Trending

The Nifty 50 Index opened with a gap up at 17711 with more than 150 points and almost closed at 17,659 on Thursday, August 11, 2022. The nearest support and resistance in the next trading session will be 17,560 and 17,717 respectively. The leading sectors were Nifty PSU Bank (2.38%), Nifty IT (1.79%) and Nifty Financial (1.57%). While the Sensex closed at 59,332.60 gaining a profit of 515.31 points (0.88%).

To know better about the market you can check the video provided above that contains Nifty 50 option chain analysis data.

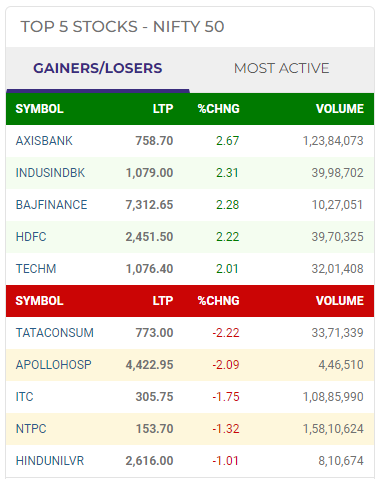

The top Indian stocks that saw a bullish and bearish performances as per NSE are:

The Nifty 50 witnessed a sideways to downtrend movement based on today’s intraday perspective. A big move was estimated to happen on either side in the coming trading sessions where it is anticipated that the move will come upside. The anticipation was almost accurate and it is still at daily trendline from where it took rejection 3-4 times. Today’s data analysis states that the bulls have complete control over the Nifty50 market. If the Nifty breaks 17,171, we can further see a bull rally.

Investing decisions should be precise and correct as that involves huge sums of money. So if you have to consider a good investment advisor, then you can surely count on Sahil Patel. He has been in the investing business for the last 5 years and will surely help you in your investment decisions.

News Magnify is a digitally focused media company committed to strengthening communities. We touch people’s lives globally by creating engaging content initiating people-first access in news, business, stocks, technology, lifestyle, health, finance, travel, food and entertainment. Despite your identity and location, you can entirely rely on us to achieve updated information on the global happenings.

Looks like you are using an ad-blocking browser extension. We request you to whitelist our website on the ad-blocking extension and refresh your browser to view the content.

1 Comment

Very good write-up. I absolutely appreciate this site. Thanks!