Upcoming Paytm IPO: Know Everything Before You Expect Anything Important

- IPO Stocks

Yaseer Rashid

Yaseer Rashid- November 6, 2021

- 4

- 25 minutes read

Paytm is a digital payments company that has come a long way with the biggest offer to date in regards to the size. The digital financial services firm is currently boosting its initial public offering or Upcoming Paytm IPO to Rs 18,300, which is more than $2.4 billion following SoftBank and Ant Financial. Several other existing investors had stated that they are looking forward to diluting more of their shares. This information has been shared with a popular news portal lately. The total fresh IPO size includes the new issue of Rs 8,300 crore with an offer for sale or OFS valuing Rs 10,000 crore.

The public issue of Paytm’s parent firm named One97 Communications will be opened for subscription (Paytm IPO date 2021) on the 8th of November, 2021. The bidding will be available till the 10th of November, 2021. Last week, the SEBI had approved Paytm’s IPO for Rs 16,600 crore. The price band for the upcoming Paytm IPO offer has been fixed at Paytm IPO listing price of Rs 2,080 to Rs 2,150 per share having a face value of Re 1 each. In the beginning, the company had thought to raise Rs 16,600 crore. However, it then increased its size by Rs 1,700 crore to Rs 18,300 crore. The current offer is expected to raise its valuation to 20 billion dollars.

The investors are allowed to place bids in the lot of 6 shares Paytm IPO lot size and thereof in the multiples. This means that at the upper range of the price bands, Paytm will shell out Rs 12,900 for purchasing a single lot. The company has also reserved 75% of the offer for the Qualified Institutional Buyers (QIB) and 15% for the non-institutional buyers. The leftover 10% will be available to the retail investors for bidding.

The share allotment is likely to happen on the 15th of November, 2021. The shares will be listed on both the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) by the 18th of November, 2021.

The founder and CEO, Vijay Shekhar Sharma had mentioned that the company might not require further capital beyond the IPO if otherwise there are any crucial circumstances. He stated that currently Paytm is making more profit and that the losses have been lowered. The upcoming Paytm IPO will be the largest in the Indian equity markets. The former largest IPO was that of Coal India while the Maharatna PSU had raised a fund of Rs 15,000 crore more than 10 years ago.

Investors such as SAIF III Mauritius, Alibaba, and ANT Financials will be offloading their stakes beside the CEO. The Chief Financial officer, Madhur Deora had mentioned that besides ANT Financials, the other shareholders are selling off the shares on a pro-rata basis.

Following the Upcoming Paytm IPO news, you might be intrigued to know more on the matter. Here is what you need to know before you expect anything from the upcoming Paytm IPO.

How Is The Technology Industry Doing Currently?

Technology is playing a key role through increasing its reach and accessibility for both the consumers and the merchants. The cloud technology and mobile revolution in amalgamation with the higher consumption rates in India as well as growing incomes is at the apex.

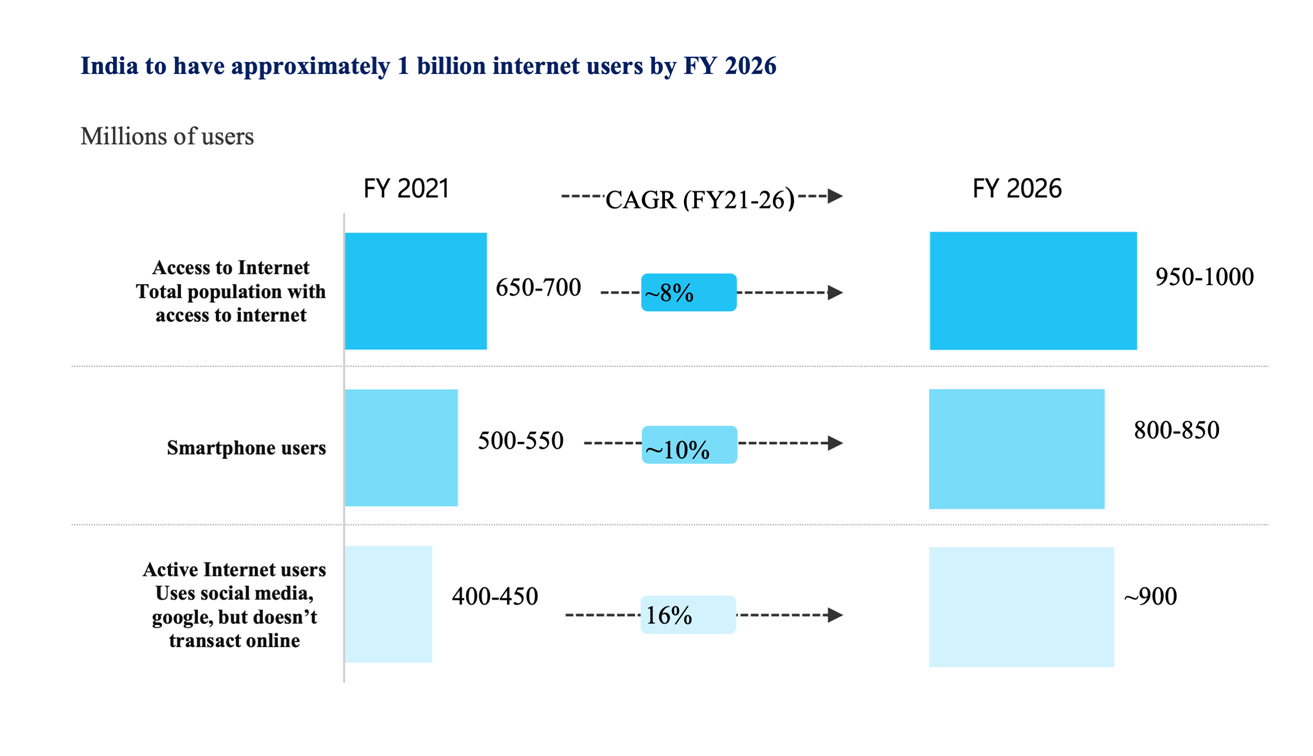

Over the past decade, India has successfully added more than 500 million new smartphone users. With the expedited affordability, the reduction in the cost of the smartphones where the average smartphone cost is below 150 USD, and the availability of the diverse value of the smartphones, the total number of smartphone users are expected to achieve 800 to 850 million in the Financial Year (FY) 2026. This represents over 55% of the total population and of course, 80% of the total internet users.

Considering FY 2021, 650 to 700 million Indians had accessed the internet. The number is expected to increase to more than 950 to 1,000 million by FY 2026. This represents over 70% of the total population and is primarily driven by the increasing smartphone penetration and thereby reducing the data cost, new technology innovations as well as the Government’s force towards digitization. As analyzed by the TRAI, the data usage per data subscriber hiked to 141 GB in 2020 from 3 GB 6 years ago in 2014. On the contrary, the data cost has declined from Rs 269 per GB to Rs 10.9 per GB in 2020.

Did the technology revolution bring in new changes in the way businesses run? Well, yes! The change in technology has also changed the consumption pattern and the way businesses run. One such area where the technology evolution has completely disrupted traditional businesses is “Retail Commerce”. As compared to how we had acquired our food and groceries earlier, what we prefer now is a whole different concept. Now we find groceries, food, and goods from around the world at our disposal where they are delivered at the doorstep.

As the fintech players emerged with some innovative business models, it has completely changed the way merchants and consumers invest their money, borrow, lend and transact. The travel industry has also experienced major changes with online ticket booking, holiday packages, discounting, loyalty programs, and much more. Small business owners, merchants, and large-scale retailers have benefited from the capability to address a wide consumer base coming directly from the developments in food-tech, e-logistics, e-commerce, and fintech.

Key Factors Associated In The Growth & Acceptance Of Online Transactions In India

The online transaction rate has been continuously growing as compared to the time it was first introduced. At a very fast pace, online transaction methods have been highly adopted by people in India. Here are the key factors that have helped in the growth and the acceptance of online transactions in Indian society.

1. Rise In The Middle-Class Population

The Indian middle class comprises 55 to 57% of the total population at present. The percentage is likely to hit over 65% by 2030. The growth will be of rapid upward mobility of the lower-income classes. This group of people will witness growth in their income via urbanization, increasing employment opportunities, and more democratized access to information that will drive consumer spending.

2. Rise In The Consumption

As the World Economic Forum estimates, India will probably be the third-largest consumer market by 2030that will be driven by the development of communication, growing momentum on capex spending by the Government, and even more job opportunities. However, private consumption is likely to rise from 1.6 trillion USD in 2019 to 2-2.5 trillion USD in 2025.

3. Digitization Altering The Transaction Method In India

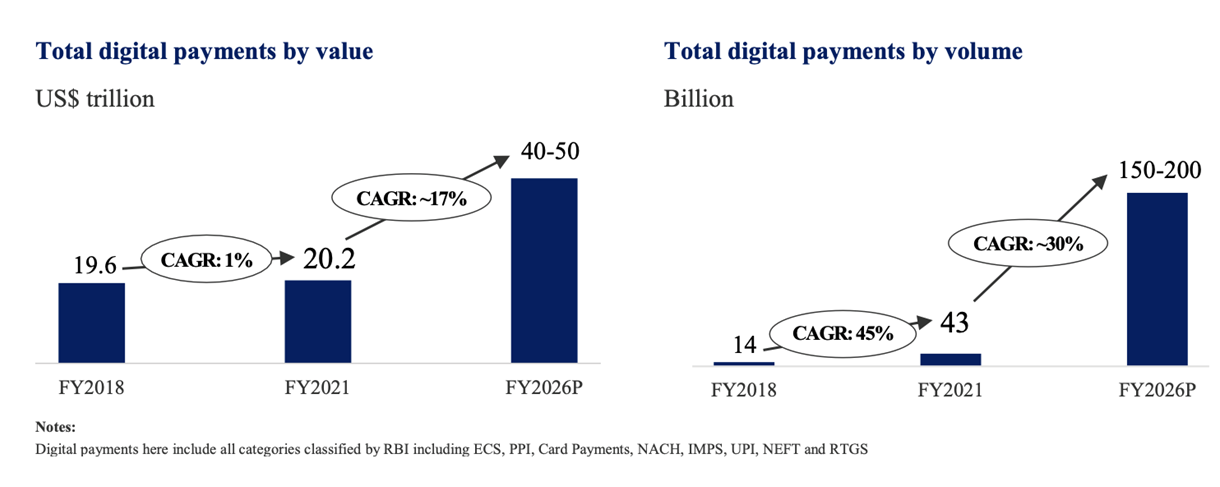

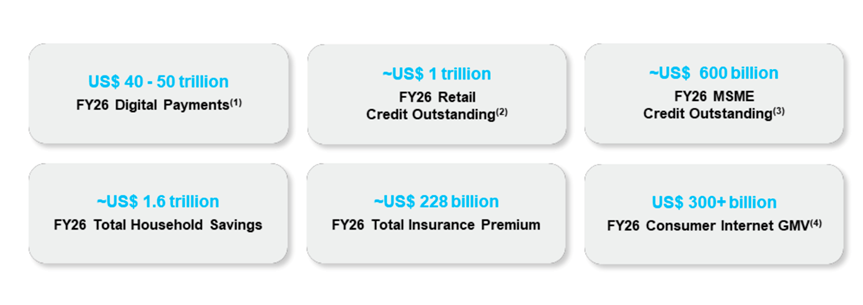

Over time, digital payments have been growing as India continues to be a cash-driven economy. In FY 2021, the market size by value of the digital payments stood at around 20 trillion USD bearing 43 billion transactions in the year. Consumers are quickly switching to various methods of digital payments. This is owing to the fact that digital payments offer safe, simple, and convenient ways to transfer money across several accounts.

Considering the merchant scenario, acceptance of digital payments has been highly incorporated and thus it has risen significantly. On top of this, the merchants have taken the whole concept of digitization to a different level which is beyond just accepting digital payments. Digitization is also helping them grow in various aspects of their business such as invoicing, credit, bookkeeping, maintaining the ledger or accost, and much more.

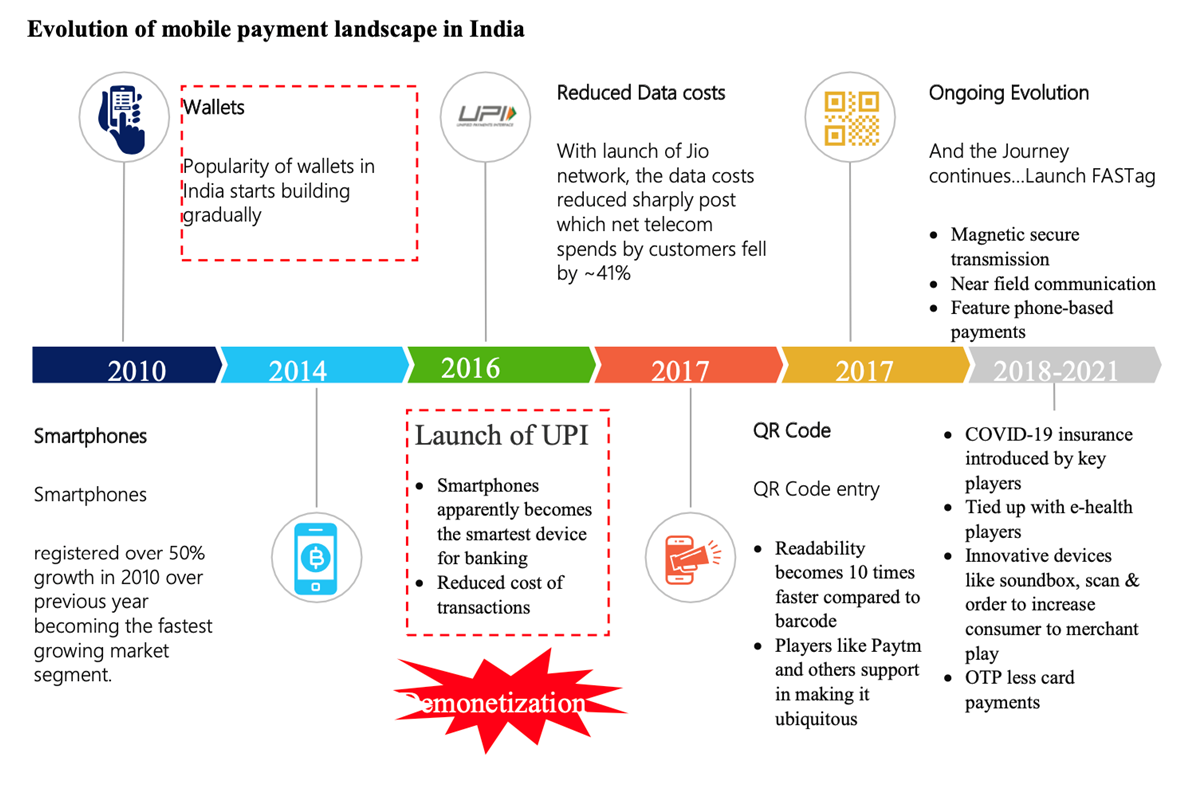

Covid-19 has let us experience the change of trends in the Kirana stores across the country. The kirana stores have been responsible for driving the crucial retail consumption during the lockdown period. As the Covid-19 situation had levied social distancing where the government guidelines have been discouraging people to move away from safety concerns. In this situation, the merchants preferred to move to the various digital modes of payments that led to the rise in the digital consumer to merchant payment volumes. Additionally, demonetization in 2016 has also played a key role in forcing the merchants to accept digital payments, which led to the growth of digital wallets and QR codes.

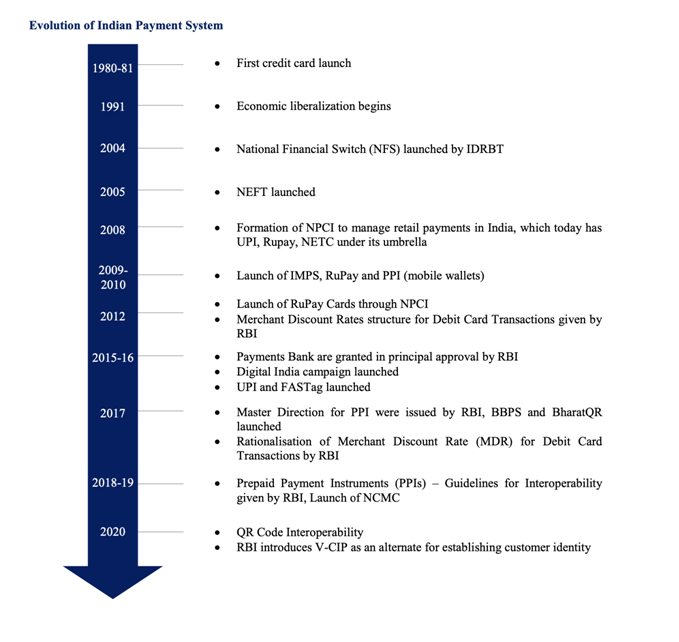

Evolution Of The Indian Payment System

It is believed that the Indian payment landscape has transformed significantly over the last decade. It is driven by the emerging mobile payments, the government’s attempt to create a cashless society and the creation of the robust and innovative payment infrastructure, risen consumer as well as merchant acceptance and the regulatory support. Owing to the growth of digital services and commerce, in combination with the increased user custom of transacting via their mobile phones for the money transfer and in-store payments, digital payment is gaining popularity and growing at a fast pace.

Owing to these factors, the unique online transacting users, transacting for various services such as online banking, in-store payments, mobile top-ups and more are expected to grow from the 250-300 million threshold in FY 2021 to 700-750 million threshold in FY 2026.

About The Brand: Paytm

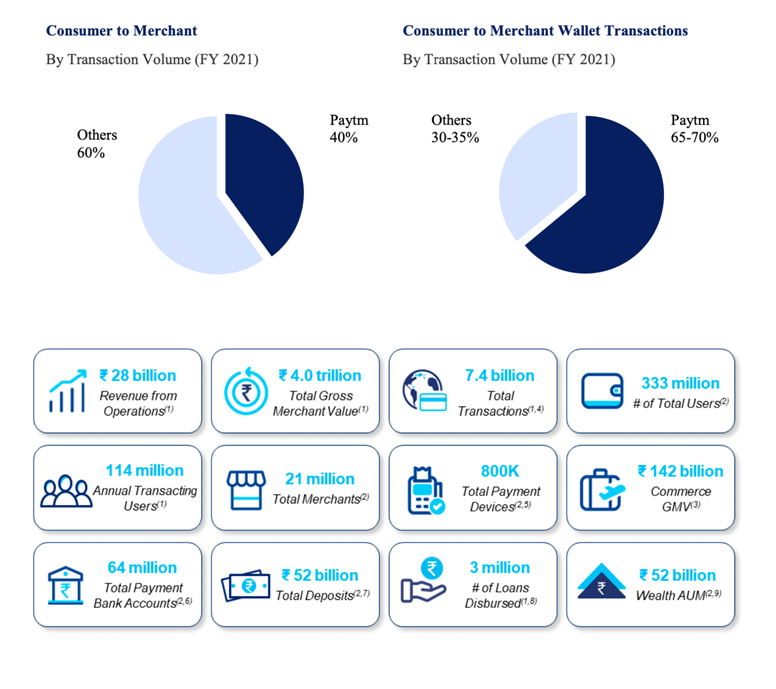

Paytm is considered the leading digital ecosystem for both the merchants and the consumers in India, as mentioned by RedSeer. The company offers payment services, cloud services and commerce alongside financial services to 333 million consumers and more than 21 million merchants that are registered with them. This statistic is dated March 31,2021. The bi-sided ecosystem that is the consumer and merchant ecosystem permits commerce and offers access to the financial services by leveraging the technology for improving the lives of their consumers and aid their merchants to expand their businesses.

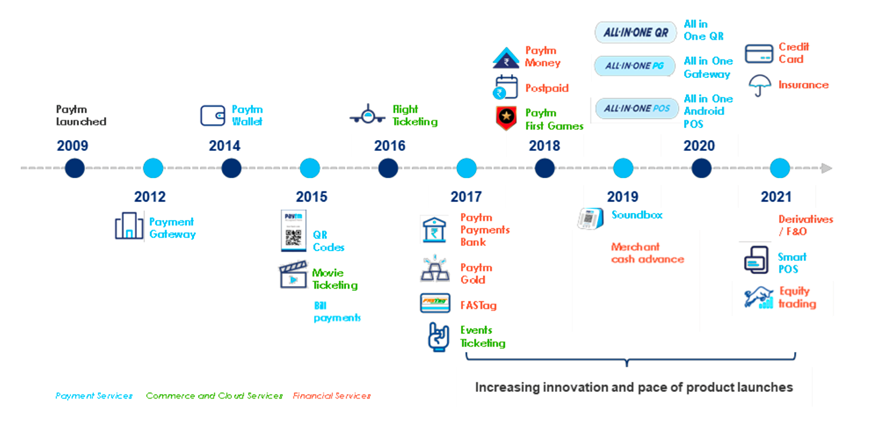

Paytm was launched back in 2009 as a “mobile-first” digital payments platform that offers cashless payments for the Indians. These provide the Indians with the power to make payments from the ease of their mobile devices. The platform started as bill payments and mobile recharge app and ultimately introduced their wallet named “Paytm Wallet” as the very first Paytm Payment Instrument.

How Merchants Adopted Digital Payments And Growth Of Paytm

In the Indian scenario, there are approximately 65 million merchants. Of this, 45 million have access to the internet. Merchants comprising the medium and the small scale enterprises are fast growing and adopting the new age payment technology. This enables them to offer hassle free shopping experiences to their customers. The digital payments at merchants usually include Point of Sale (POS) machines, QR code and payment gateway.

Trends Favouring The Digital Payment Flourish In India

India is a country that has hundreds and millions of young and aspiring consumers who remain underserved in the financial services products and payments. Millions of small businesses in India will benefit from the increased access to affordable software, financial services and technology. It is believed that these groups of consumers and the small businesses can be better served via the technology-led digital first commerce.

Paytm has driven innovation in the Indian payments zone with the designing and building of products for the Indian consumers and the merchants alongside creating the new market segments. They had launched a wallet product, called the Paytm Wallet back in 2014 that experienced widespread acceptance in the Indian communities. Many people of these communities were making efforts to make digital and mobile payments for the very first time.

In 2015, Paytm had launched the QR codes that they had upgraded to All-in-One QR in the month of January, 2020. It was the only source code that enabled the merchants to accept online payments seamlessly from the Paytm Payments Instruments, the third party and all the UPI instruments directly into their bank accounts.

Products Offered By Paytm

Paytm offers a couple of products and services to its consumers and merchants across the payment services, cloud services, financial services and commerce. Paytm App with the Paytm Wallet having the ease of utility and bill payments is what they had earlier focussed into. In 2015 and 2016, they have further launched QR codes for the in-store payments followed by the entertainment and flight ticketing that have helped open up scope for more people to use Paytm as their digital payment.

Over the past five years, they have introduced additional products such as Paytm FASTag and the Paytm Postpaid. Finally they had launched their financial services offerings such as lending, wealth and insurance for the merchants and consumers in partnership with the various financial institutions. In the past three years, Paytm has accelerated as they expanded their distribution.

Payment Services Offered

- Money Transfer: The Paytm app allows the users to make money transfers from the UPI and the Paytm Wallet that the Paytm Payments Bank supports. The users can directly transfer to either any other wallet, their own linked account, any other mobile number (if the receiver’s bank account is linked with their Paytm platform), any other bank account or any other UPI identification.

- Paytm Wallet: The Paytm Payments Bank offers a secured digital wallet that permits the consumers to conduct payments at more than 87,000 online merchants and 21.1 million in-store merchants.

- Paytm Postpaid: Via the paytm Postpaid, and in collaboration with the paytm’s financial partners, they offer consumers flexibility for using the buy-now-pay-later option across their merchant base. The consumers can also make payments up to their individual credit limit each month and then repay their balance the next month by UPI, debit card, paytm Wallet and net banking, making use of the Paytm App. The Bill EMI feature enables the consumers to convert their complete expenditure into the customized EMIs and are payable alongside the nominal interest rates.

The other services include:

- Paytm UPI

- Paytm FASTags

- Fixed Deposits

- Paytm Payments Bank Debit Card

- Paytm Credit Card

- Other Paytm Payments Bank instruments

Board Of Directors At Paytm

It is important to look into the board of directors before investing in an IPO. The same is applicable with the upcoming Paytm IPO. Here is a list of the board of directors currently at Paytm.

Mr. Vijay Sekhar Sharma

He is the Managing Director and also the Chief Executive of Paytm. He is also the Chairman in the board of directors. He holds a bachelor’s degree in Electronics and Communications from the Delhi College of Engineering. Being the founder of the company, he oversees the company’s key strategic efforts that includes design, marketing and engineering. He was featured in ‘2017 Time 100’, the list of ‘hundred most influential people in the world’ by Time magazine. He has also received several industry awards such as ‘Entrepreneur of the Year’ award in 2018 by All India Management Association, ‘Entrepreneur of the Year’ at ET Awards for Corporate Excellence’ in 2016 and ‘GQ Man of the Year’ in 2016.

Mr. Ravi Chandra Adusumalli

He is a Non-Executive Director of Paytm and a nominee of SAIF as well as Elevation Capital on the Paytm board of directors. He holds a Bachelor’s degree in Economics and Government from Cornell University. Currently, he is the managing partner of Elevation Capital.

Ms. Pallavi Shardul Shroff

She is an independent Director of Paytm. She holds a Bachelor’s degree in law and a Master’s degree in management studies from the University of Bombay. At present, she serves as the managing partner of Shardul Amarchand Mangaldas & Co. recently, Ms. Shroff was conferred the ‘Lifetime Achievement Award’ at the Chambers India Awards 2019. She had also been recognized as one of the ‘most powerful women in Indian business’ by Business Today, seven years in succession.

Mr. Mark Schwartz

He is an independent director at Paytm. Mr. Schwartz holds a bachelor’s degree in arts and a master’s degree in business administration from Harvard University. He has served as a vice chairman and participating managing director of the Goldman Sachs Group, Inc. and chairman of Goldman Sachs Asia Pacific.

Mr. Douglas Feagin

Mr. Feagin is an Additional director at Paytm and a nominee API in the company. He holds a bachelor’s degree of Arts from the University of Virginia and a master’s degree in business administration from the Harvard Business School. He had been previously associated as a Managing Director in the investment banking division of the Goldman Sachs Group, Inc. he serves as a Vice President of the ANT Group.

Mr. Munish Varma

He is a Non-Executive Director of Paytm and a nominee of SVF in the company’s board of directors. He has acquired his master’s in business administration degree from Cornell University. At present, he is serving as a managing partner at SoftBank Investment Advisers. He was earlier associated with Deutsche Bank AG.

Upcoming Paytm IPO Offer

- Offer Up to Equity Shares aggregating up to ₹ 166,000 million

- Fresh Issue Up to Equity Shares aggregating up to ₹ 83,000 million

- Offer for Sale Up to Equity Shares aggregating up to ₹ 83,000 million

- Equity Shares outstanding prior to the Offer (as on the date of this Draft Red Herring Prospectus) 605,930,140 Equity Shares.

Investors At Paytm

- Softbank Vision

- BERKSHIRE HATHAWAY inc

- ELEVATION

- ANT GROUP (Alipay)

- Alibaba Group and many more.

Investors Selling Their Shareholdings

- Antfin (Netherlands) Holding B.V.

- Alibaba.com Singapore E-Commerce Private Limited

- Elevation Capital V Limited

- Elevation Capital V FII Holdings Limited

Competitive Strengths

- Ecosystem allows us to address large market opportunities

- Trusted brand, scale and reach

- Deep insights of Indian consumers and merchants

- Grow consumer and merchant base

- Expand into international markets

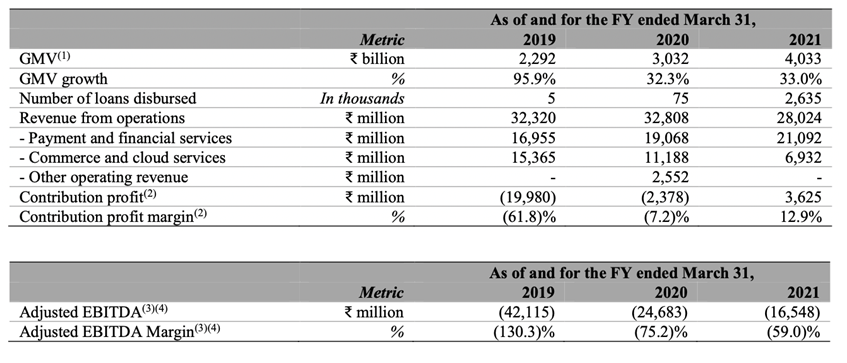

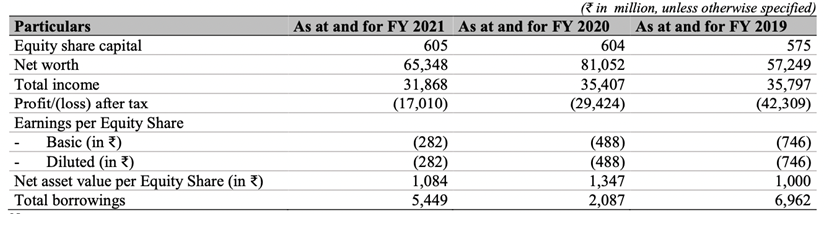

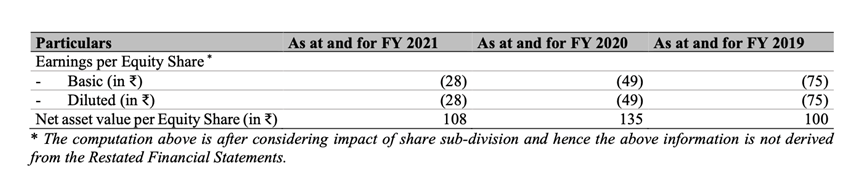

Financial

Verdict

The upcoming Paytm IPO does not seem to give a positive vibe. There are a couple of shortfalls that might hinder the growing prospect of the company. The first and foremost is that Mr. Vijay Shekhar Sharma is the only one who rules the company and has a tendency to replace other board of directors from time to time. This might cause a problem in the company’s board of directors panel and then to its shares.

In 2 years over 10 senior executives of Paytm including Pravin Jadhav, the initiator of Paytm Money has resigned. In 2017, Pravin Jadhav started Paytm Money. The net profit was Rs 65 crores in 2018 that slid down to Rs 18 crores in 2021 after he resigned. Paytm’s parent company One97 had once taken a hefty loan and was under debt. Piyush Agarwal invested in the company and in return asked him for a 40% stake in his company. However, what happened next remained a mystery. Another incident in this regard needs to be taken into consideration. The Ex-Director of One97, Ashok Kr. Saxena had lent Rs 27,000 million to Vijay Shekhar for the company and in return asked for 55% stake in the company. Vijay Shekhar declined the stake to Ashok Kr. Saxena.

The second thing is that the Paytm UPI is used by the consumers while the merchants use Paytm as a whole. Wallets are also going through losses as they charge a certain amount when an user tries to transfer his amount from the wallet to his linked bank. The same thing is with the Paytm Wallet and thus the number of users of the Paytm Wallet has significantly decreased.

Thirdly, The investors of the Paytm company are mostly Chinese companies. This is not an issue until there is some serious conflict between India and China. In any circumstances, if India chooses to ban usage of Chinese brands or companies having Chinese investors, Paytm will be grounded. Thus, it can be concluded that the upcoming Paytm IPO will be fully subscribed. But it will not be subscribed to 8x or 10x unlike the previous IPOs.

4 Comments

I am really glad to read this webpage posts which carries plenty of valuable

information, thanks for providing this kind of information.

This is really interesting, You’re a very skilled blogger.

I have joined your feed and look forward to seeking more of your great post. Also, I’ve shared your website on my social networks!

Wonderful post however I was wondering if you could write a little more on this subject? I’d be very grateful if you could elaborate a little bit more. Appreciate it!

Hello to all, I am really keen on reading this website’s posts updated regularly. It carries pleasant stuff.