IPO Mistakes

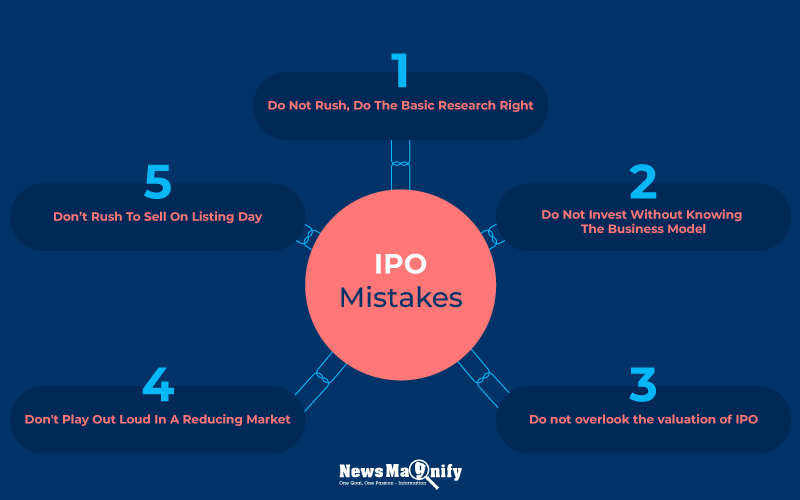

5 Common IPO Mistakes All Retail Investors Should Avoid Now

- IPO Stocks

Sahil Patil

Sahil Patil- June 22, 2022

- 0

- 6 minutes read

The Initial Public Offering (IPO) industry has witnessed a big spike in interest in the past 12 months. Most of the IPOs have been oversubscribed. However, like industry associated investment options, IPO investing as well arrives with its share of obstacles. One among them can be getting lured to heavy listing profits instead of eyeing long term gains. Knowingly or unknowingly, several retail investors fall prey to various IPO mistakes, which otherwise could be avoided easily.

There has been a gold rush in the Indian IPO industry in recent times. Last year, close to Rs 1.2 lakh crore worth of capital was raised by businesses through the IPO avenue. It is prominently greater than the whole capital raised between 2018-2020, which amounted to slightly more than Rs 73,000 crore. E-commerce companies, tech startups, SMEs, and many more have been pioneering the space.

Along with experienced investors, first-time purchasers are also venturing into the space in big numbers. The growing transforming and digitizing fintech area have also elevated the growth saga. In the meantime, it is crucial to have a sound understanding of the market. Just like any financial tool, making sustainable returns from an IPO needs scrutinizing the market scenarios and making informed decisions. In this section below, we will have a look at some of the tips that investors should avoid when they plan for investing in any IPO. These are also the IPO mistakes that investors should be aware of.

IPO Mistakes All Retail Investors Should Avoid

The words of Warren Buffet are true for the stock market in general and since the initial market is also a part of it, this aphorism is ideal for IPOs as well. However, there are so many pitfalls in IPO investing that investors, mainly beginners, find themselves at the earning end. Knowingly or unknowingly, investors do fall prey to these common IPO mistakes which can be ignored easily.

1. Do Not Rush, Do The Basic Research Right

As an initial step to identifying a proper IPO, it is important to conduct in-depth research on the entity. The extent of research should include but not be restricted to the past track record, industry analysis, financial health, competitive intelligence, and many more. Perceptive investors should also search into the future of the entity and its growth roadmap. If you are wondering how to check IPO shares in Zerodha? You will get many guides on the internet.

2. Do Not Invest Without Knowing The Business Model

One should not invest in a business without knowing the business structure at hand. Both established along with a new project need a robust business structure to function. A business structure of a company revolves around knowledge about the items and services, the target audience, and also the future prospect. Having an idea regarding the business structure can help the investor to determine whether the business can earn a profit or not in the foreseeable future.

3. Do not overlook the valuation of IPO

This is another crucial IPO mistake that you should keep in mind. The valuation of an Initial Public Offering is the most important quantitative parameter. It is evaluated with the help of share market trends, discounted cash flow, past financials, performance with regard to peers in the same sector, and many more.

The greater the valuation of an Initial Public Offering, the larger the demand. In the meantime, retail investors should also remember that the valuation of an IPO cannot be the only parameter. There have been several scenarios in the past, wherein despite high valuations in the starting values.

4. Don't Play Out Loud In A Reducing Market

As a rule, one should ignore investing in a reducing market. If the industry is bearish and analysts and other sector experts think that the reduction will continue, one should ignore investing in an Initial Public Offering. There is a high possibility that the IPO would not offer great returns in the near future.

5. Don’t Rush To Sell On Listing Day

Normally, there is a thumb rule to sell on the IPO listing date, as it can offer great returns. However, it has been seen that because of the rush on a listing day, values get corrected. Hence, it is suggested to wait for a day or two rather than sell on the listing day itself.

Takeaway

When you are planning to invest in an IPO, make sure that you think beyond the listing gains. Rather than long term and focus on entities with proper governance and promoters track the record and whose shares are accessible at a “decent” valuation. So in the above article, we have discussed about 5 effective IPO mistakes that all retail investors should avoid committing.