Nifty 50 Today Recovery

Trending

Nifty 50 Today Recovery

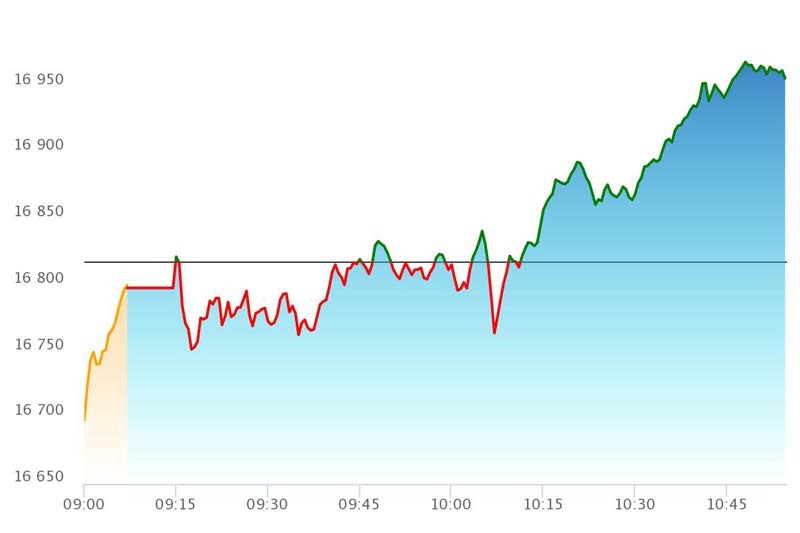

The Nifty 50 today is in the ‘green’ after an array of bearish sessions. However, is it really a time to rejoice? Well, we think that would be too early. The thing to be noted here is that the Nifty 50 today has just rebounded slightly. Moreover, the trend is still not upward. Therefore, we can expect further downtrends as well. But the fact that it is nearing the 17,000 mark again seems promising as well.

This Indian stock market index opened about 20 points lower than the previous close at 16,798.05 on Friday, September 30, 2022. At the time of writing, the index was up by 0.81% and traded at 16,953.70 (gaining 135.60 points). Earlier, on September 28, 2022, the index opened at a gap-down of 136.85 points at 16,870.5, which was the biggest hit as it extended below the 17,000 mark.

In addition to Nifty’s recovery, we even spotted BSE Sensex India to be gaining as well. The Sensex India had increased by 0.77% and traded at 56,843.08 (down by 433.12 points) at press time on Friday. But the trend for it remains bearish as well. Also, the index is far below the 60,000 mark, which is notable

The 50-day EMA of the Nifty 50 Index stood at 17294.14. Since this Indian stock market index is trading below this level, it indicates a bearish trend. The 20, 100, and 200-day EMAs, on the other hand, indicate a strong bearish trend. Therefore, this slight recovery is literally of not that importance as until and unless the index breaks the 50-day EMA level, the downtrend will persist.

The five top Indian stocks out of the 34 stocks that are advancing the Nifty 50 today have been listed below.

Oil & Natural Gas Corporation Limited (NSE: ONGC) saw its stock increase by 3.24% and trade at ₹130.75 (up by 4.10 points) at press time in the trading session today. The total trade volume was 1,84,67,743, which was worth ₹24,104.10 lakhs.

Power Grid Corporation Of India Limited (NSE: POWERGRID) saw its stock increase by 3.37% and trade at ₹215.00 (up by 7.00 points) at the time of drafting this article in the trading session today. The total trade volume was 2,72,73,491, which was worth ₹58,602.55 lakhs.

Hindalco Industries Limited (NSE: HINDALCO) saw its stock gain by 2.79% and trade at ₹381.55 (up by 10.35 points) at the time of writing in the trading session today. The total trade volume was 66,81,175, which was worth ₹25,390.47 lakhs.

Kotak Mahindra Bank Limited (NSE: KOTAKBANK) saw its stock rise by 2.06% and trade at ₹1,801.75 (up by 36.45 points) at the time of reporting in the trading session today. The total trade volume was 10,37,282, which was worth ₹18,475.96 lakhs.

Ultratech Cement Limited (NSE: ULTRACEMCO) saw its stock go up by 2.03% and trade at ₹6,301.05 (up by 125.15 points) at the time of writing in the trading session today. The total trade volume was 1,53,770, which was worth ₹9,637.69 lakhs.

The Nifty 50 today started slow but then acquired a gaining momentum. If it is able to maintain this then the situation might change for the stock market. However, the stock market conditions are extremely volatile and bear dominated, it is uncertain what will happen next and whether these Indian stock market indices recover.

Investing decisions should be precise and correct as that involves huge sums of money. So if you have to consider a good investment advisor, then you can surely count on Sahil Patel. He has been in the investing business for the last 5 years and will surely help you in your investment decisions.

News Magnify is a digitally focused media company committed to strengthening communities. We touch people’s lives globally by creating engaging content initiating people-first access in news, business, stocks, technology, lifestyle, health, finance, travel, food and entertainment. Despite your identity and location, you can entirely rely on us to achieve updated information on the global happenings.

Looks like you are using an ad-blocking browser extension. We request you to whitelist our website on the ad-blocking extension and refresh your browser to view the content.