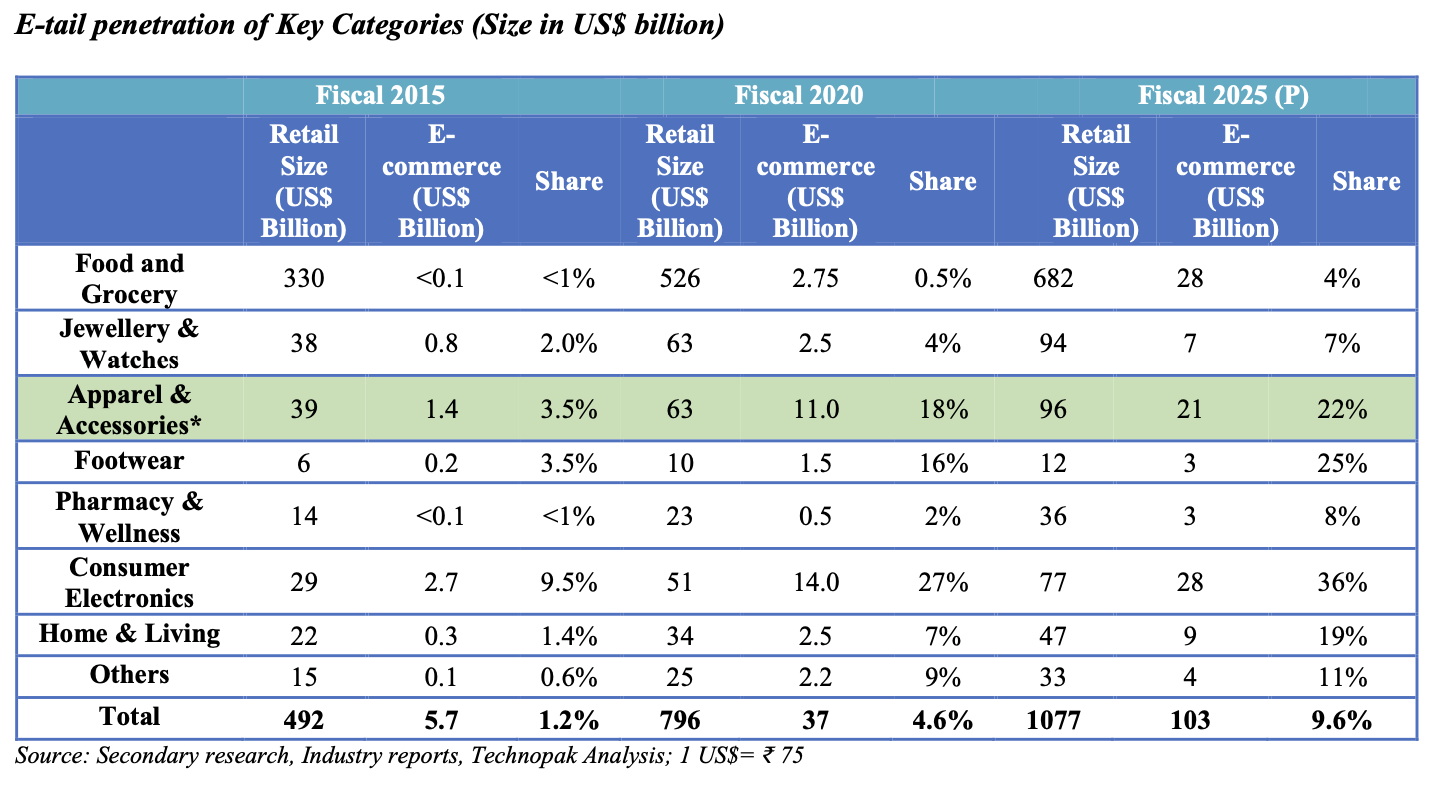

E-tail in the Indian context has witnessed a speedy growth trajectory and is likely to reach 9.9% or INR 780,000 crores of the total retail by the Fiscal Year 2025 as compared to its share of 4.6% or INR 277,500 crores in the Fiscal Year 2020. The growth rate is expected at 23%. Between the years 2015 and 2020, the e-commerce sales have grown at a CAGR of 44%. Back in 2012, the e-tail pie had been INR 4,500 crores which was approximately US$0.6 billion and was limited to the primary categories of Books, Electronics, Music and Stationery catering to about 50% of the pie.

Apparel E-tail Sector

The share of accessories and apparel E-tail sector in the overall retail share has been 3.5% inthe Fiscal Year 2015. It has been estimated that in the Fiscal Year 2020, E-tail’s share in the accessories and apparel had been more than 17.5% and the share is anticipated to reach approximately 22% by the Fiscal Year 2025.

How Is the Indian Women Apparel Market Performing?

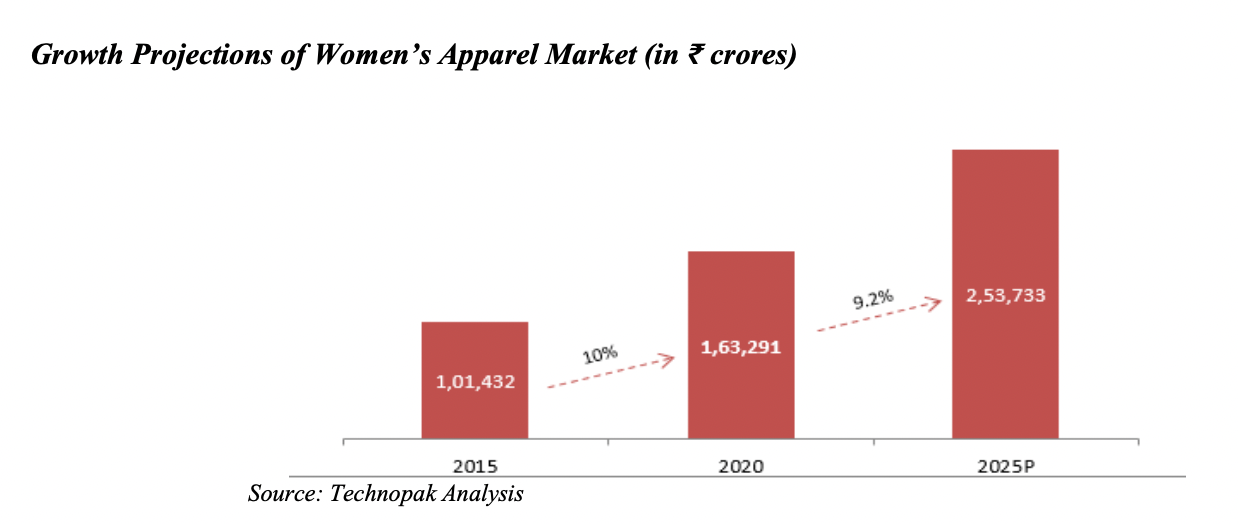

The apparel or clothing market of women has been estimated to be around 36% of the total apparel market of INR 447,666 crores which is US$ 59.7 billion. The 36% is equivalent to INR 163,291 crores, which is approximately around US$ 21.8 billion.

It is anticipated that the apparel market for women is likely to leap from INR 163,291 crores (approx. US$ 21.8 billion) in the Fiscal Year 2020 to INR 253.733 crores (US$ 33.8 billion) by the Fiscal Year 2025. The women’s apparel market is projected towards a growth due to the following factors:

- A rise in the number of working women

- A switch towards the aspiration over the need based purchases

- Innovative design

- A switch from the purchasing separates for mixes and matches over the selection of sets.

How Is The Indian Apparel Retail Market In Respect To Size & Organization Level?

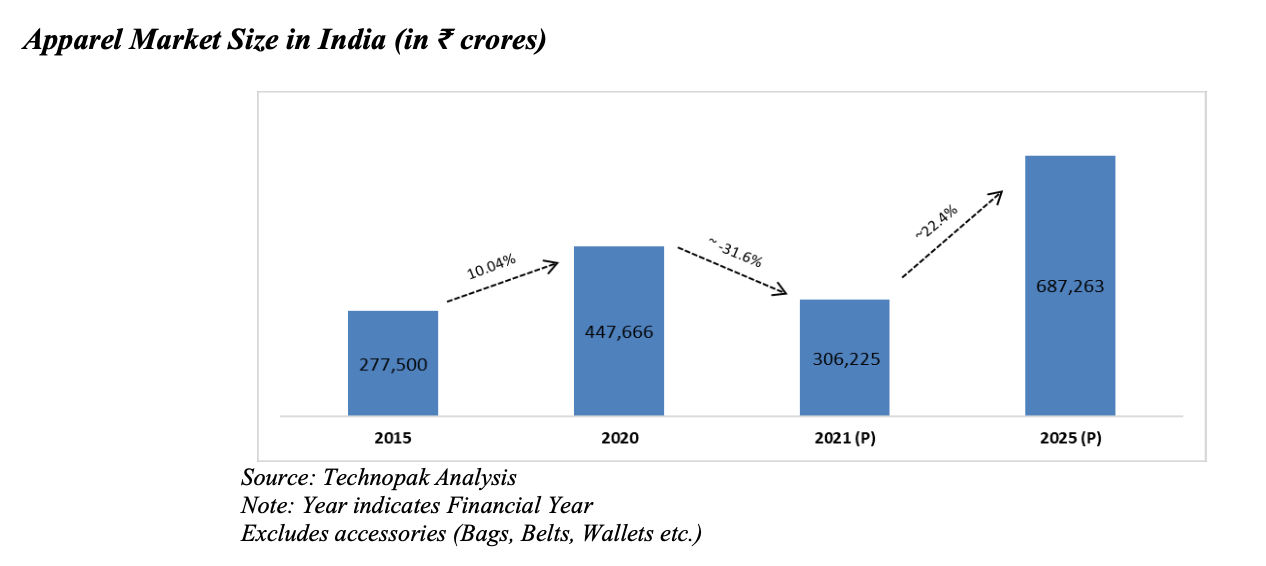

The USA and China are the largest markets globally. However, India stands as the third largest apparel market in the whole world. India shares its position with Germany and Japan in respect to the value. But, the unit consumption of India is estimated to be over 4 times as compared to Japan and Germany. This indicates that the Indian market has been dominated by value fashion.

The clothing market size in the Fiscal Year 2020 had been INR 447,666 crores which accounts to US$ 59.69 billion. This market size is expected to grow at a CAGR of nearly 8.95% between the Fiscal Years 2020 and 2025 to reach INR 687,263 crores (US$ 91.64 billion) by the Fiscal Year 2025. The factors that are likely to contribute to the growth include increasing digitization, higher brand consciousness, increasing urbanization and higher purchasing power.

While the apparel market has degrown enough by nearly 32% to reach a value of INR 3,06,225 or US$ 4.083 billion in the Fiscal Year 2021 owing to the negative impact of the Coronavirus pandemic. However, the market is likely to recover at a bigger rate of 22.4% between the Fiscal Years 2022 and 2025.

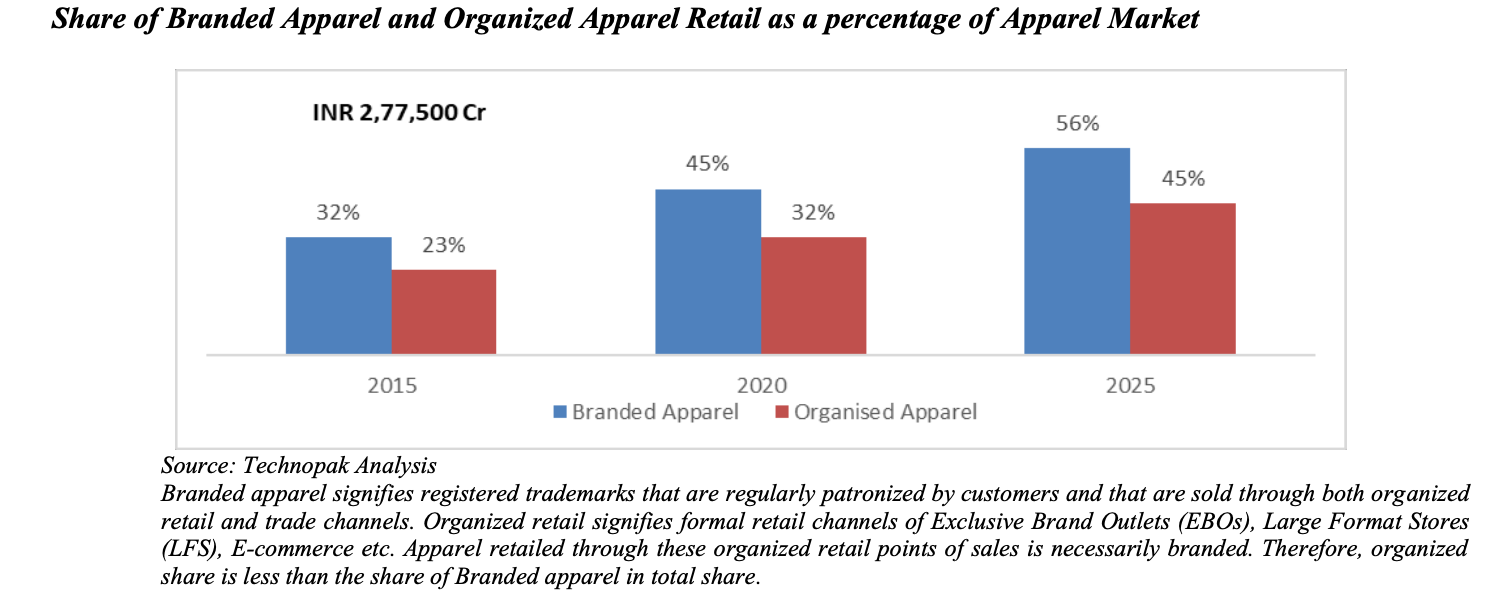

The CAGR of the total clothes market between the Fiscal years 2020 and 2025 is anticipated to be roughly 8.95%, the organized apparel and the branded apparel retail are anticipated to grow at a CAGR of nearly 10% and 11% respectively in the same Fiscal Years. In simple words, the rise of both the branded apparel and organized apparel shares in the apparel category will exceed the overall category growth. The Covid-19 offered a momentum to the growth of e-commerce that is expected to have a significant growth driver for the organized market.

The total organized apparel retail market in the fiscal Year 2020 had been INR 143,429 crores of US$ 191.1 billion that is expected to prosper to INR 309,044 crores of US$ 40.9 billion in the Fiscal year 2025 at a CAGR of 16.4%. The share of organized retail had been 32% (14.5% B&M+18% Ecommerce) in the year 2020. This is likely to grow to 45% (23% B&M+22% Ecommerce) in the Fiscal Year 2025.

How Is The Apparel Market Segmentation Across Cities?

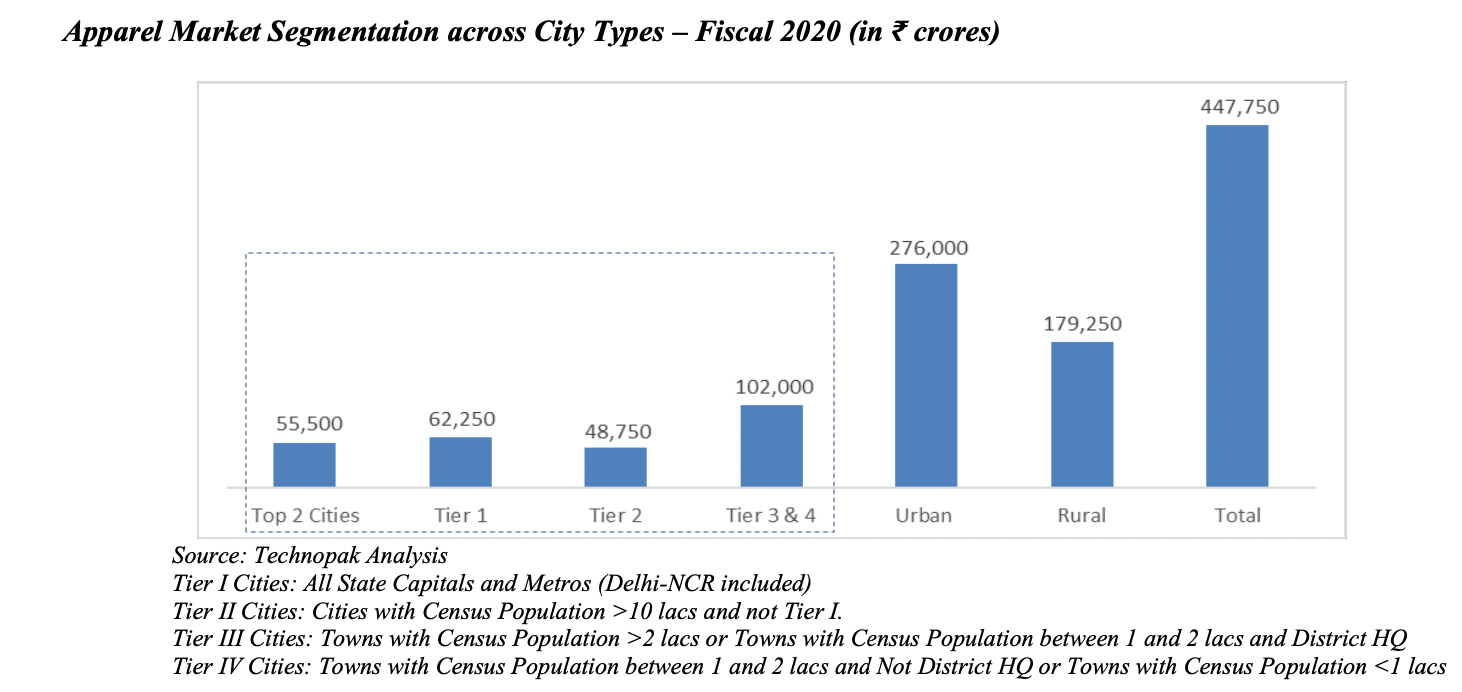

The apparel market in the urban sphere had a share of 60% of the total marketa s compared to the share of 40% contributed by rural India in the Fiscal Year 2020. Nearly 21% of the demand for urban apparel comes from Delhi NCR and Mumbai, These cities are the largest consumers of apparels in India. Whatsoever, a distributive growth across the country has been resulting in the growth of the demand from Tier II, III and IV cities that collectively accounts for 34% of the total demand.

Women’s Apparel Market: Channel Wide Segmentation

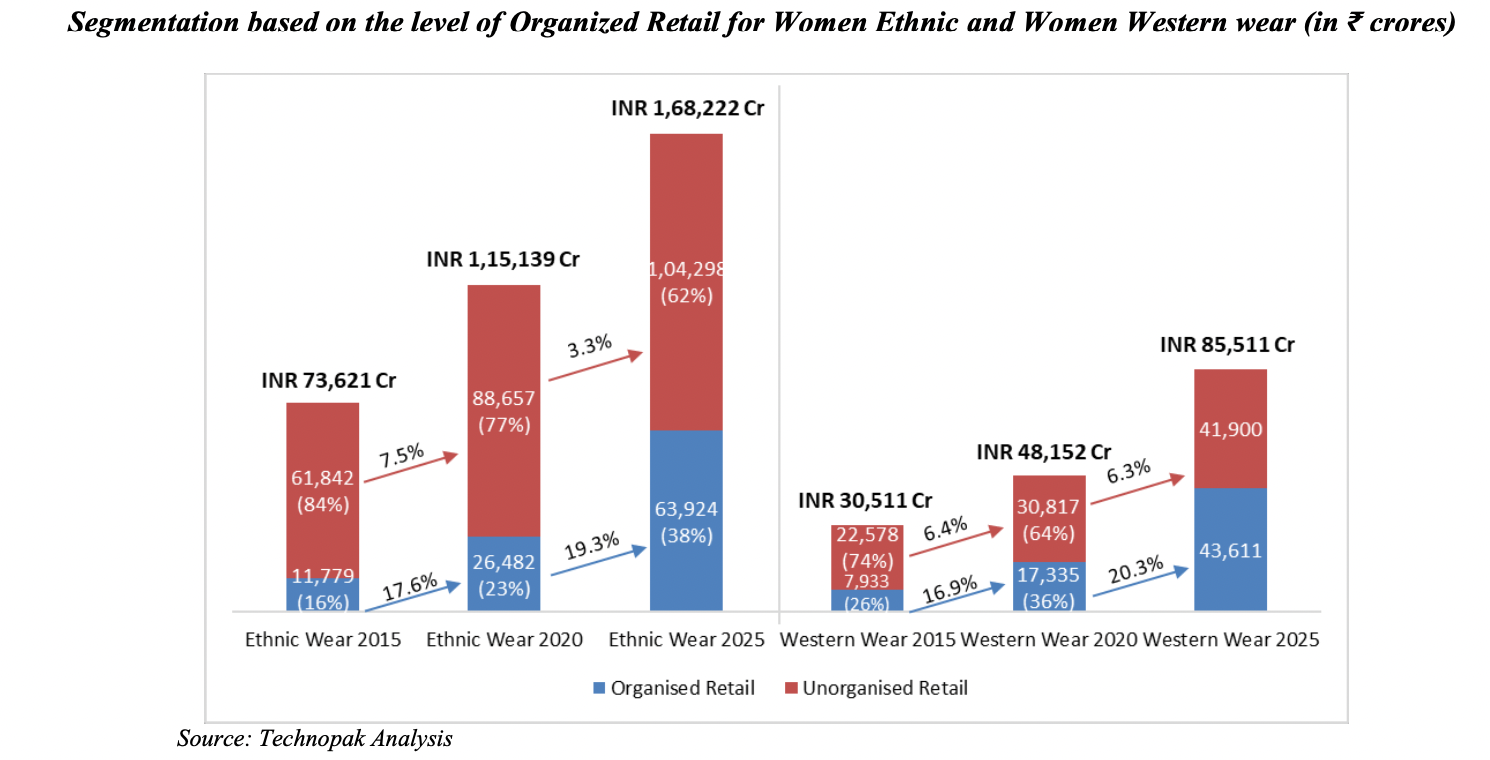

In India, the women’s apparel market was INR 163,291 crores or US$ 21.8 billion in the Fiscal year 2020. The women’s ethnic wear comprised nearly 71% or INR 115,139 crores (US$ 15.3 billion) in the Fiscal Year 2020. The remaining 29% of the market had been made up of western wear that accounts for INR 48,152 crores or US$ 6.4 billion. The highest share of Indian wear in the total apparel is a pretty unique feature of the Indian apparel market.

In the other major apparel markets such as Japan, China, Southeast Asia etc, almost the entire apparel category comprises the western wear products. As a result, the Indian fashion here must be interpreted as the influence of the Indian ethos on the cut, shape, silhouette and raw material used on the apparel. This is, however, not restricted to the p[ower looms but at the same time extends to the handloom fabrics.

The Growth Drivers Involved In The Indian Women’s Apparel Sector

The following are the major growth drivers to be considered in the Indian women’s apparel sector rise:

- Increase in the number of Working Women

- Design Innovation in Women’s wear

- Growth in organized retail offering a great shopping experience

- Use of AI for Style Guidance

- Growing youth population and increasing propensity to spend

How Is “Go Fashion” As An Indian Apparel Brand?

Go Fashion Business is amongst the largest women’s bottom wear brands flourishing in India. The company possesses a market share of nearly 8% in the branded women’s bottom wear market in the Fiscal Year 2020, as stated by the Technopak Report. The company is engaged in the development, design, sourcing, retailing and marketing of a wide range of the women’s button wear products under the brand name “Go Colors”.

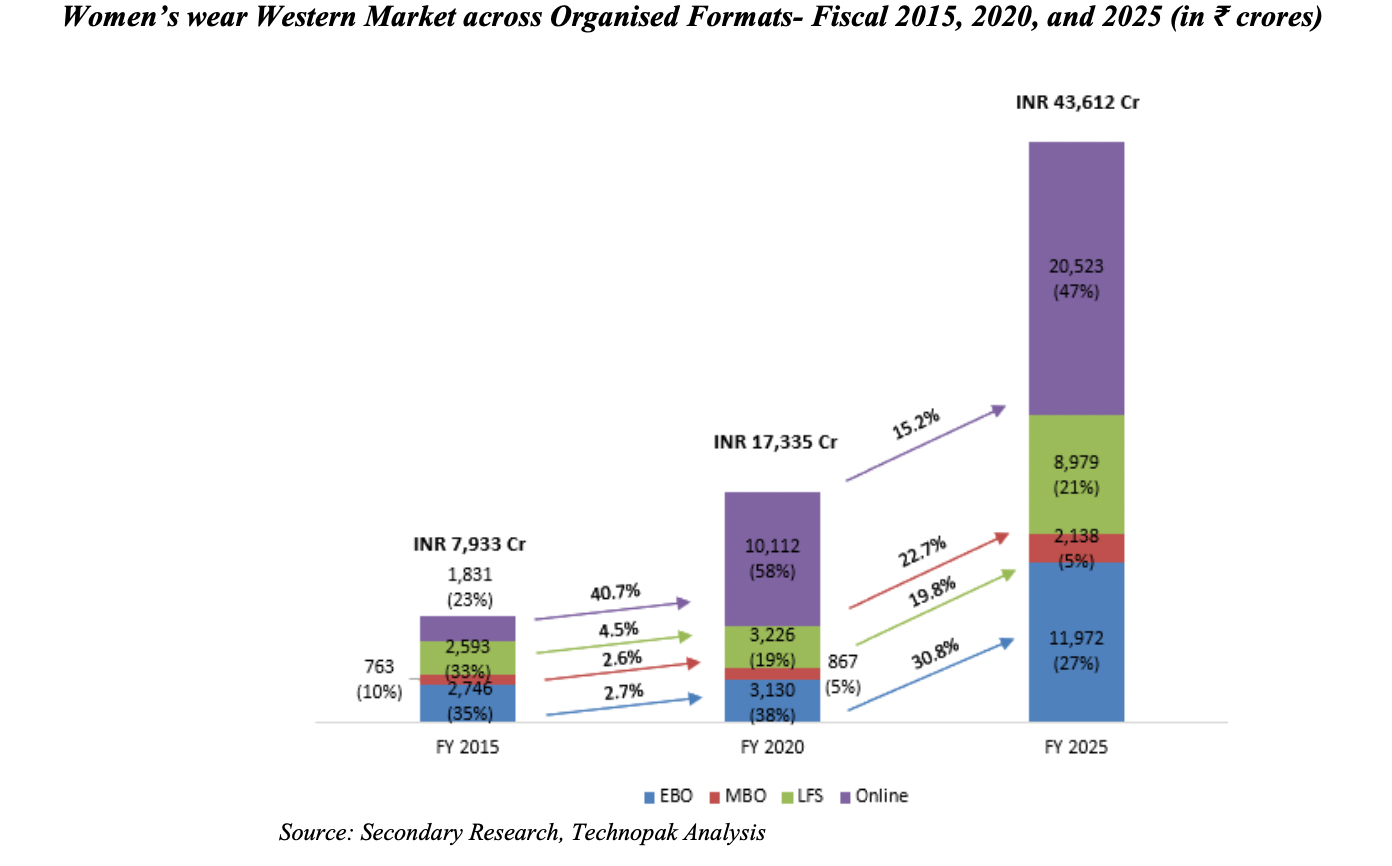

The organized retailing share within women’s apparel has skyrocketed from 19% in the Fiscal Year 2015 to 27% in the Fiscal Year 2020. It is also expected to reach a whopping 42% by the Fiscal Year 2025. This prompt growth has been attributed to a growing female population, evolving fashion trends, increase in the number of working women and the highest spending power of the consumers.

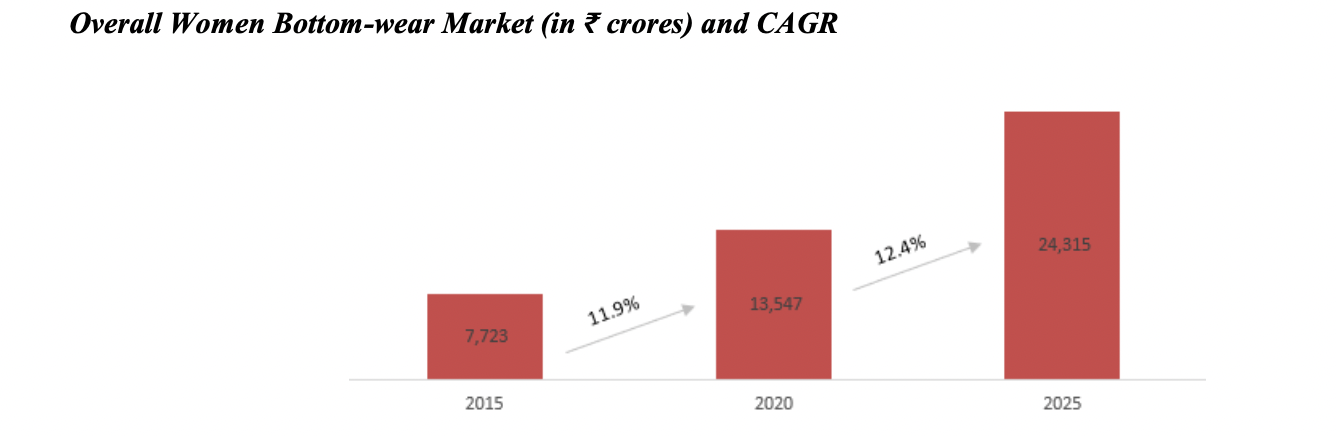

In particular, women’s bottom wear is the quickest growing category in the women’s apparel segment market. It contributes 8.3% of the women’s clothing market amounting to INR 135,470 million in the Fiscal Year 2020. It is expected to grow at a smooth CAGR of 12.35% for reaching INR 243,150 million by the Fiscal Year 2025. The organized share of the women’s bottom wear market has been anticipated to reach INR 92,400 million bearing a share of 38% in the Fiscal Year 2025 that will be in the growing state of 24.3% until 2025.

Go Colors offer one of the diverse range portfolios of the bottom wears for the women to the Indian retailers. Their product has been termed to be one of the best in terms of styles and colours as of July 2021 via Technopak Report.

Go Colours products include:

- Churidars

- Leggings

- Dhotis

- Harem Pants

- Patiala

- Palazzos

- Culottes

- Pants

- Trousers

- Jeggings

The apparel categories Go Colors have included in their business:

- Ethnic Wear

- Western Wear

- Fusion Wear

- Athleisure

- Denims

- Plus Size

- Girl’s Wear

The portfolio of Go Colors can be termed as “universal” and suits every occasion. As of the 31st may, 2021, they sold bottom wear in more than 50 styles and in over 120 colors.

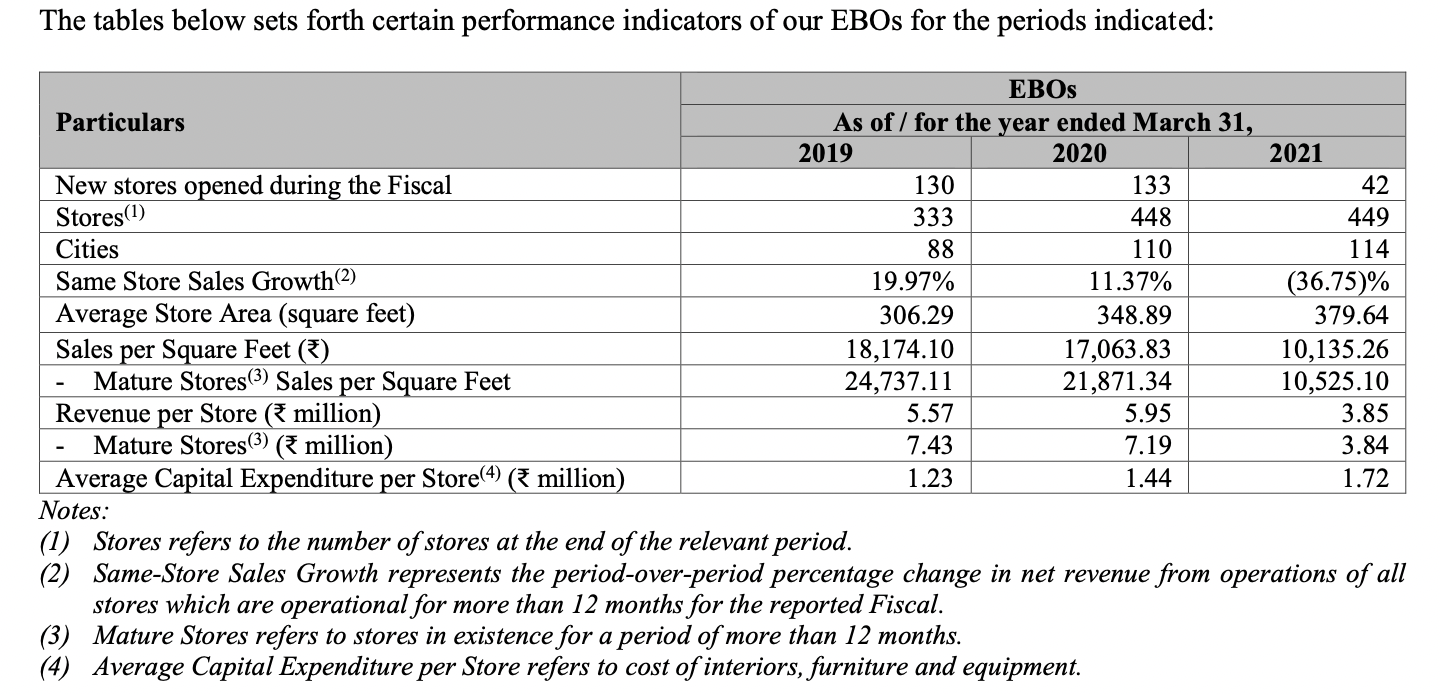

The company states that they serve their customers mainly through their extensive network of 450 brand outlets (EBOS) that includes 15 kiosk operated on a “company owned and company operated” (“COCO”) model and 11 franchise stores that are located across 23 states and union territories in India, as of the 31st May, 2021. Their cluster based approach to opening and operating the EBOs permits them to pursue the COCO model that results in better operational control and higher store profitability.

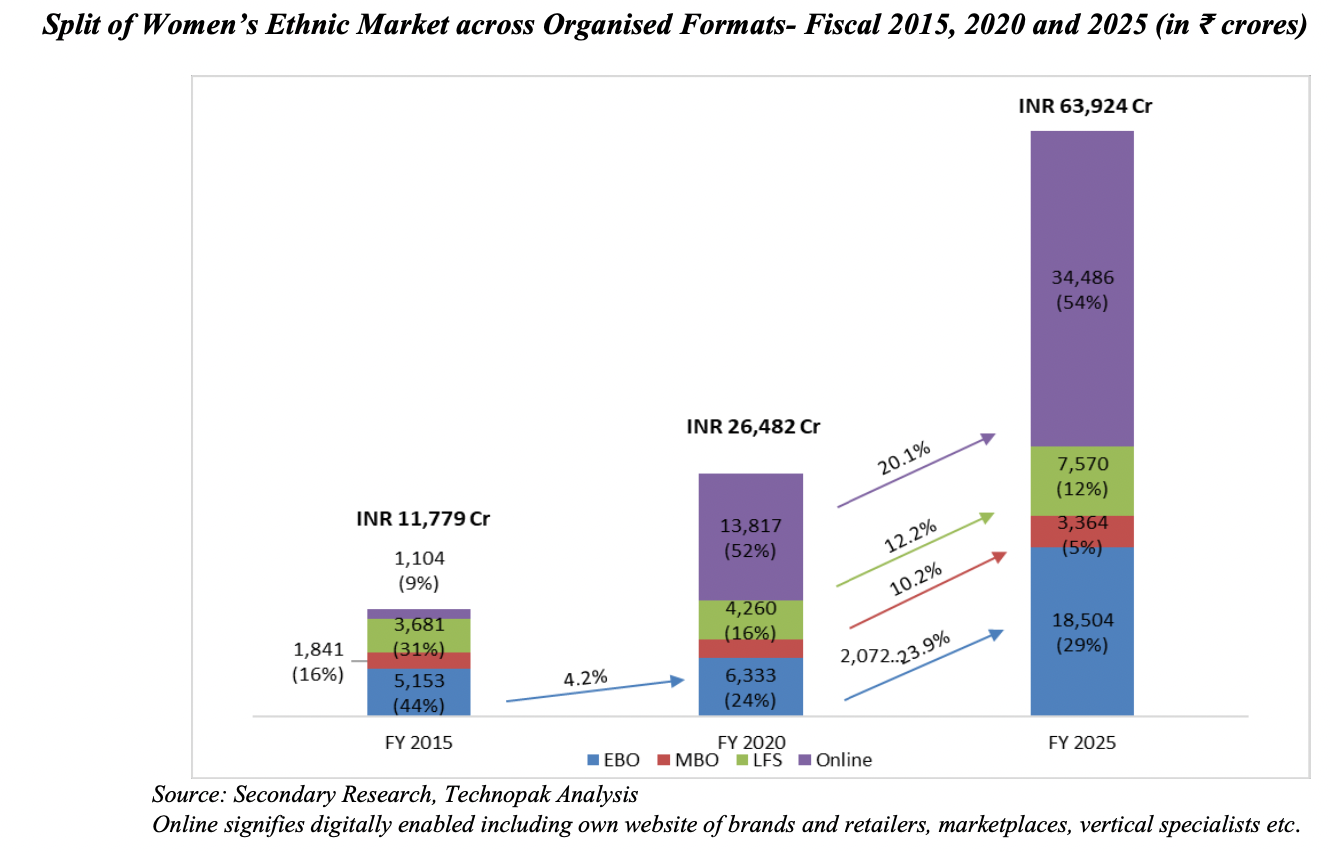

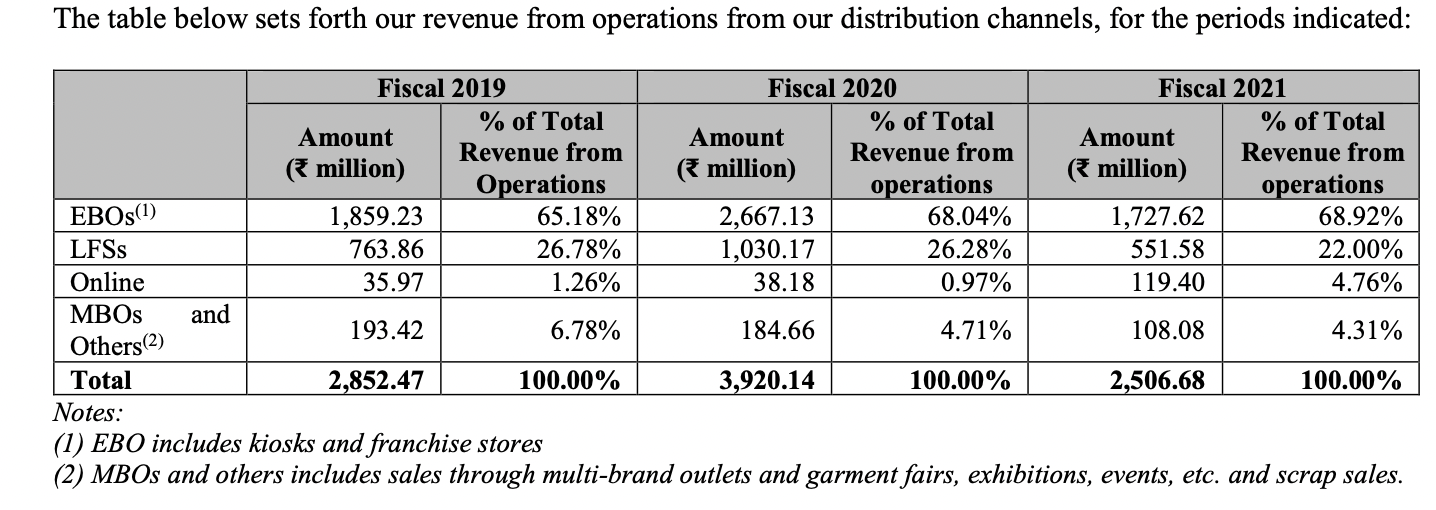

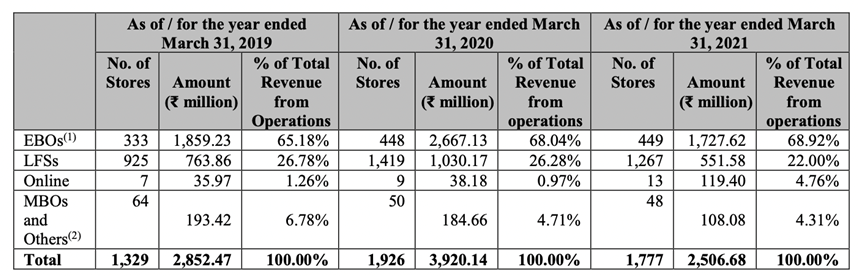

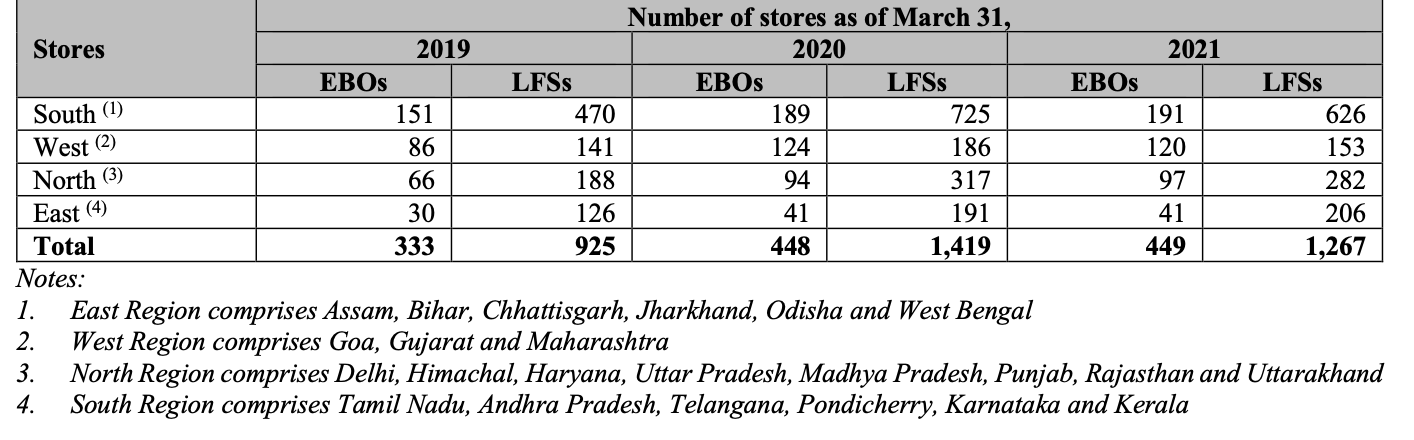

Go Colors’ EBOs are situated in the malls, high streets, large cities, residential market areas in the major metro cities and various other tier II and Tier III cities as well as airports. Additionally, their distribution channels comprise large format stores of LFSs including the Reliance Retail Limited, Unlimited, Central, Spencer’s Retail, and Globus Stores, amongst many. Their LFSs has grown from 925 LFSs as of the 31st of March 2019 to 1419 LFSs as of the 31st of March 2020. This has further increased to 1267 LFSs as of the 31st of March 2021. As of the 31st March, 2021, the company has operated in 1332 such stores. They also sell their products via their own website and online marketplaces and also via the multi-brand outlets (MBOs).

The company states that they directly retail their products to the consumers especially through their network of the EBOs. AS of 31st may, 2021 they have operated 450 EBOs across 115 cities in 23 states and union territories pan India. As of the 31st March, 2021, they had the largest network of RBOs amongst the key women’s apparel brands in India.

Furthermore, as of May 31, 2021, they had also retailed their products via the 1332 LFSs such as the Reliance Retail Limited, Unlimited, Central, Spencer’s Retail, and Globus Stores, amongst many across 499 cities spanning the entire country including 31 states and the union territories. The following table depicts the details of the number of stores and the revenues that are generated from their EBOs, LFSs as well as the online sales for the indicated periods/dates:

How Is The Women’s Bottom Wear Market Doing So Far?

The Women’s bottom wear market has successfully contributed 8.3% of the women’s apparel market that amounts to INR 13,547 crores or US$ 1.81 billion in the Fiscal Year 2020. The women’s bottom wear market is likely to grow at a CAGR of 12.4% to reach INR 24,315 crores of US$ 3.24 billion by the Fiscal Year 2025 and is amongst the fastest evolving categories in women wear.

The company is currently profiling the first movers in various retail sectors that have become synonymous to their current categories. A first mover receives a competitive advantage of being in the first in the market for a service or a product. They are able to create and define the category as well as the rules of play that the other players usually tend to follow as the market keeps expanding. The below chart depicts the profiling of some of the first movers in various retail categories that became synonymous with their categories in the future.

The Board of Directors (BOD) Of Go Colors

Here are the board of directors of Go Colors or Go Fashion that you need to consider before you subscribe for the Go Colors IPO.

Prakash Kumar Saraogi

He is the Managing Director of Go Colors. He is also a promoter for the company who possesses over 28 years of experience in the garment manufacturing, retail industry and fashion industry. He holds a Bachelor’s degree in Chemical Engineering from Anna University, Chennai.

Gautam Saraogi

He is an Executive Director and the Chief Executive Officer of Go Colors. He also acts as a promoter in the company and possesses over 10 years of experience in marketing, consumer retail, garment manufacturing and brand building. He also holds a bachelor’s degree in Commerce from the University of Madras, Chennai as well as an executive diploma in marketing management from the Loyola Institute of Business Administration, Chennai. He had been awarded a token of appreciation for his valuable contribution to the Chennai Retail Summit of 2018.

Rahul Saraogi

He is a Non-Executive Director of the company and also serves as a promoter having over 10 years of experience in the garments industry. He holds a Bachelor’s degree in Science from the University of Pennsylvania, Philadelphia, United States. Additionally, he is the founder director of Atyant Capital Advisors Private Limited.

Ravi Shankar Ganapathy Agraharam Venkataraman

He is a Non-Executive Nominee Director of the company having over 15 years of experience in the private equity funds. He holds a Bachelor’s degree in Computer Science and Engineering from the Indian Institute of Management, Ahmedabad. Additionally, he used to be associated with McKinsey & Company, Inc. However, presently, he is associated with the Sequoia Capital India LLP, where he acts as the managing partner.

Srinivasan Sridhar

Mr. Sridhar is the Chairperson of the Go Colors Board of Directors and also an Independent Director of the company. He possesses a Bachelor’s degree in Science Bangalore University, a diploma in systems management from University of Bombay, Mumbai and master’s degree in science from Indian Institute of Technology, Delhi. He possesses an experience of more than 38 years in the commercial and development banking. He is an associate of the Indian Institute of Bankers. Earlier, he used to be the Chairman and the Managing Director of National Housing Bank and Central Bank of India, the executive director of Export Import Bank of India and was also associated with the State Bank of India. A proud moment was, he had been felicitated with the honorary fellowship by the Indian Institute of Banking and Finance in recognition of his invaluable contribution in the field of banking and finance.

Go Colors IPO Offer

- Issue Size[.] Eq Shares of ₹10(aggregating up to ₹1,013.61 Cr)

- Fresh Issue[.] Eq Shares of ₹10(aggregating up to ₹125.00 Cr)

- Offer for Sale 12,878,389 Eq Shares of ₹10(aggregating up to ₹[.] Cr)

Shareholders of Go Colors

Here is a list of the current shareholders of the company:

- Dynamic India Fund S4 US I

- India Advantage Fund S4 I

- PKS Family Trust

- Sequoia Capital India Investments IV

- VKS Family Trust

The Competitive Strengths of Go Colors / Go Fashion

Below are some of the most competitive strengths of Go Colors knowing which would be easier for you to decide whether or not to subscribe to the Go Colors IPO:

- One of the largest women’s bottom-wear brands in India

- Wide, well-diversified, product portfolio and first-mover advantage

- Multi-channel retail presence across India

- Strong unit economics with an efficient operating model

- Extensive procurement base and automated procurement & supply chain

- In-house expertise in developing and designing products

- Strong financial performance record

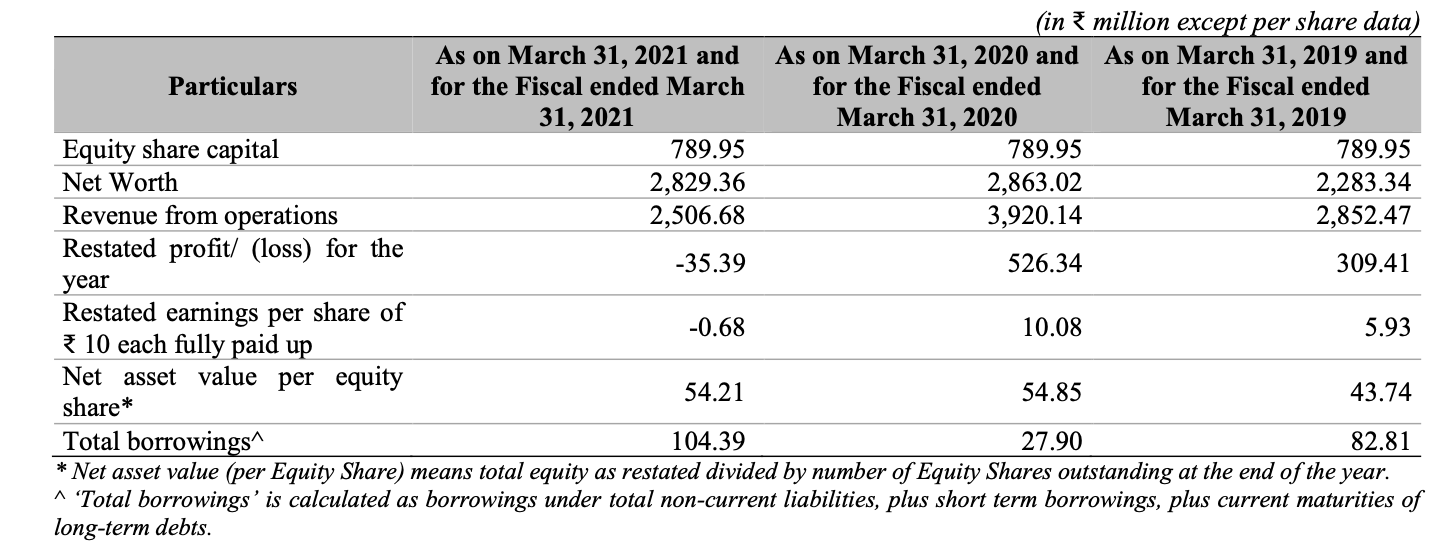

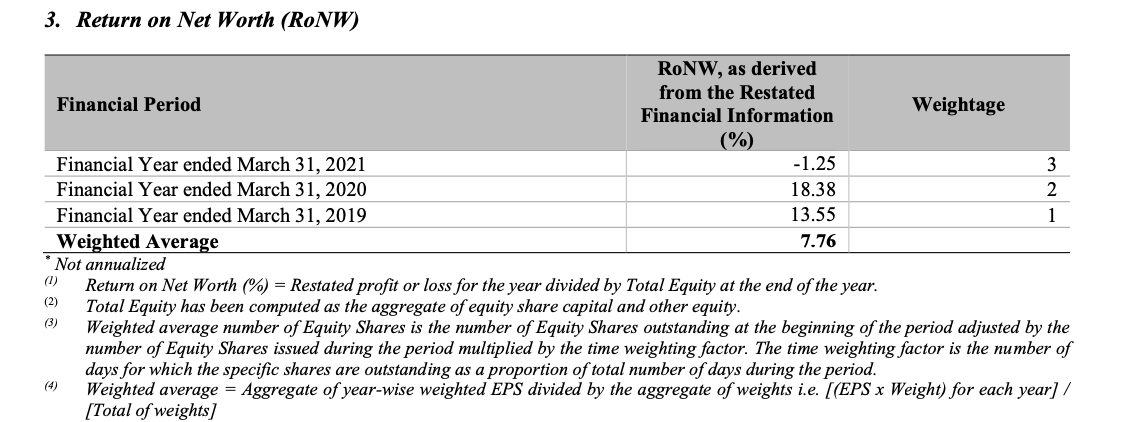

Financial

Verdict

Now, you might have a question, “Go Colors IPO Should I Buy?”. Well, it seems that the Go Colors IPO will be beneficial. The company is good for investments. It can be seen that the IPO may be subscribed 5x to 8x or more by the end. The listing gains can be 3x. There are various reasons that can make this current IPO a grand success.

First and foremost, the company is a growing one and it is a first mover at the same time. This means that the company focuses on a single perspective of apparels (bottom wears) as compared to the other related companies that does not specifically focus on a single aspect of apparels. Secondly, the collection of the company is commendable and they have over 120 colours to choose from apart from a huge variety of cloth material and designs.

Thirdly, they have retail outlets at places with high demographics such as metro cities (Tier II, Tier III and Tier IV), malls, airports and also in the streets. This means that people walking by might take an interest in visiting them. They are also available digitally, via their website. Fourthly, the price of the products falls under the affordable slot. They offer products for both their high-end to medium customers.

Fifthly, the board of directors comprises great reliable people who are highly educated, highly experienced and pro in their respective fields. Sixthly, Go Colors is one of those companies that has an ever growing revenue and profit. They are about to use the funds for setting up 120 more retail stores which indicates more revenue and yet more profit.

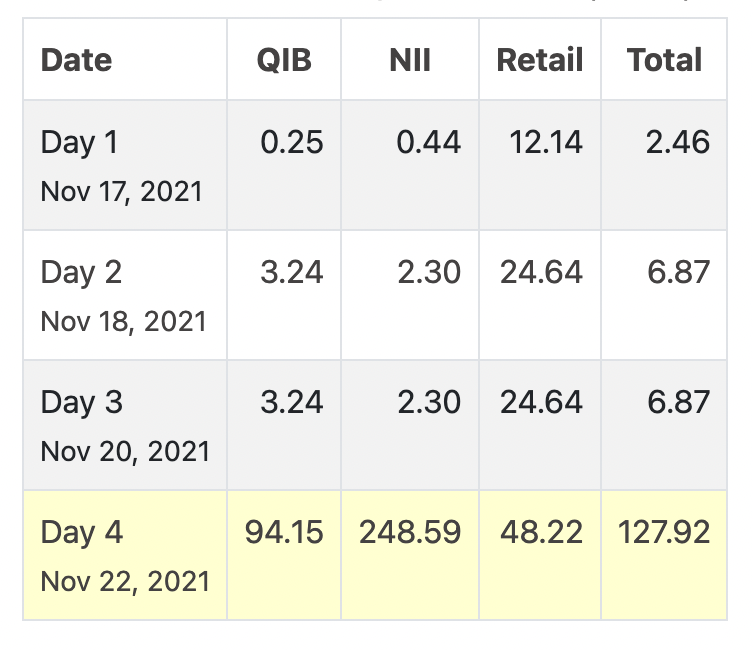

Go Colors IPO Subscription Details