Upcoming Go Air IPO Announced: Will It Make You Buy?

- IPO Stocks

Yaseer Rashid

Yaseer Rashid- December 8, 2021

- 0

- 32 minutes read

The Upcoming Go Air IPO was earlier announced to be live on the 8th of December 2021 (Go Air IPO Launch Date) that was mentioned to end on the 10th of December 2021. Go Air is about to raise INR 36000 Millions via its IPO. The company has rebranded itself as the “Go First” as a part of its preparation for the Initial Public Offering or IPO. The retail portion of the IPO is 10%. The QIB is 75% while the NII is 15%. Here are all the GO Air IPO Details. We will update all the details including the price band and lot size as the IPO goes live.

Airlines Industry Overview

The economic overview of the aviation industry has been such that over the last twenty years, India has been one of the fastest growing economies globally. There has been a recession in 2020 due to the serious Covid-19 pandemic. Despite this, India’s economy had been expected to rebound strongly in 2021 and thereafter it will resume a growth at around 7% per annum until at least 2025. As per the IMF forecasts, the GDP growth rate of India is likely to surpass that of China between the years 2021 and 2025. It will be around double the global everage.

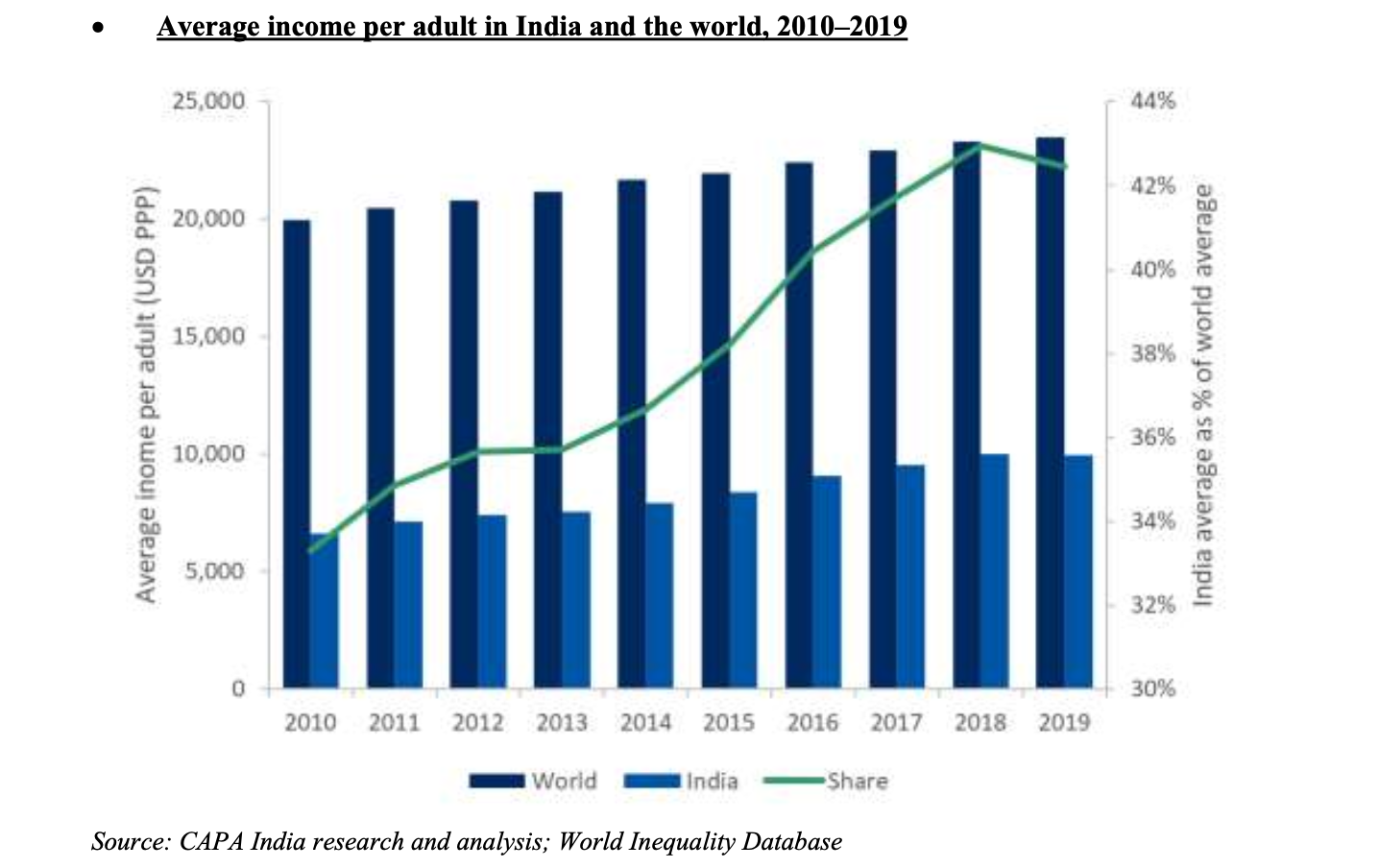

The Economic Growth Will Drive Higher Income Levels And Consumption

Considering the strong GDP growth, the average income of each adult has been increasing much faster than the global average. As per the World Inequality Database, the average income per adult or the USD PPP Dollars in India has risen at a CAGR of 4.6% between the years 2010 and 2019 to reach a height of USD 9,971. Back in 2009, the average PPP Income in India had been equivalent to 32.5% of the total world average. However, this has risen to 42.5% in 2019.

The Average Income Per Adult In Indian and Globally (2010-2019)

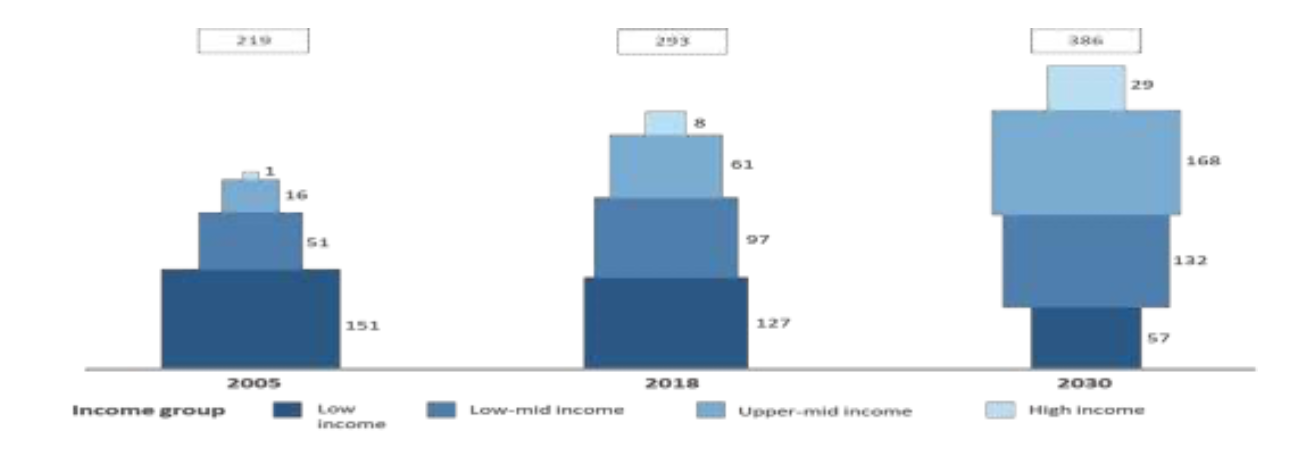

The population share categorized as low income has been expected to lower from 43.3% in the year 2018 to 14.8% by 2030. The high income households are projected to flourish at a CAGR of 11.3% between the years 2018 and 2030, the fastest rate of all the income categories have been followed by the high mid income households at 8.8%. Owing to this, the number of the high and the upper mid income households as a proportion of the total will more than double from 23.5% in 2018 and to 51.0% in 2030, making them the largest income category.

The Number of The Indian Households across the Income Groups (In Millions, 2018)

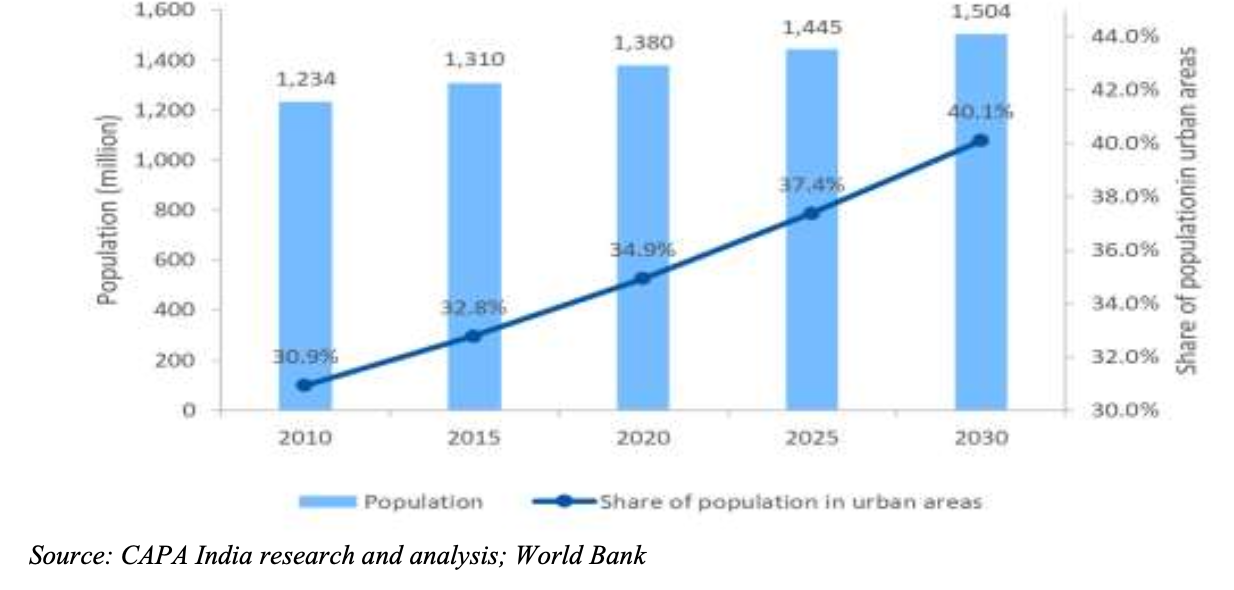

Population And The Share Of The Urban Areas Of Population (Fy2010-Fy2025)

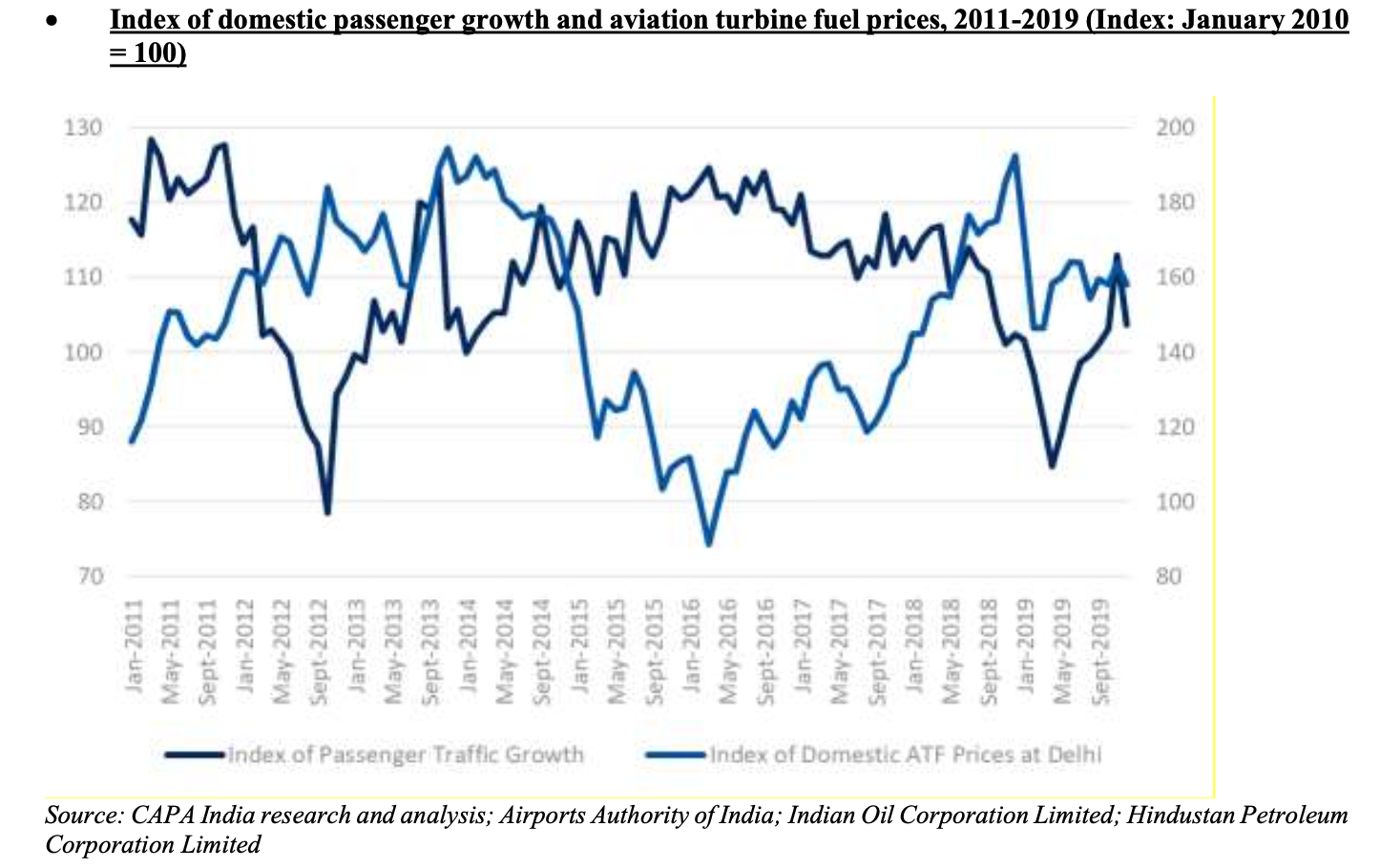

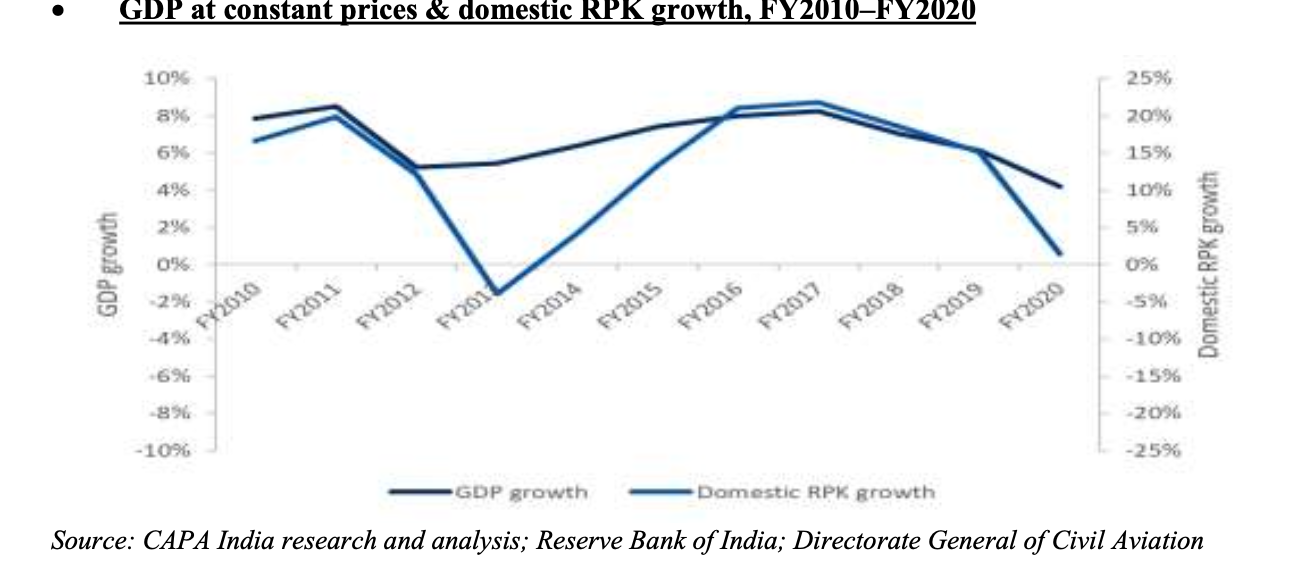

Longest time, the air traffic had been firmly correlated to GDP. Although the fuel prices, the supply side and the several other external shocks might cause short term disruption. Over the past decade to the Financial Year 2020, there existed a very strong positive correlation between the GDP growth and the domestic revenue passenger kilometers of RPKs in India. This had mirrored the relationship observed globally over a couple of decades. Over the past two decades, the Indian domestic traffic had grown on an average at nearly 1.8 times the GDP growth.

However, there existed a couple of supply side issues like the airline capacity that can have a negative impact on the traffic in the individual years. For instance, the exit of the Kingfisher Airlines had resulted in the negative growth in the Financial Year 2013. On the contrary, the Jet Airways’ closure had led to the subdued growth in the Financial Year 2020.

The fuel prices are a different exogenous factor that can also have an impact on the demand. The fuel is the single largest operating expense for all the airlines operators where the carriers must partially or fully pass on increases in the fuel costs to the passengers in the form of steep airfares leading to a decline in the traffic. Also, the reverse can be true. The below figure displays how the passenger growth tends to flow in reverse correlation to the fuel prices.

The Upside Potential In the Global Travel Amongst The Indian Nationals

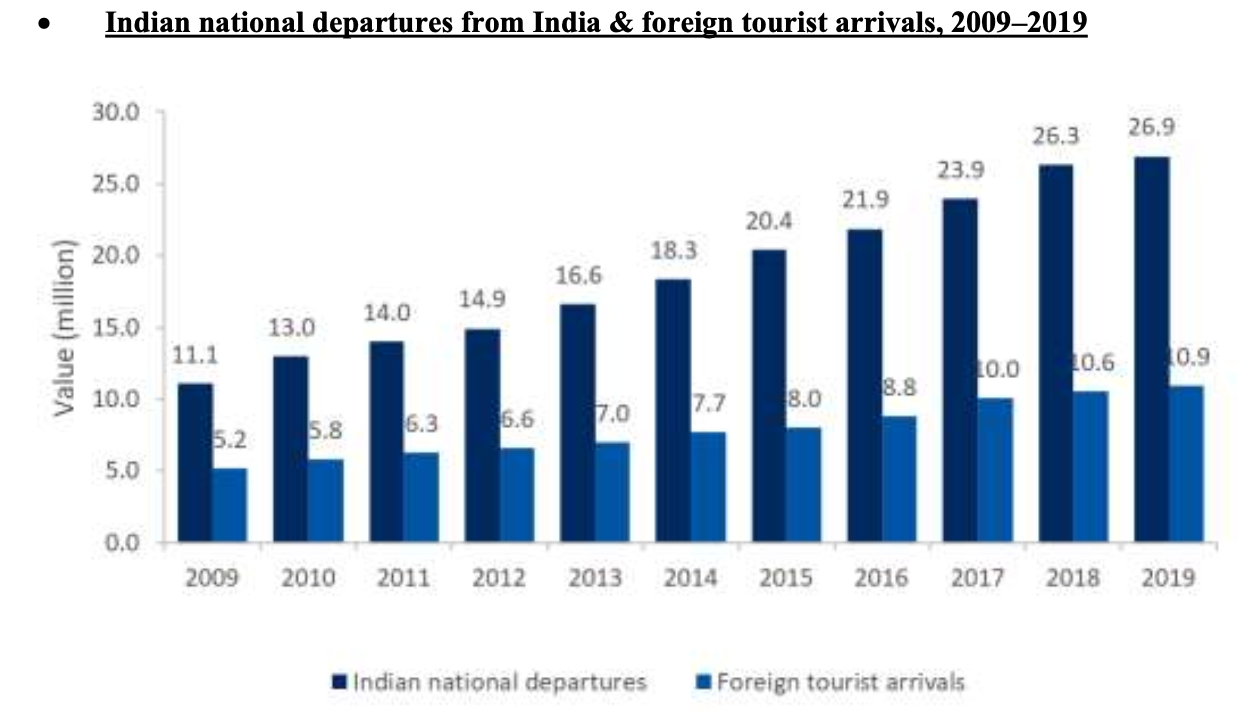

There is a heavy demand from the foreign and Indian nationals in the international market. But as of now, only an insignificant Indian population travels overseas. This indicates a strong upside potential.

In the past decade till 2019, the international departures by the Indian nationals have significantly increased at a CAGR of 9.3% for reaching 26.6 million. Simultaneously, the foreign tourist arrivals have seen a major growth at a CAGR of 7.8% to reach 10.9 million. The split of the outbound and inbound travel has been evenly balanced as a sizable share of the Indian national departures that comprise the Non-Resident Indians. However, a variety of segments will drive International travel.

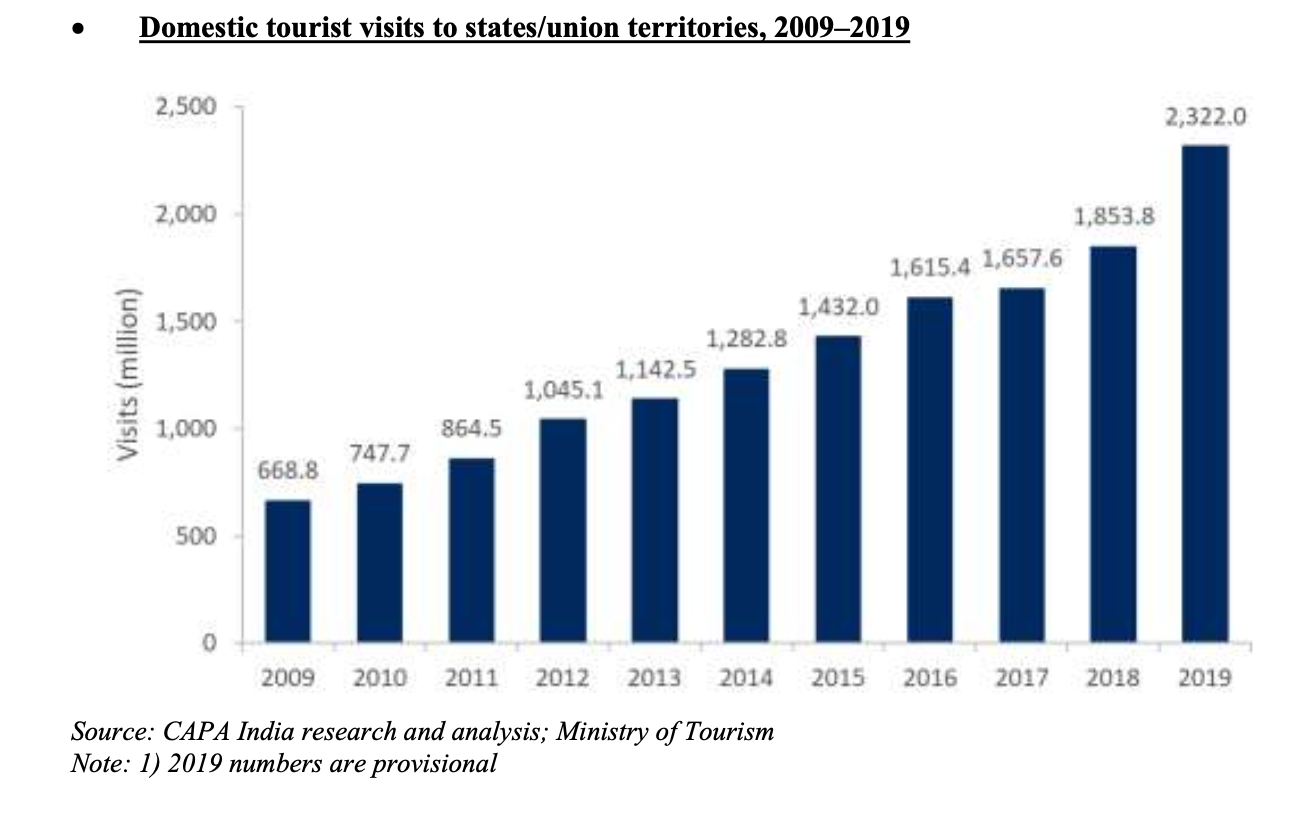

The domestic tourism has increased at a CAGR of 13.3% in the past ten years till 2019 for reaching 2.322 billion having a particularly strong year-on-year growth of 25.3% in 2019. The states that experienced the highest number of the visits were:

- Uttar Pradesh (23.1% share of the total)

- Tamil Nadu (21.3%)

- Andhra Pradesh (10.2%)

Domestic Tourist Visits To States/Union Territories, 2009–2019

The Indian Aviation Market: An Overview

In the past couple of years, India has been the world’s fastest growing large aviation market. Considering the ten largest aviation markets in the world, that has been measured by the total weekly seats deployed as at the end of December 2019, India stands as the fastest growing over the earlier four years. Bearing a CAGR of 12.1%. As a result of this, India has improved its ranking from the sixth position that it held in 2015 to become the third largest market in 2019 in absolute terms, thrashing behind China and the USA.

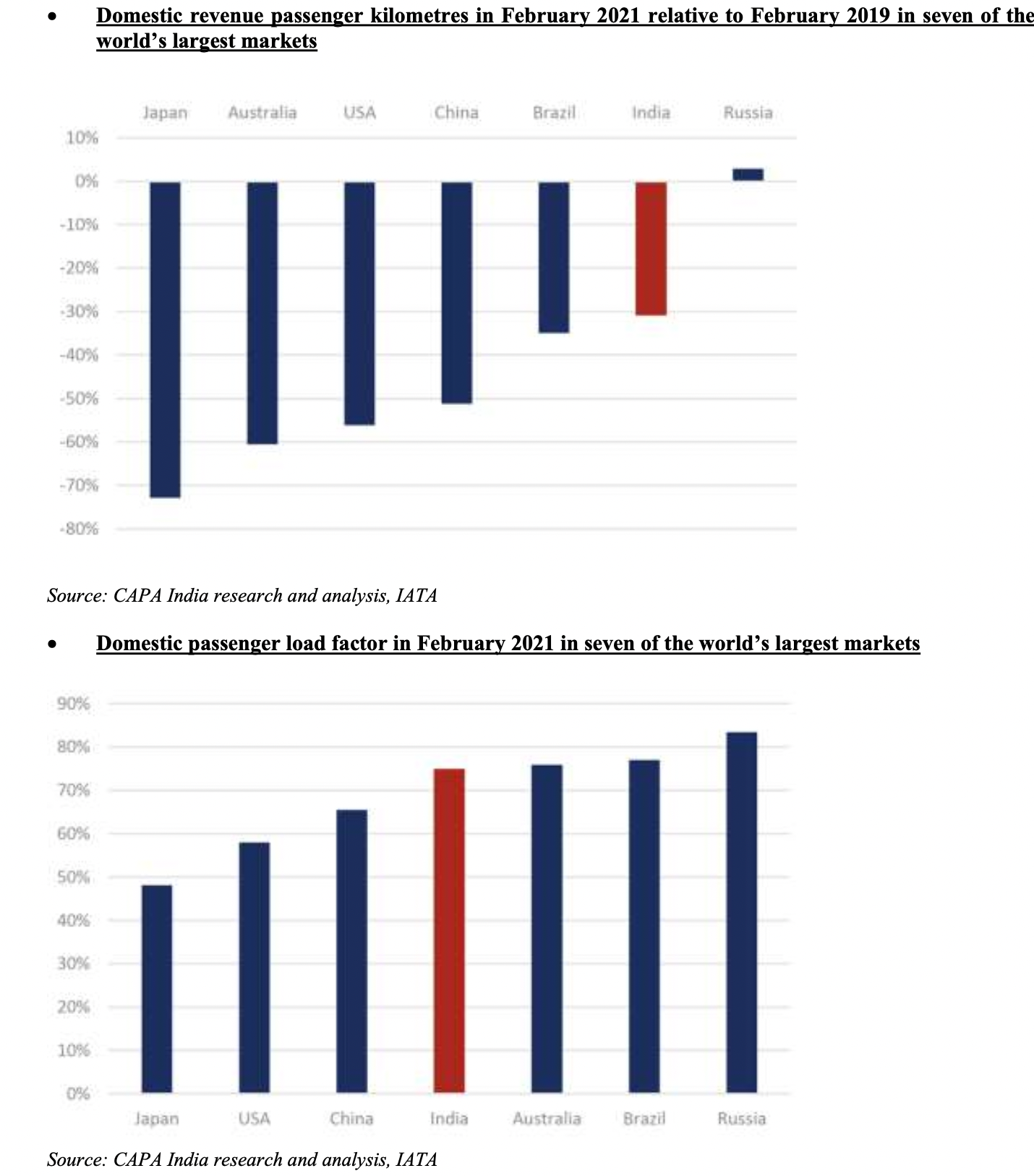

There had been a massive slowdown in the aviation industry during 2020 owing to the Covid-19 situation. Despite this condition, India has continued to rank third in the world depending on the total seat capacity as at the end of December 2020. This reflected the positive recovery in the domestic aviation activity that are relative to most of the other global markets.

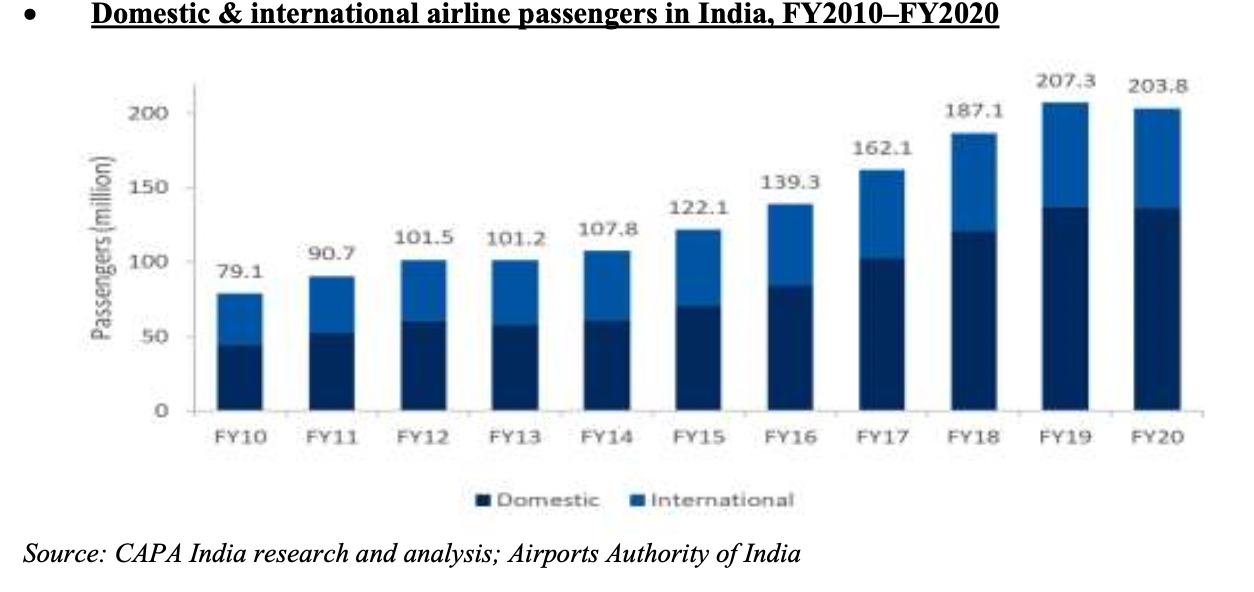

The Industry Deregulation In The Second Wave (From FY 2004) Has Successfully Transformed the Shape & Size Of The Indian Aviation

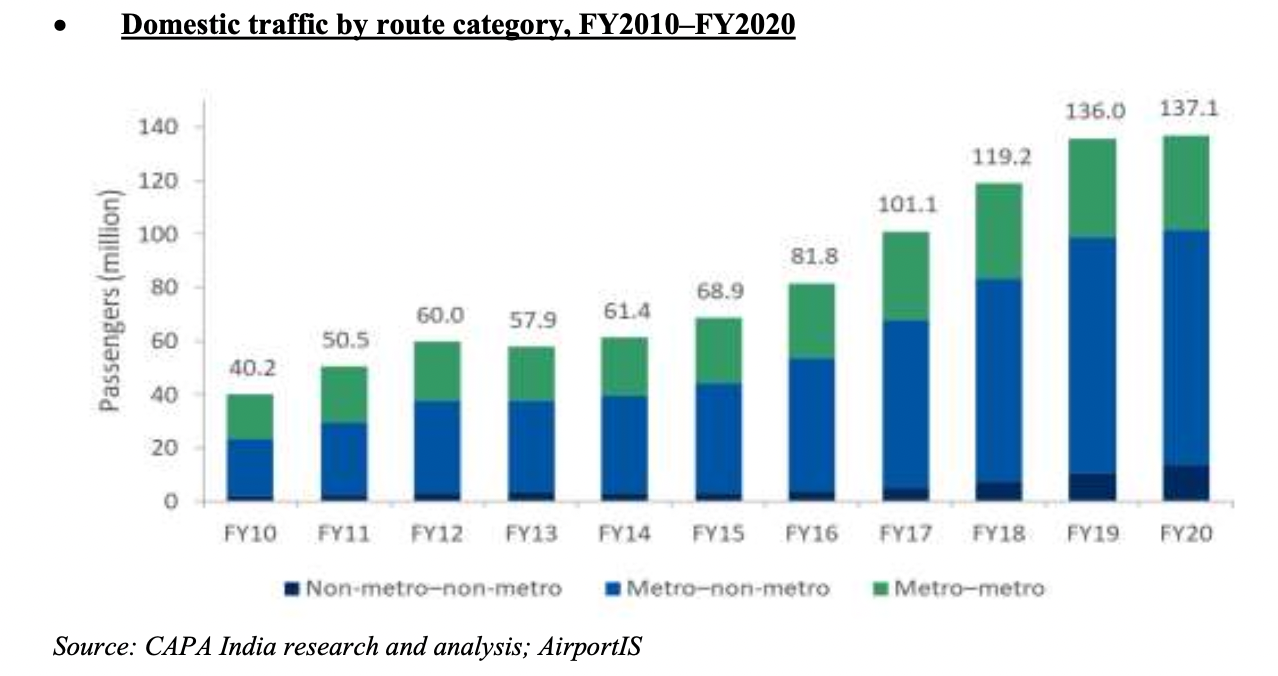

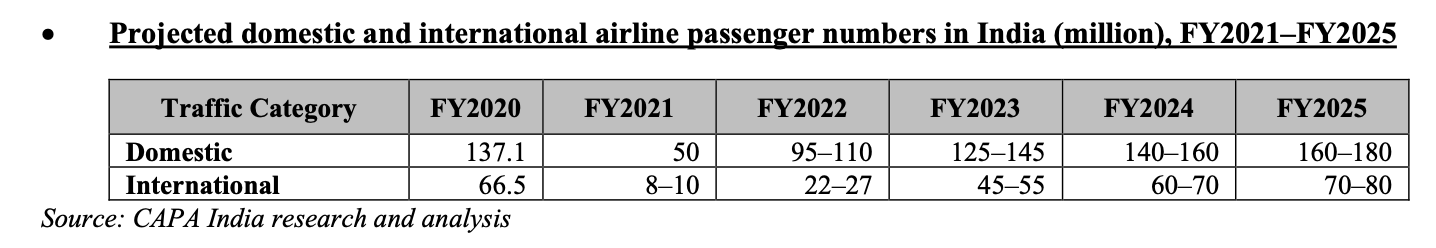

Low airfares had stimulated the traffic that created the new traveler segments that had never flown before. During the Financial Years between 2004 and 2020, the domestic international traffic had surged at a CAGRs of 14.3% and 9.0% respectively. In the past decade alone, the total number of domestic and international passengers have grown severely to 2.5 times. The number of the domestic airlines passengers in the Financial Year 2020 had been 137.2 million and was just over double of the number of the international passengers that is 66.5 million.

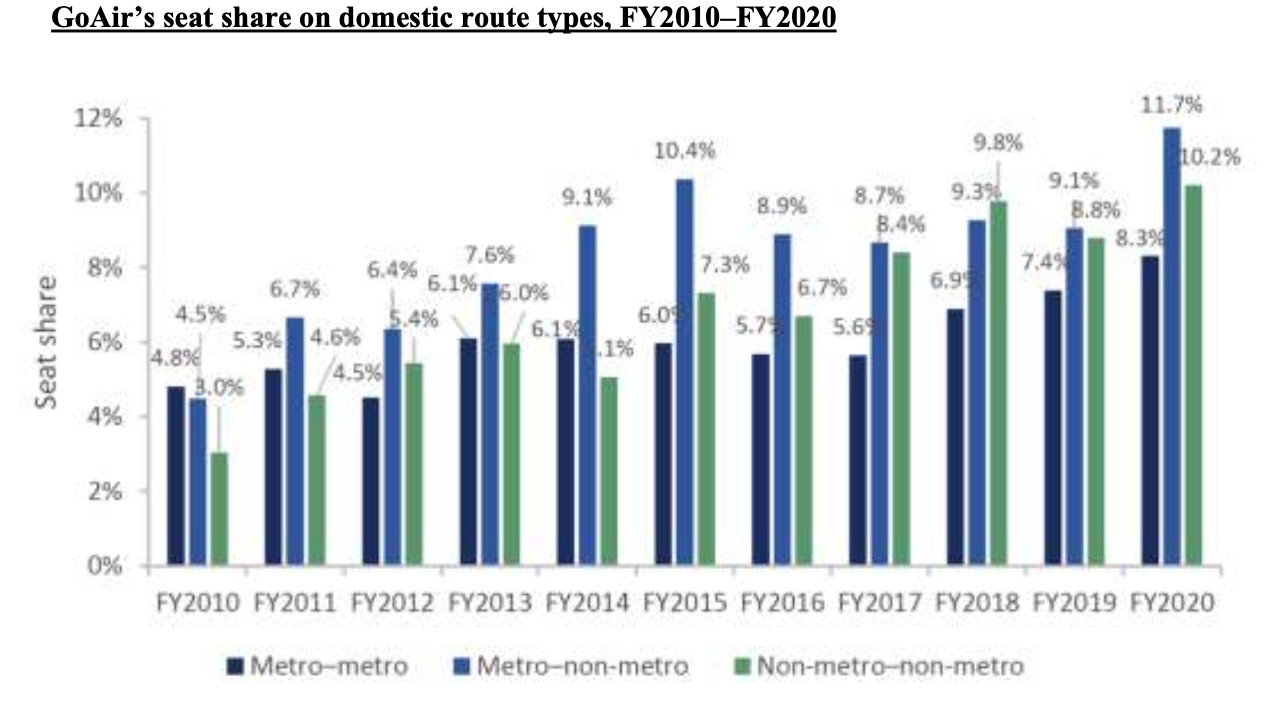

In the Financial Year 2020, the routes between the six metro cities such as Bengaluru, Chennai, Delhi, Hyderabad, Kolkata and Mumbai had accounted for 41.6% of the complete domestic traffic. This has simultaneously declined to 25.7% by the financial year 2020 as the sir services got access to more and more cities. In the past ten years to the financial year 2020, the traffic on the metro to non-metro routes had spiked at a CAGR of 15.2% that is almost twice the 7.7% CAGR on the metro to metro routes and reflects the under-penetration and potential of the non-metro routes. In the past half decades, the non-metro to non-metro routes had seen a particularly strong growth of CAGR 31.2% but has a small base.

India Is Expected To Remain One Of The Fastest Growing Aviation Markets In the World

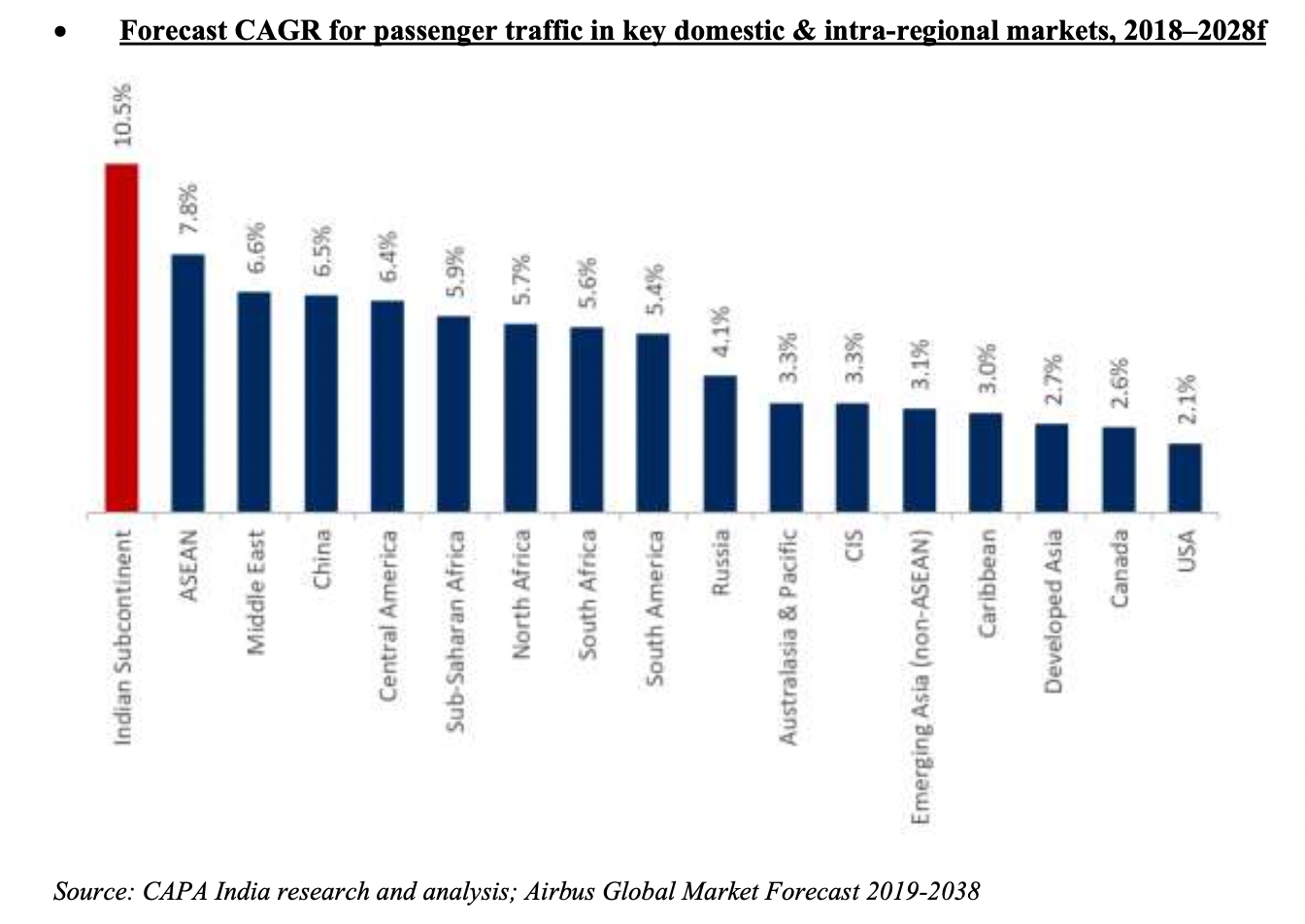

This expectation had been reflected in a fact prior to the Covid-19 that the intra-Indian subcontinent traffic that had been dominated by the Indian domestic market had been projected to rise at a CAGR of 10.5% between the years 2018 and 2028, which is relatively faster than the other large intra-regional or domestic markets in the world, inclusive of China.

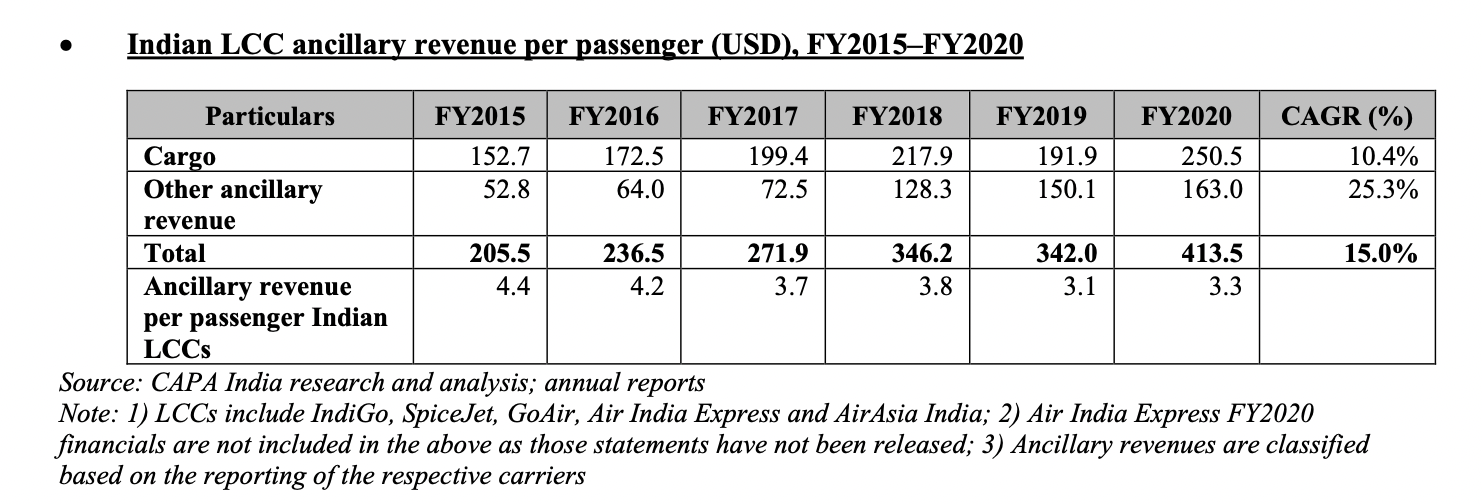

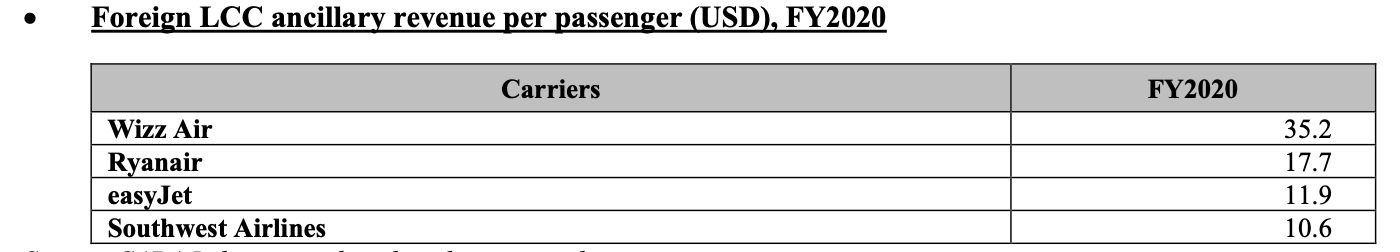

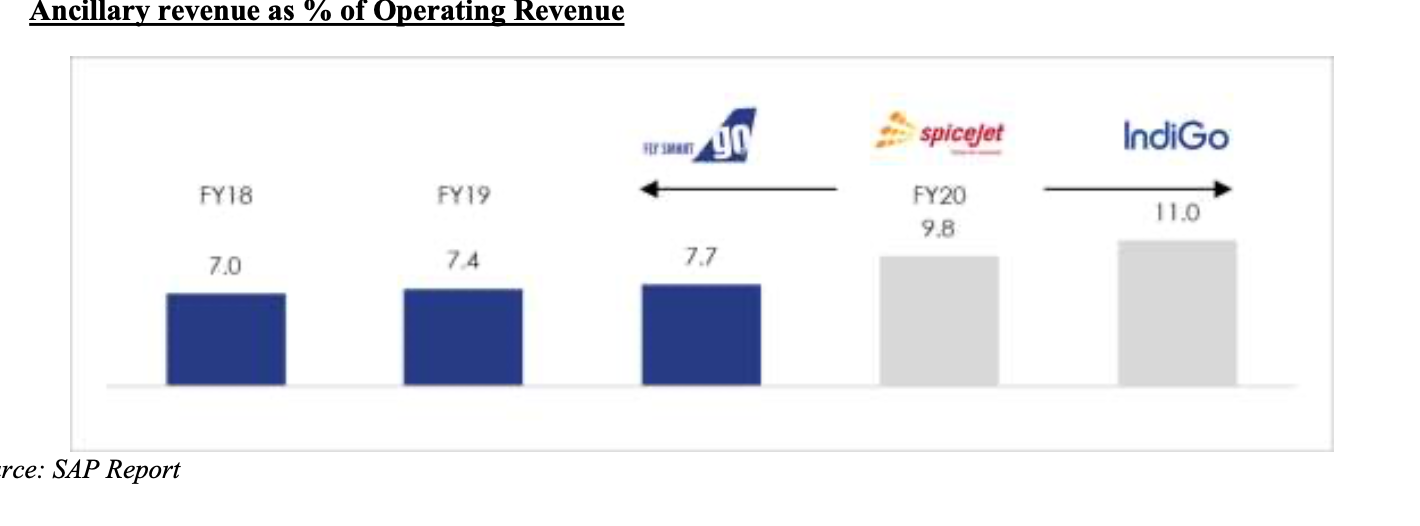

The Aviation Market Had Provided An Opportunity To Expand The Ancillary Revenue

The Ancillary Revenue represents a very low proportion of the total operating revenue for the Indian LCCs. This indicates that there exists a significant room for growth of this segment and thereby to increase the profitability. Over the past five years to the Financial Year 2020, the LLCs earned ancillary growth have raised at a CAGR of 15.0%. This segment accounts for the $3.30 per passenger and the majority of this is generated from the cargo.

What Is The Go Air Business All About?

Go Air is an ultra-low-cost carrier or ULCC that is focused on maintaining the low unit costs and delivering compelling value to the customers that drives their unit revenues. They are one of the fastest growing Indian airlines having an increase in the domestic market share from 8.8% in the Fiscal Year 2018 to 10.8% in the Fiscal Year 2020, as per the CAPA Report. The company’s target customers are the MSME businesses and the young Indians. The company believes that their product and the service offerings are uniquely attractive to these large and growing segments of the Indian population. The middle-class and the young urban demographic in India comprises the majority of the Indian population. Over 75% of the Indian population is just below the age of 45 years of which nearly 35% lives in Indian urban areas while the MSME businesses in India had contributed to 33.5% of the Indian GVA, as the CAPA Report states.

Being a ULCC, the company is focused on maintaining a low-cost base and high utilization of the fuel-efficient modern fleet. As of the 10th of February, 2021, the company’s fleet inventory consisted of 56 air crafts, of which the 46 air crafts had been A320 NEO models while the remaining 10 had been A320 CEO models. Of the 10 A320 CEOs. three had been in the process of re-delivery that will further enhance the homogeneous nature of their fleet.

All the aircrafts of Go Air utilize the same airframe and are considered sister ships having common configurations for reducing the operational and the maintenance costs. All the aircrafts employ high-density seating bearing a single cable configuration. The average age of their aircraft had been 3.7 years. According to CAPA, this was the youngest average fleet age amongst the Indian LXX Xarriers and of the youngest fleets of any global LCC. The A320 NEOs are 17-20% more fuel efficient than the A320 CEOs constituting 82% of their fleet size as of the 10th of February, 2021. The CAPA and the SAP Reports states that the company’s CASK of 3.06, Fuel CASK of 1.27 and the maintenance CASK of 0.60 alongside the Employee Benefits CASK of 0.45 in the fiscal year 2020 had been the lowest LCCS in India.

Go Air has benefited and expects to continue benefiting from the highly attractive industry dynamics characterizing the Indian aviation market. As per CAPA, the Indian domestic air travel passenger market has grown at a CAGR of 11.9% while the international air travel passenger market has grown at a CAGR of 6.8%. Bearing very low seat capacity per capita, a very low number of the airline passengers, a highly under penetrated total fleet size as well as the capacity to provide an alternative to the lengthy rail travel, the Indian aviation market has grown from 76 million passengers in 2010 to 208 million passengers in 2020. This is the fastest growing aviation market in the whole world. The company believes that they are positioned uniquely for benefiting from expected growth in traffic owing to their focus on various segments viz.,

- Leisure travelers within India

- The leisure travelers traveling overseas from India

- The MSME business travelers

- The route connectivity between the Tier 1-Tier 2 cities and the Tier 2-Tier 3 cities

- Frequency of the flights between Tier 1 and Tier 2 cities.

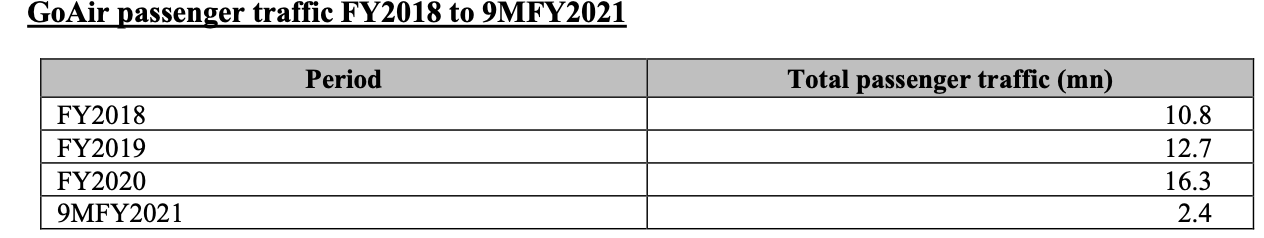

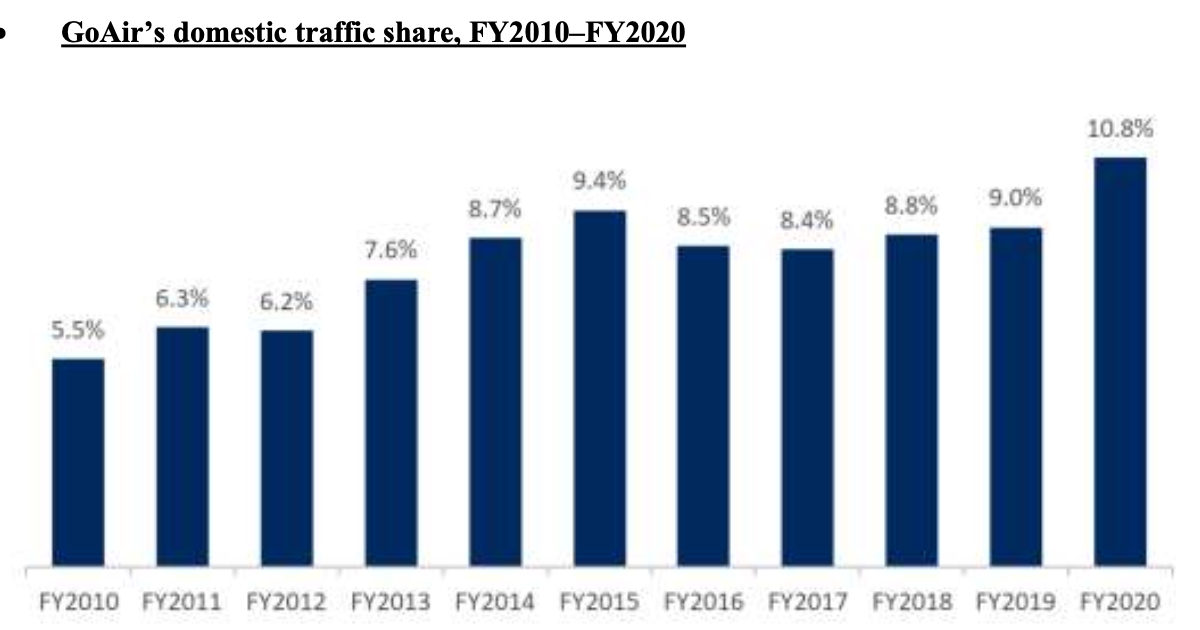

The Go Air passenger volume had increased at a CAGR of 22.4% from the 10.8 million passengers in the Fiscal Year 2018 to the 16.2 million passengers in the Fiscal Year 2020. The company’;s market share of the domestic passenger volume had increased from the 8.8% in the Fiscal Year 2018 to the 10.8% in the Fiscal Year 2020.

The company states that they are consistent with their ULCC model for operating their airline. They employ a single aircraft type across their entire fleet. The current A320 fleet comprises the sistership having a single airframe and the engine type. The company states that the entire fleet is fitted with the lightest and the most cost-effective Buyer Furnished Equipment options. All of their aircraft bear high-density seating having a seating capacity of 186 passengers for the NEO aircraft and 180 passengers for the CEO aircraft.

The company offers a single service class that permits the A320 aircraft to possess a maximum seating capacity. 82% of the company’s fleet comprises NEO aircraft as of the 10 the of February 2021. The company expects that their entire fleet will consist of the NEO aircraft by the end of the Fiscal Year 2024. Go Air bears the highest percentage of the next generation aircraft in their fleet as compared to the other Indian airlines.

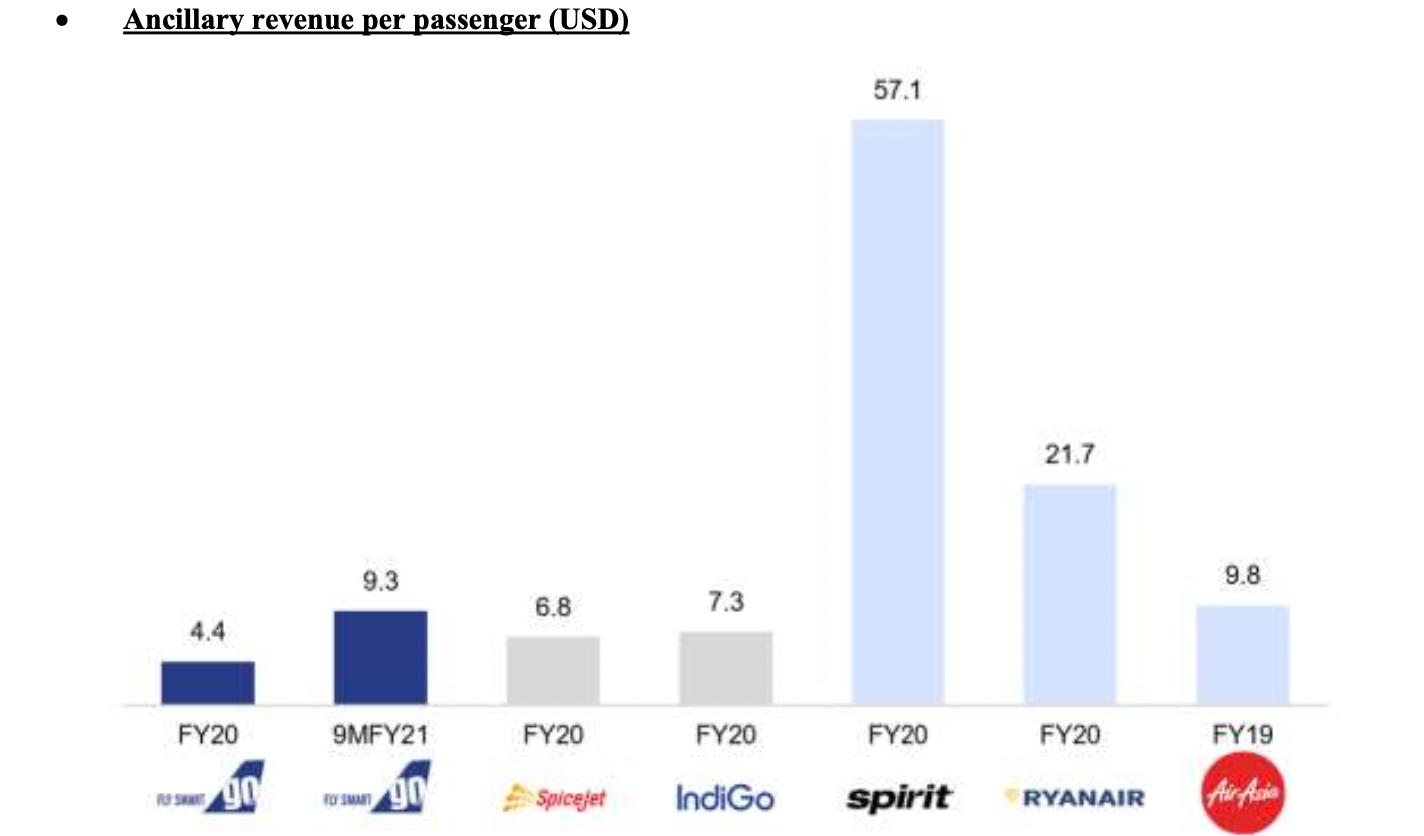

Go Air Receives Further Ancillary Opportunities For Driving Revenue

As per the CAPA India Report, the company does not offer any particular ancillary services by its peers. This includes the lounge services, trip assurance, the online merchandises, baggage delivery, cabin baggage and car rental. The company has further ancillary opportunities for driving the revenues.

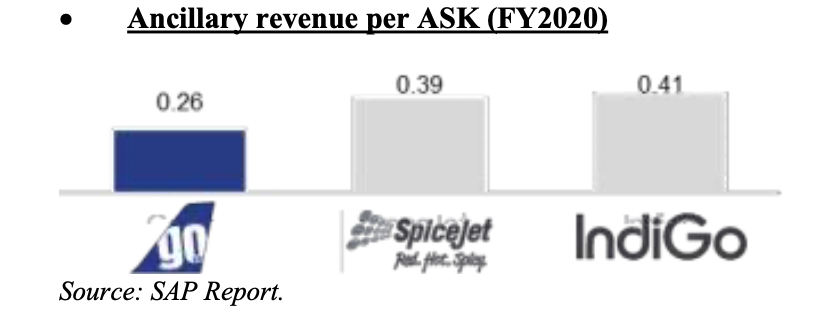

The Go Air Ancillary Revenue Per ASK

Go Air’s ancillary revenue per ASK for the Financial Year 2020 had been INR 0.26, while it had been INR 0.39 for SpiceJet and INR 0.41 for Indigo, as per the SAP Report. The ancillary revenue of GO Air on a per ASK basis is lower than that of IndiGo and SpiceJet.

Go Air Benchmark Against The Major Indian Carriers And The Global LCCs

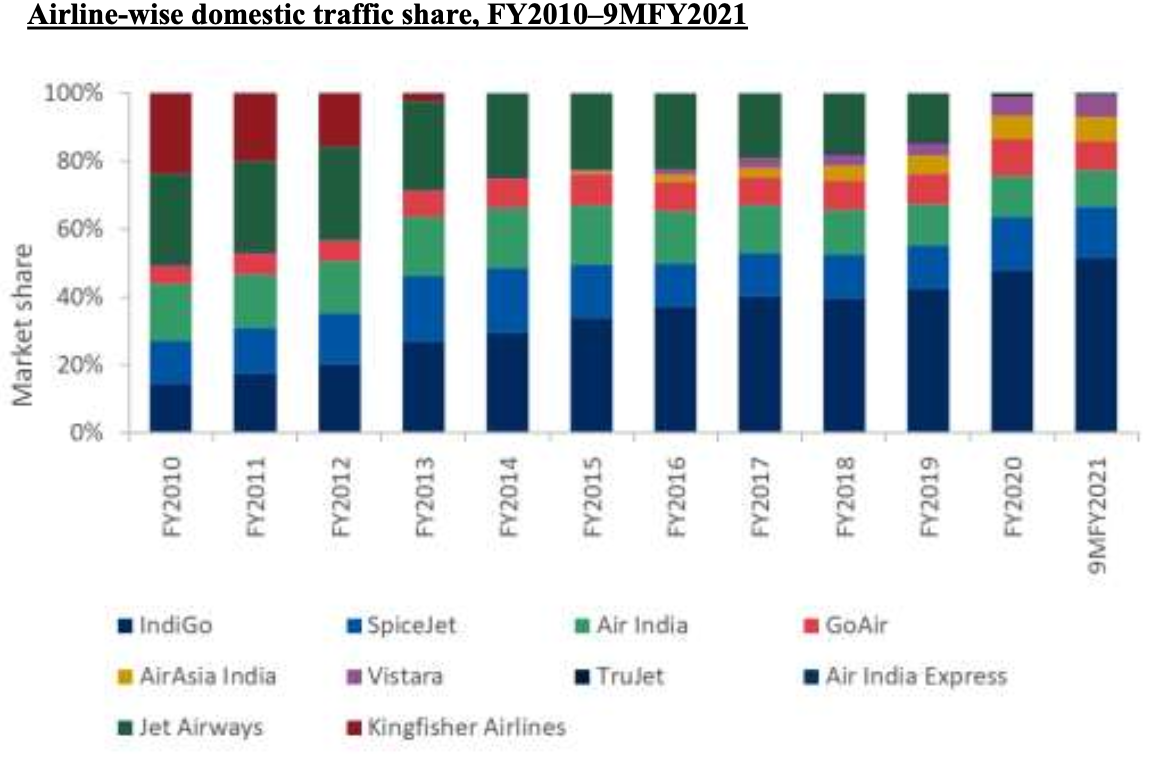

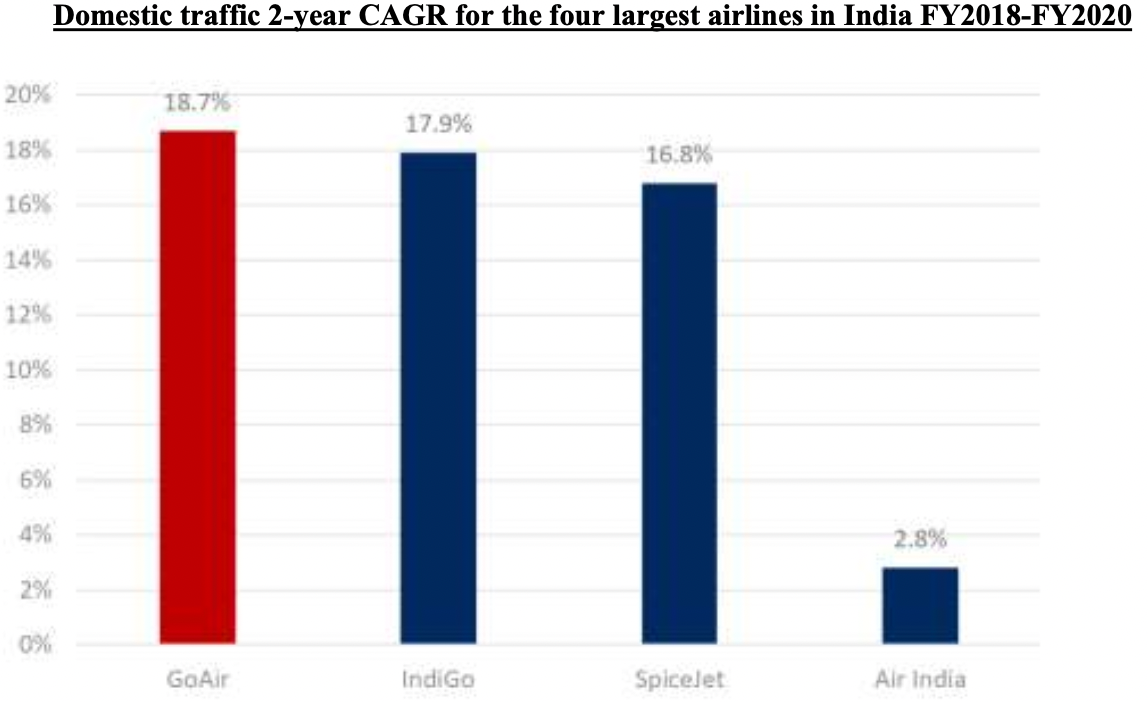

In the past two years to the Financial year 2020, Go Air had experienced the fastest growth in the passenger traffic amongst the four largest airlines in India. Due to the result of this strong growth, the domestic market share of the company has increased by 2% points between the Financial Year 2018 and the Financial Year 2020. Over the past 10 years, the domestic market share of the company has nearly doubled from 5.5% in the Financial Year 2010 to 10.8% in the Financial Year 2020.

The Domestic Traffic Share of Go Air (FY2010-FY2020)

The market share of Go Air on the metro-non-metro routes of 11.7% is higher than its overall market share of 10.8%. This reflects a strong position in the largest and the fastest growing segment of the aviation market in absolute terms. The airline possesses a seat share of 8.3% on the metro-metro routes and 10.2% on the non-metro-non-metro routes.

Go Air had the largest share of slots at its home base in Mumbai amongst the largest 10 airports in India. In Mumbai, the company accounted for 12.5% of the movements as of the end of 2019. This furnishes it with a competitive position in the financial and commercial capital of India and its most slot-constrained airport.

How Well Can Go Air Be Compared With Its Competitors IndiGo and SpiceJet?

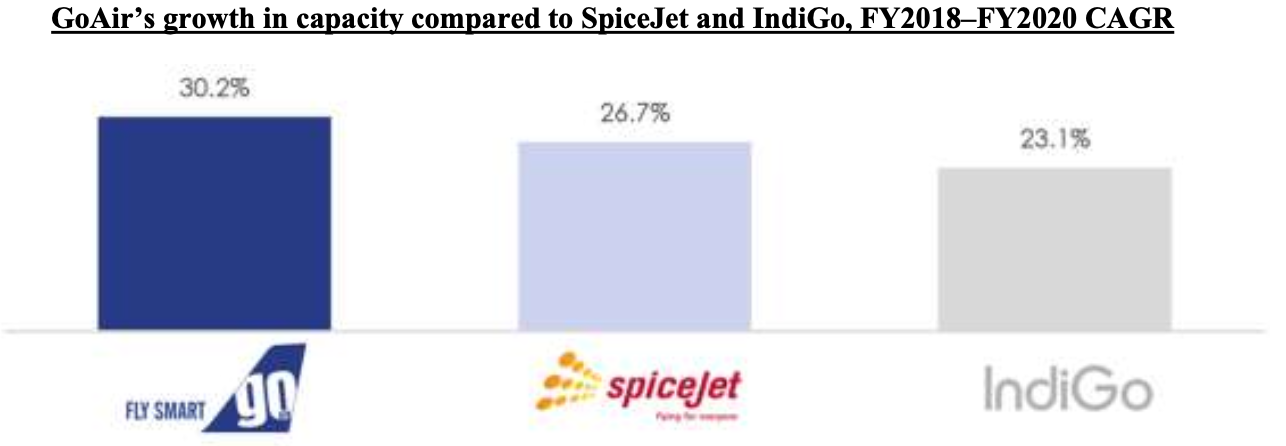

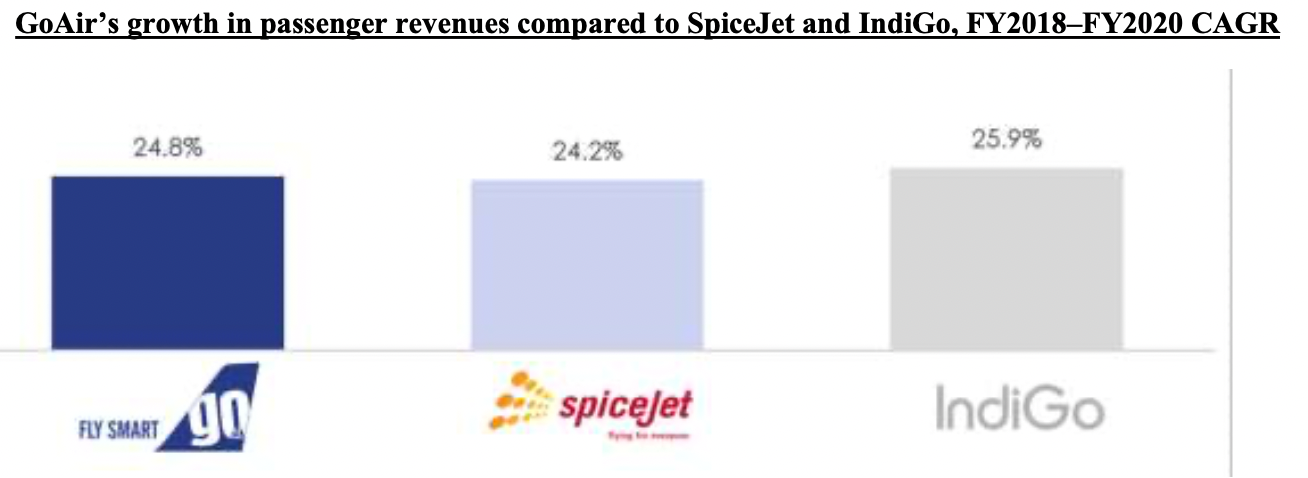

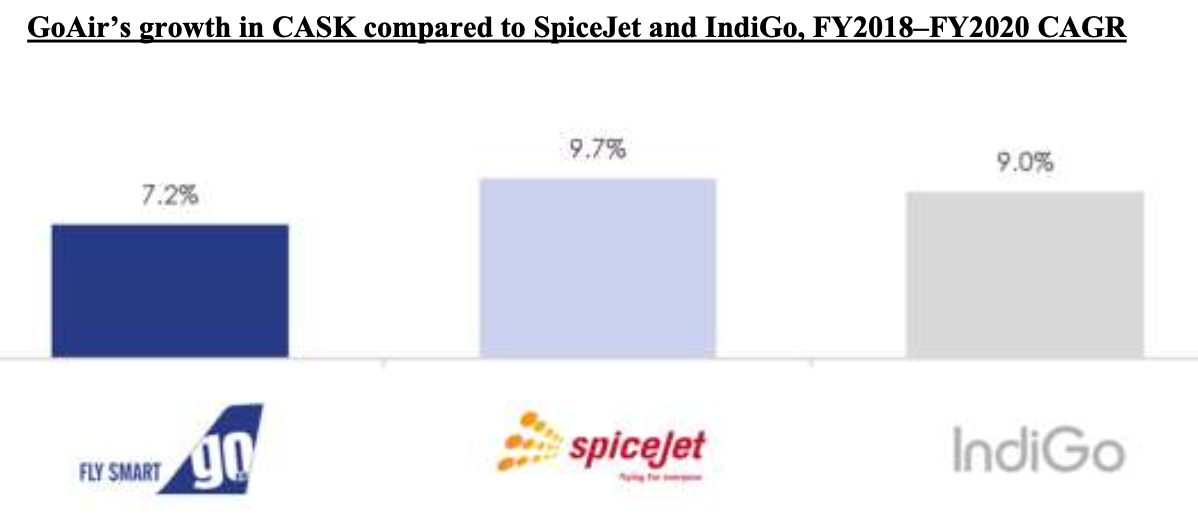

In the past two years to the Financial Year 2020, the company has seen the highest capacity growth in terms of ASK, lowest CASK growth and the high growth in the passenger revenues as compared to Indigo and SpiceJet.

The Key Cost Metrics

Below are the primary cost metrics of Go Air.

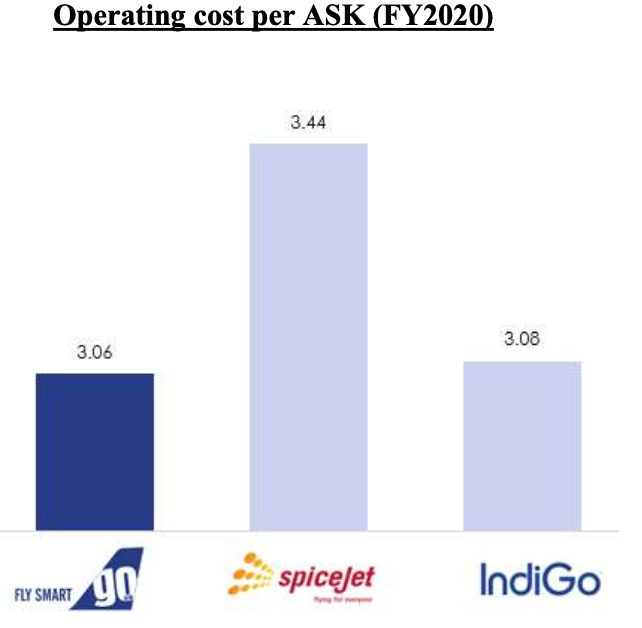

Operating Costs

The operating costs per ASk for the Financial Year 2020 had been INR 3.06, while it has been INR 3.44 for SpiceJet and INR 3.08 for IndiGo, as per the SAP Report. The operating cost per ASk comprises the fuel cost per ASK, airport charges cost per ASK, maintenance cost per ASK, employee benefit cost per ASK and the other expenses cost per ASK. The operating costs of Go AIr as per teh ASK basis are comparatively lower than that of indiGo and SpiceJet.

Fuel CASK

The fuel cost in every ASK for the Financial Year 2020 had been INR 1.27 for Go Air, while it was INR 1.47 for SpiceJet and INR 1.29 for IndiGo, as stated by the SAP Report. The fuel costs on a per ASK basis of Go Air are lower than that of IndiGo and SpiceJet.

Maintenance CASK

The maintenance costs can be termed as one of the main cost components for any carrier. A carrier’s maintenance costs are heavily impacted by the business model , overall fleet management and fleet composition, as per the SAP Report. The maintenance cost of various Indian airlines per ASK for the Financial Year 2020 had been INR 0.60 for Go Air, INR 0.61for IndiGo and INR 0.69 for SpiceJet, as per the SAP Report. The maintenance cost of Go Air is comparatively lower than that of its competitors, IndiGo and SpiceJet.

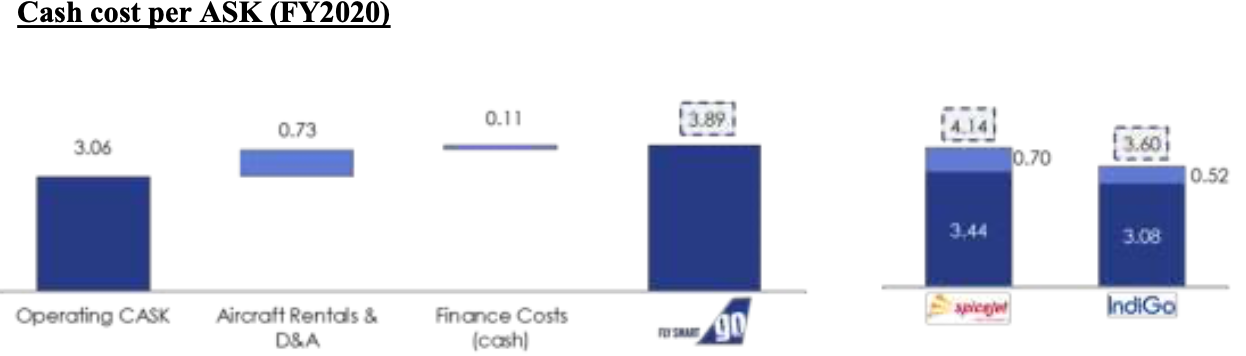

Cash CASK

The SAP Report states that the cash cost per ASK in the Financial Year 2020 for Go Air was INR 3.89, while it was INR 4.14 for SpiceJet and INR 3.60 for IndiGo. The cash costs of Go Air on a per ASK basis are quite lower than that of its competitor SpiceJet but higher than that of IndiGo.

Who Are There In The Go Airlines Board Of Directors?

The following entities occupy the Board of Directors of Go Air.

Nusli Neville Wadia

He is the Chairman of the Board of Directors and the Non-Executive Director of the company. He has completed his elementary education from the Rugby School. He is an Indian Industrialist and the Chairman of several other companies such as The Bombay Dyeing And Manufacturing Company Limited, Wadia Group, Britannia Industries Limited and The Bombay Burmah Trading Corporation Limited. He has been on the board of directors of various Indian and foreign companies. On the 1st of June 2004, he joined Go Air.

Ness Nusli Wadia

He is a Non-Executive as well as Non-Independent Director of the company. He has a Master’s degree in Engineering Business Management from the University of Warwick. As of now, he serves as the Managing Director of The Bombay Burmah Trading Corporation Limited, as Chairman of The National Peroxide Limited, as the Director on the Board of Directors of various other companies of The Wadia Group including The Bombay Dyeing and Manufacturing Company Limited and Britannia Industries Limited.

Ben Baldanza

He is the Vice Chairman. Non-Executive and Non-Independent Director of Go Air. He holds a Bachelor’s degree in arts with a major in policy studies and economics from Syracuse University, a Master’s degree in public administration and urban regional planning from the Woodrow Wilson School of Public and International Affairs, Princeton University.

Yashwantrao Shankarrao Patil Thorat

He is a Non-Executive and Independent Director of the company. He holds a Bachelor’s degree in arts, a bachelor’s degree in law and a doctor of philosophy degree in economics from Shivaji University, Kolhapur. Additionally, he also holds a doctor of literature degree from the Padmashree Dr. D.Y. Patil University.

Keki Manchersha Elavia

He is an Independent Director of the company. He holds a bachelor’s degree in commerce from the University of Bombay. He is a fellow member of the Institute of Chartered Accountants of India. He was associated with both Kalyaniwalla& Mistry LLP and S.R. Batliboi& Co., Chartered Accountants in the capacity of a partner. He has over 40 years of experience in audit and finance related matters.

Dr. Vijay Kelkar

He is an Independent Director of our Company. He holds a bachelor’s degree in science from the University of Pune, a master of science degree in industrial engineering from the University of Minnesota, USA and a doctorate from University of California, Berkeley. He is currently the chairman of India Development Foundation, New Delhi, the vice president of Pune International Centre, Pune and the chairman of Janwani, Pune. He served as chairman of various organizations and committees such as the National Institute of Public Finance and Policy, New Delhi, the Committee constituted on Revisiting and Revitalization of the PPP Model of Infrastructure Development, and the Forum of Federations.

Upcoming Go Air IPO Offer

Below is the offer presented by the Upcoming Go Air IPO.

Initial public offering of up to [●] Equity Shares of Go Airlines (India) Limited for cash at a price of ₹ [●] per Equity Share (including a premium of ₹ [●] per Equity Share), aggregating up to ₹ 36,000.00 million.

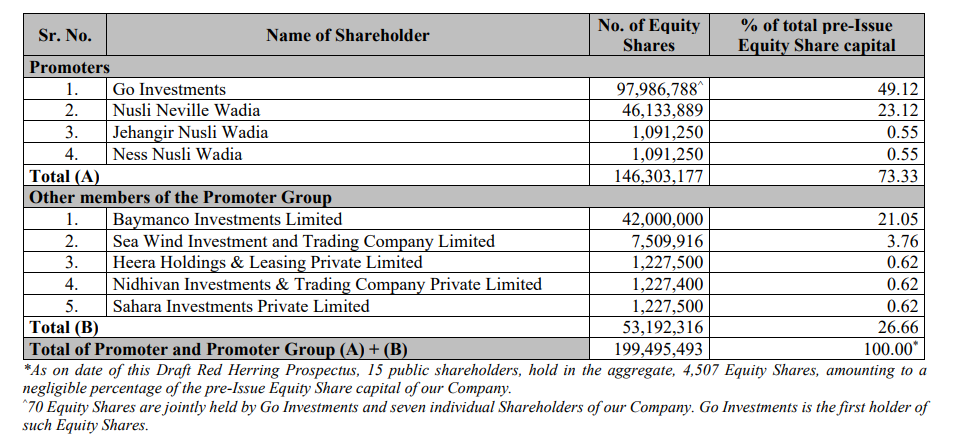

The Shareholders

Competitive Strengths Of The Company

- Fuel-efficient, next-generation fleet

- Strong focus on operational efficiency

- Strategic network for slot-constrained airports

- Leisure travelers and MSEME businesses as target customers

- Track record of growth across key performance indicators

- Experienced Board and management team backed by the Wadia group

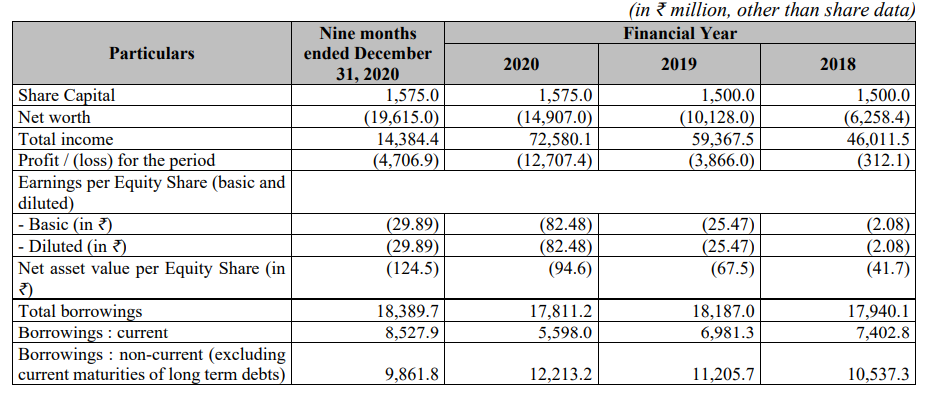

Financials Of The Go Air IPO

Verdict

The situation seems kind of tricky to state whether the upcoming Go Air IPO will be a grand success. However, it can be stated that it might be subscribed not more than 2X. Below are the reasons for the same.

The aviation industry has a massive competition and mostly they are loss making companies. However, in the coming years there will be technological innovations that might lead to the prosperity of the aviation companies. The passenger growth of the airlines are going speedy at a rate of 12% CAGR. Considering the Go Air Airlines, it is the fourth largest aviation company in India. Its greatest competitors are SpiceJet and IndiGo. The best part of Go Air is that it emphasizes on the ULCC model where the fares for traveling are much lower than its competitors. The airlines company is also working on cutting down the fuel cost of what it was earlier at 30%. The government has also launched udaan schemes that primarily focuses on the ULCC model making it easier to access for the travelers especially the young generation. The individuals in the Board Of Directors are experienced. To conclude, it can be stated that if you are a risk taker and looking for a long run, you can purchase the IPO or decline the thought if you are not one of them.