Upcoming Star Health IPO: Can It Make The Desired Profit Now?

- IPO Stocks

Yaseer Rashid

Yaseer Rashid- November 25, 2021

- 0

- 27 minutes read

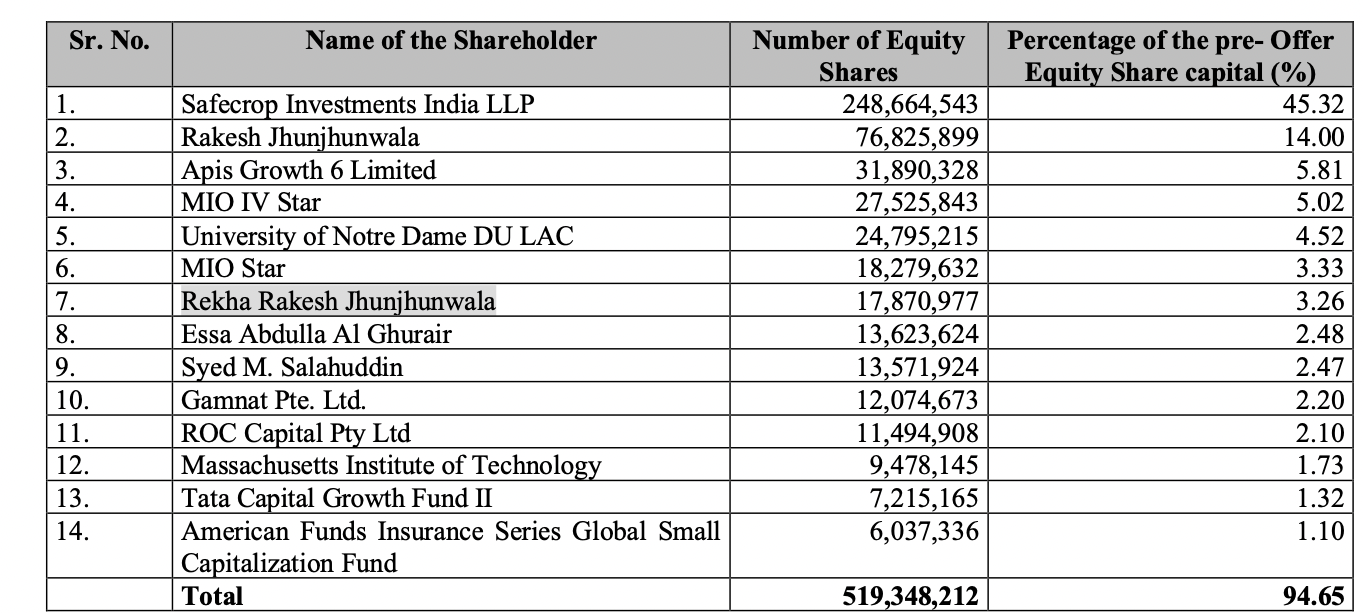

The Upcoming Star Health IPO has already been declared. As per the Star Health IPO news, the issue will open on the star health IPO date, 30th of November, 2021, and will continue till the 2nd of December, 2021. Star Health and Allied Insurance Company that the billionaire investor Rakesh Jhunjhunwala, Safecrop Investments India, Westbridge have promoted, have come up with the fixed price band (Star Health IPO share price) of INR 870 to INR 900.

The IPO has a fresh issue worth INR 2,000 crore while the offer for sale (OFS) is up to 58.32 million shares by its existing shareholders and promoters. However, the shares worth INR 100 crore have been reserved for the company’s employees. The company aims to utilize the proceeds of the fresh issue for augmenting its capital base and simultaneously maintaining its solvency ratio. IRDA I norms and regulations state that the minimum solvency ratio to be maintained by the health insurers is 1.2. As of 31 March, the solvency ratio of Star Health has been 2.23x.

Coming to the lot size of the Upcoming Star Health IPO, the investors are required to apply for a minimum of 16 shares and in the multiples thereof. Thus, the minimum investment that is required for the retail investors is INR 14,400 while the maximum investment is decided to be INR 1,87,200 for 13 lots (208 equity shares).

Following the public issue closure, the share allotment will be finalized by the 7th of December, 2021. The unsuccessful investors will receive their refunds in their respective bank accounts by the 8th of December, 2021. The successful investors will receive their shares in their respective Demat accounts by the 9th of December, 2021. The expected market debut date for the shares is the 10th of December, 2021.

Health Insurance Industry: An Overview

The global health insurance market has been estimated to be around $1.5 trillion in 2019. The health insurance industry is primarily driven by the surge in the health expenses and the rise in the prevalence of chronic ailments. The government across countries are taking initiatives for increasing the health insurance coverage via diverse ways of funding. The Covid-19 pandemic outbreak has further pushed forward the growth of the health insurance industry.

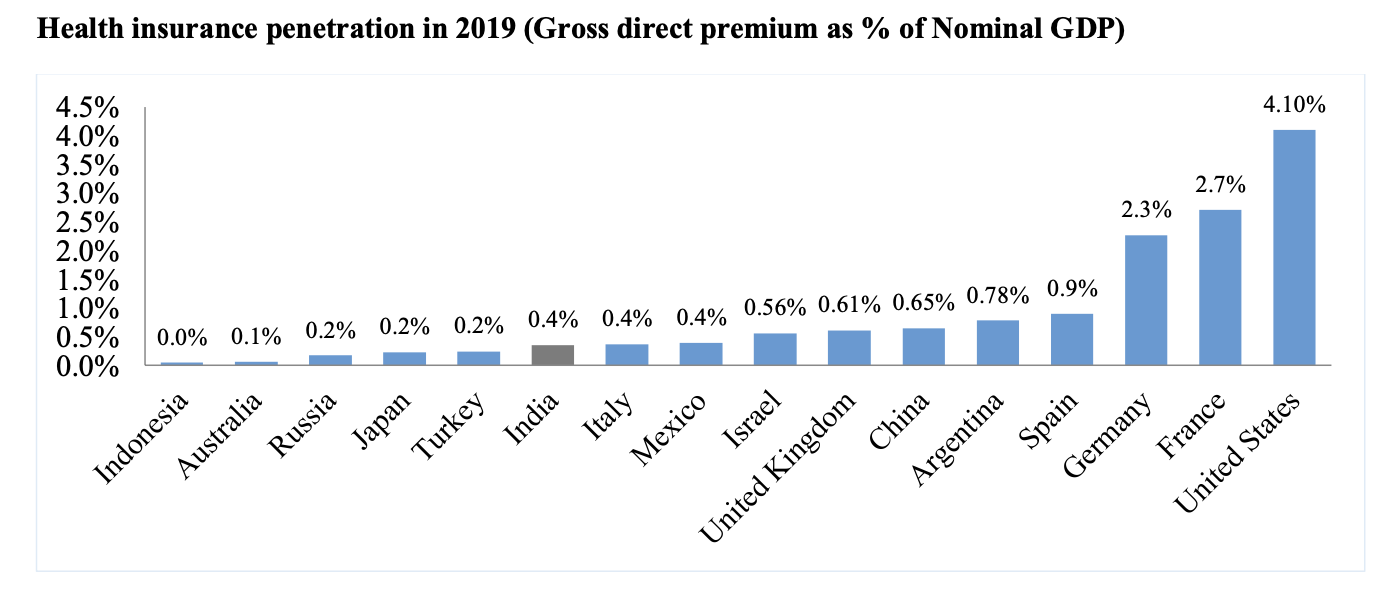

Asian regions are expected to experience a relatively higher growth owing to the enhancement of the health facilities and the rising awareness regarding the health insurance that further results in the higher unmatched demand for the health insurance in several high demographic countries including India and China. The following graph shows the health insurance penetration in India and several other countries in 2019.

Health insurance penetration in India is as low as just 0.36% of the GDP. On the contrary, the global average comes around 2% of GDP. Some of the countries such as Argentina, China, UK and the United States possess higher penetration levels of 0.78%, 0.65%, 0.61% and 4.1% respectively.

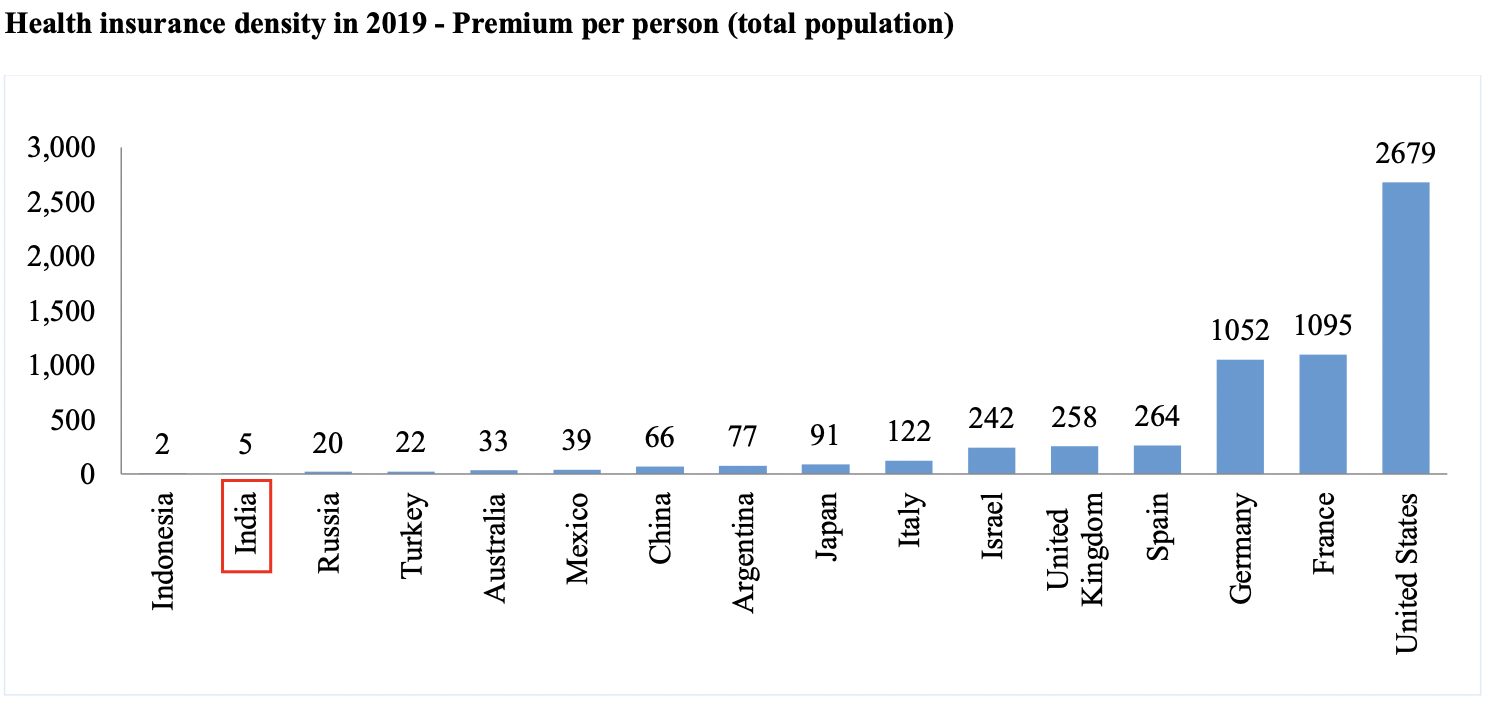

Health Insurance Density Promises Huge Scope For Indian Health Insurance Growth

The health insurance density acts as a crucial indicator to determine whether a country’s health insurance sector has developed. On this basis, as compared to other countries, India is much backwards in terms of the health insurance density. It is surprising to see that despite a pretty lower penetration in Australia and Japan, the per person premium for health insurance is much higher than in India. Considering the case, populous countries like China, had recorded 13 times higher premium per person in 2019 than India.

What Impact The Covid-19 Pandemic Had On The Health Insurance Industry?

Owing to the Covid-19 pandemic, the income growth and savings had come under pressure. But the demand for term insurance has increased further elevating the demand of the health insurance industry. For instance, in 2003 and 2004, during the SARS outbreak in China, the China Life Insurance Company had witnessed the growth of nearly 40% for the short term health insurance in a year. Additionally, from 2013 to 2014, when the MERS broke in the Middle East, Bupa Arabia, the largest health insurer of Saudi Arabia had gone through a growth of 45% and 81% year-on-year growth in premiums in the same years.

While the hike in the demand for health insurance during such an outbreak increases the awareness of the health insurance and the opportunity of the health insurers, in the short term, it will probably result in an elevation in the claims pay out. For example, in the Indian Market, the Indian Regulator (IRDAI) has instructed all the insurance companies to cover the COVID-19 claims under the existing active policies.

The Health insurance gross direct premium has increased by ~16% in the fiscal year 2021. The individual policies had highly driven this wherein the gross premium had increased by ~28% as against 10% for the group policies and the de-growth in the government business. As the matter of fact that the COVID-19 risk would not have been accounted for in policies active at the moment of the outbreak of the pandemic, the claims on this front are likely to be larger than originally expected.

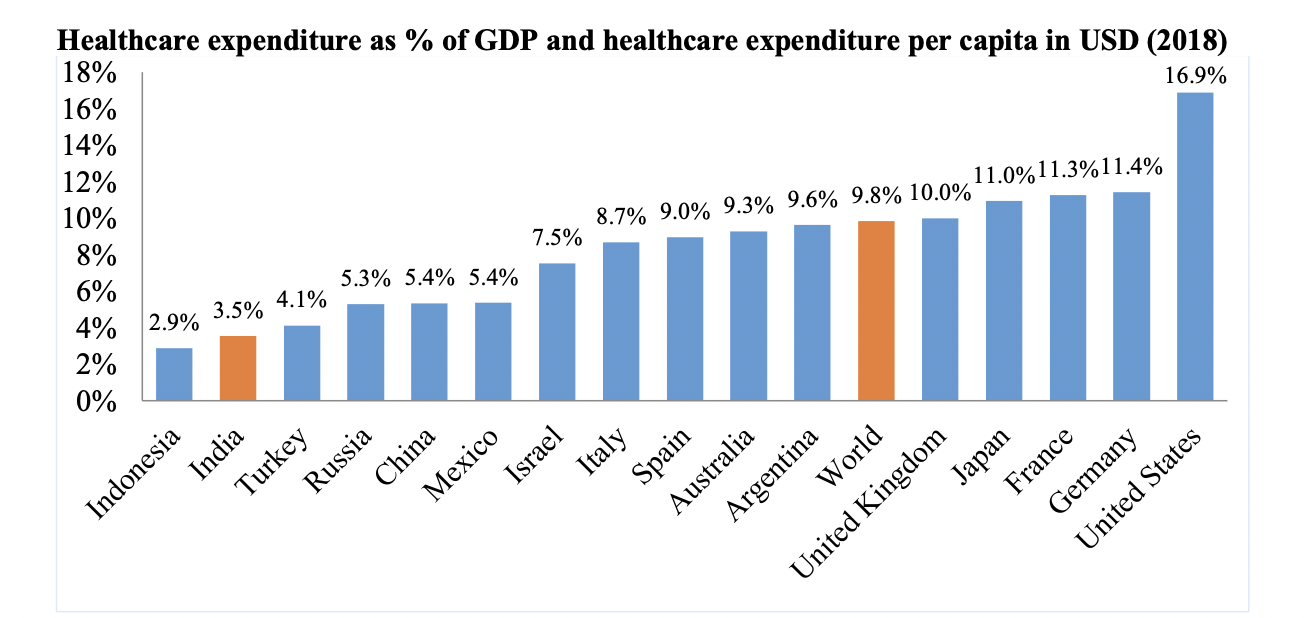

India’s Healthcare Spends and Comparison With The Other Global Markets

As per the Global Health Expenditure Database that the World Health Organization (WHO) has compiled, the current expenditure of India on healthcare was 3.5% of the GDP in 2018. India is located behind the world’s average of 9.8%.

India’s Out-of-Pocket Expenditure Of The Total Healthcare Expenditure (2018)

The out-of-Pocket expenditure on healthcare in India is nearly 63% of the complete health expenditure of 2018. This indicates the fact that most of the households and individuals either do not have health insurance or they never had an adequate cover.

Healthcare Inflation Trends

As seen frequently, the healthcare inflation has been constantly higher than the overall CPI inflation between the Fiscal Year 2018 and the Fiscal Year 2020. Nevertheless, in the Fiscal Year 2021, the growth in healthcare inflation had reduced a lot. This was partially as a result of the measures imposed b6y various governments for controlling the pricing of the medical facilities and to reserve beds for the Covid-19 patients. Below is a graph that demonstrates the forth healthcare inflation as compared to the CPI inflation for the indicated periods.

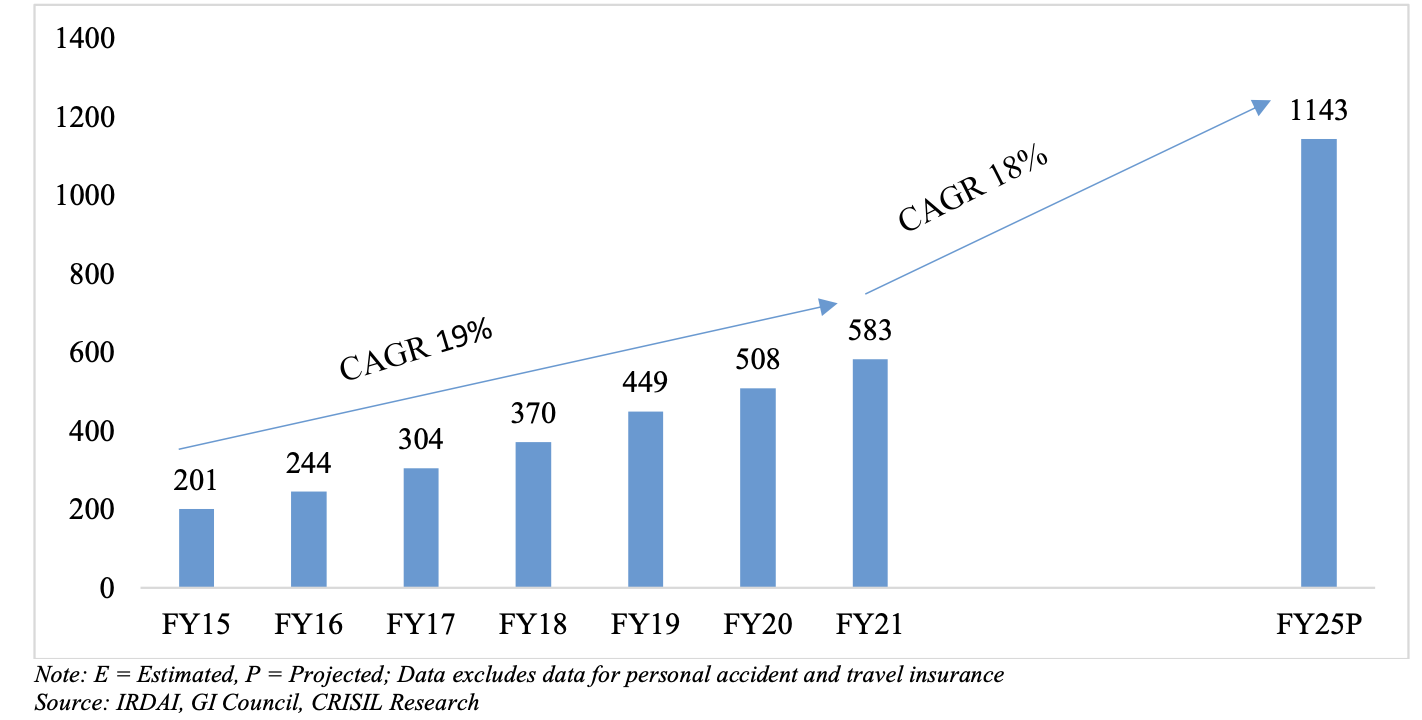

Projected Growth In Gross Direct Premium over Next 5 Years

Moving forward, digital innovation is the key to elevated productivity of the core business, enhanced customer support, optimize costs, unlock partnerships with digital companies outside insurance and improved business quality.

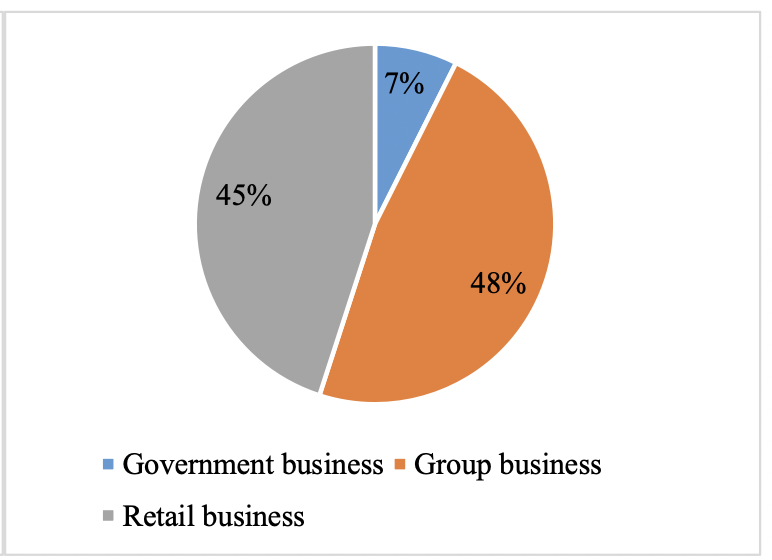

Retail Business Sector Will Grow At A Much Faster Speed

Considering the health insurance industry, CRISIL Research has expected that the Retail business will see a growth at a CAGR of 23% between the Fiscal years 2021 to 2025 in comparison to the 11% CAGR growth in Government and 15% growth in Group businesses. The coronavirus pandemic has subsequently increased both the awareness and the demand for health insurance that has driven the individuals to take up health insurance in the existing financial year. Furthermore, the increasing penetration, rising focus from the private and SAHI companies towards the retail business and the expedited customer awareness are likely to facilitate the strong growth in the segment.

How Is Star Health As A Medical Insurance Company?

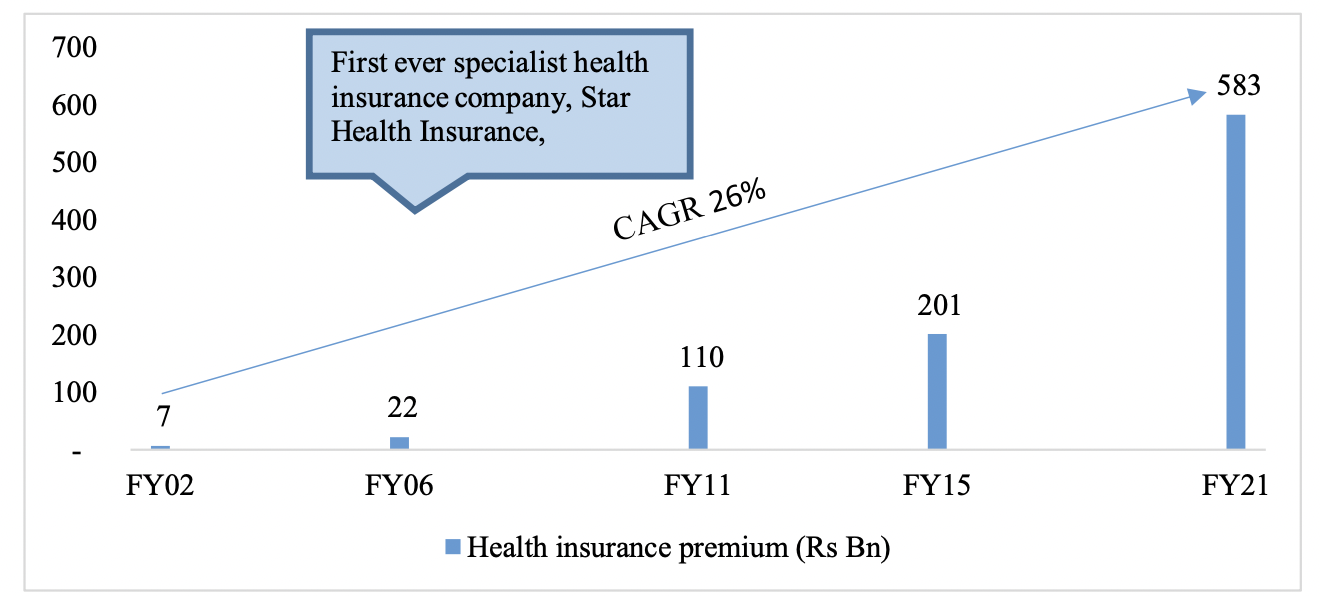

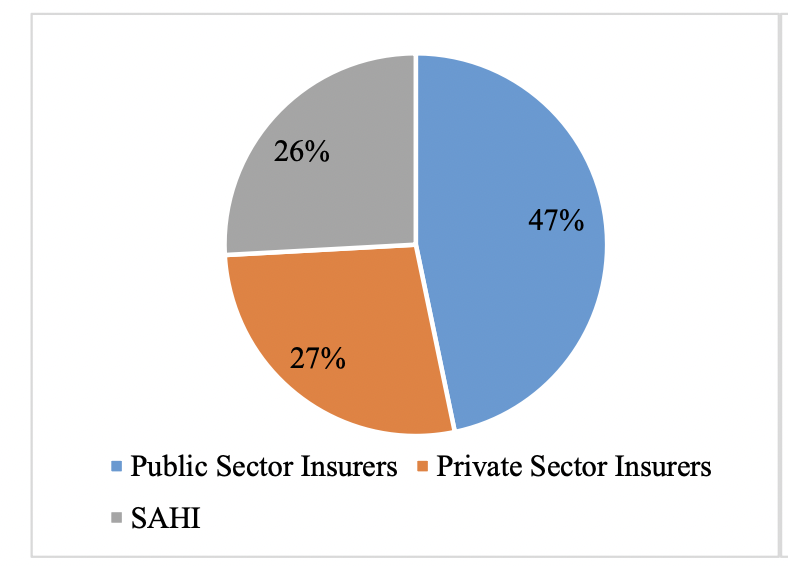

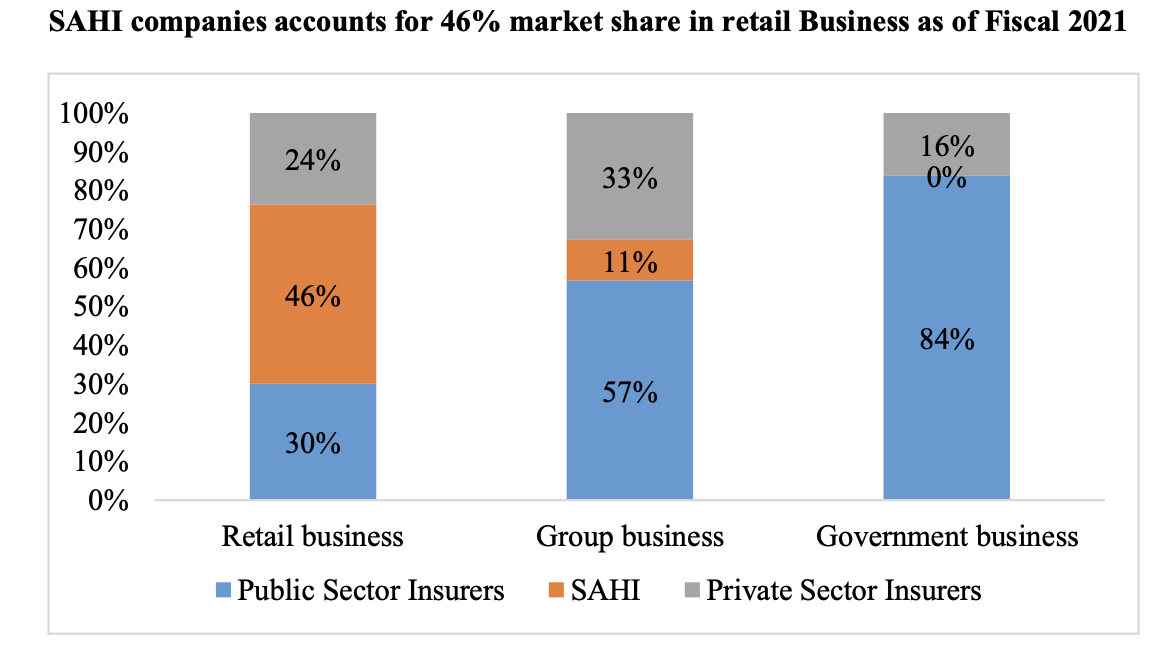

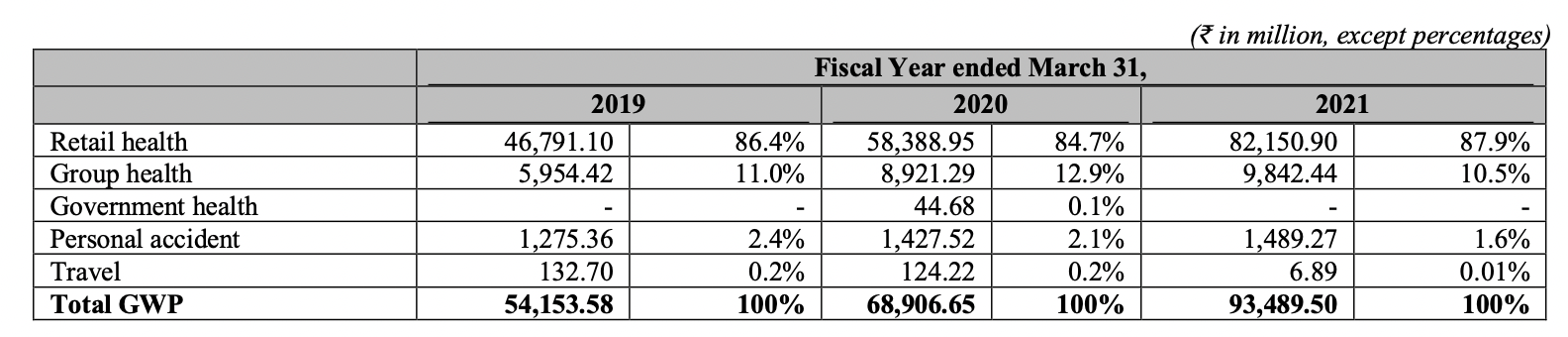

Star Health continues to be the largest private health insurer in India bearing a market share of 15.8% in the Indian health insurance market in the Fiscal year 2021. This is also approved by CRISIL Research. The research also states that the company had a total GWP of INR 93,489.50 million. It was the very first standalone company in India (“SAHI”) that was established way back in 2006. Now, they have grown into the largest SAHI company in the overall Indian health insurance market, as per CRISIL Research.

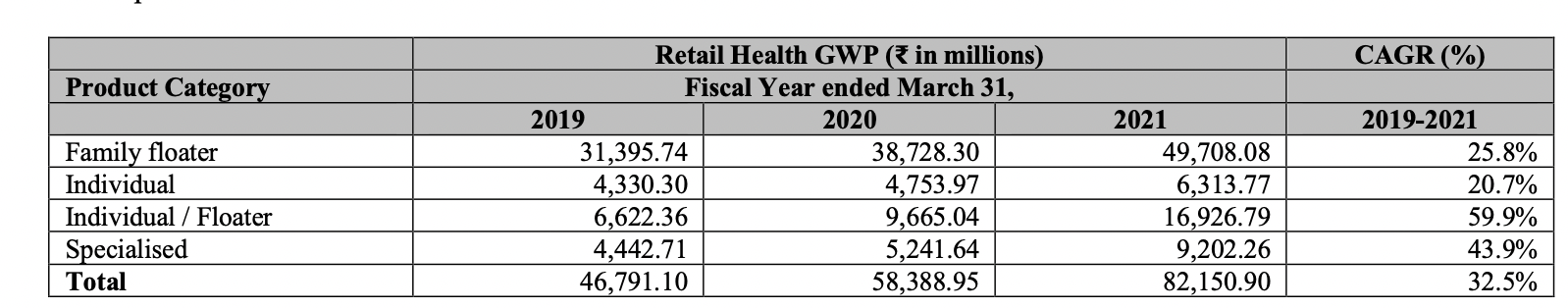

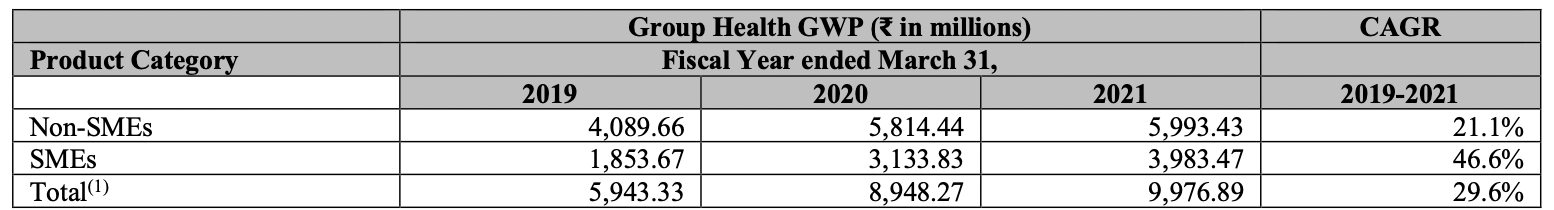

Star Health’s comprehensive health insurance product suite has successfully insured 20.5 million lives in the Fiscal Year 2021 in the group health and retail health. This accounted for 89.3% and 10.7% respectively of their total health GWP in the Fiscal Year 2021. They strategically focussed on the retail health market and enjoyed a retail health GWP of INR 82,150.90 million in the Fiscal Year 2021.

The company had been frequently ranked first in the retail health insurance in India depending on the retail health GWP over the past three Fiscal Years, as per Crisil Research. Additionally, the retail health market sector is expected to come out as a major growth driver for the total health insurance industry in India following the Covid-19 crisis in the country owing to the low penetration of the health insurance, the high out-of-pocket expenses for healthcare costs and just 10% of the population possesses insurance policies outside the government plans, states the CRISIL Research.

In the Fiscal Year 2021, the company’s retail health GWP has been over three times of the retail health GWP of the next participant of the highest retail health insurance market. As per CRISIL Research, Star Health is well positioned to continue growing its business and the market share.

In the primary phase, the company distributes their Health insurance policies via the individual agents that accounted for 78.9% of their GWP in the Fiscal Year 2021. Star Health has also led the non-public health insurance market in terms of the new branch openings since the Fiscal Year 2018. The company’s branch network bears over three times the number of the next largest non-public health insurance provider (31st December, 2020), as stated by CRISIL Research.

The company offers a wide range of the flexible as well as comprehensive coverage options especially for the retail health, personal accident, group health and overseas travel that accounted for 87.9%, 1.6%, 10.5% and 0.01% respectively of their complete GWP in the Fiscal Year 2021.

Star health has also successfully curated one of the largest health insurance hospital networks pan India having over 10,870 hospitals. Amongst these, in over 7,000 hospitals, they have entered into the pre-agreed arrangement that accounts for 64.9% of the total number of hospitals in their network. This statistic is based on the 31st of March, 2021. In the Fiscal Year 2021, the company has processed 0.33 million claims accounting to 55.0% of their total number of the cashless claims via their agreed network hospitals.

Who Are There On Star Health’s Board Of Directors?

The following personnel can be seen currently in the Board of Directors of Star Health.

Mr. V. Jagannathan (Chairman & CEO)

He is the senior of the insurance industry having 50 years of experience in the insurance sector. He has also held several positions of authority including the position of Chairman cum Managing Director of one of the largest Public Sector Insurance Companies of India.

Dr. S. Prakash Subbarayan (Managing Director)

He is the first ever passionate medical doctor In India to become a managing Director of a chief Health Insurance Company. He has 20 years of clinical experience from Overseas and India with over a decade of experience in health insurance. His efficient contribution to the growth of Star Health Insurance has been effectively reflected in the GWP of $3 million in 2007 and $780 million in the Financial Year 2019. Subsequently, he has played a key role in the implementation of Mass Health Insurance Schemes such as the “Aarogyasri” in Andhra Pradesh alongside The Chief Minister’s Health Insurance Scheme for the Life Threatening Diseases in Tamil Nadu covering 12 crore population.

Mr. Subbarayan is also the Chairperson of CII Tamil Nadu Healthcare Panel for the past 3 consecutive years (from 2016-17). Star Health Insurance has received several awards under his leadership of which the most recent ones include ‘Emerging Trends in Corporate Governance Award’ received from the hands of the Honourable Governor of Tamil Nadu Shri Banwarilal Purohit at ‘Corporate Governance Summit 2019 and ‘The World Health Day Award of Excellence’ from the Honourable President of India, Shri Pranab Mukherjee.

Mr. Anand Roy (Managing Director)

He holds multi-dimensional responsibilities as he is the Managing Director of Star Health. He oversees some crucial functions of the company such as Marketing, Business Development, Products, Publicity, IT, HR, Actuarial and Investments.

Mr Berjis Desai (Independent Director)

He holds a Master of law Degree from the University of Cambridge, UK. He is a renowned law practitioner having nearly 40 years of experience in the transactional and the dispute resolution laws.

Ms. Anisha Motwani (Independent Director)

She is a consultant with the World Bank and has worked on the prestigious Swachh Bharat Programme in addition to the National Mission for Clean Ganga and Adoption of Solar Rooftops. She is a multi talented business leader and has an experience of over 28 years in various industries such as automobiles, advertising, financial and health services. She has been recognized amongst the ‘Top 50 Women in Media, Marketing and Advertising’ by Impact & Colors for four consecutive years since 2011. She has been awarded the ‘Women at Work Leadership Award 2011’ by Asian Confederation of Business and ‘Brand Builder of the year’ award by NDTV amongst many others.

Padmashree D R Kaarthikeyan (Independent Director)

He holds several prestigious positions by far that includes Director of Police Academy – Mysore, Chief of Intelligence and Security, Karnataka State, Special Director General of Central Reserve Police Force, Director of the CBI and Director General of the National Human Rights Commission. He had been the Chief of Special Task Force that has been instituted by the Indian Government in the Rajiv Gandhi assassination case.

Mrs. Rajni Sekhri Sibal (Independent Director)

She is an Indian Administrative Services Officer of the Haryana cadre. Recently, she has superannuated as the Secretary to The Government of India. Currently, she is the Independent External Monitor of SEBI. She is the very first woman to have topped the All India Civil Service Examinations in 1986 Batch. In her last assignment she served as the first Secretary of the Ministry of Fisheries and took the responsibility to bring about a sustained and accelerated growth in the blue economy. She has also worked as the Director Health Insurance Max India and has led the company’s initiatives into health insurance. Additionally, she has helped in the development of the business proposition and has set up the Joint Venture – Max Bupa Health Insurance.

Mr. Rajeev Agarwal (Independent Director)

He is an Engineering graduate from I.I.T, Roorkee and was in the 1983 batch of Indian revenue Service. He holds a diverse experience in the Commodity Markets, Securities Markets, Taxation – Whole Time Member of SEBI for 5 years, Member of Forward Markets Commission, erstwhile regulator of Commodity futures markets for 5 1/2 years and Indian Revenue Service for 28 years. During his tenure on the SEBI Board, he had supervised and handled the policy of the important departments that were dealing with the markets in bonds, equity, commodities and currencies, Foreign Investors, Mutual Funds, Corporate Governance, International Affairs, VCFs, PEs and Startups etc.

Mr. Sumir Chadha (Director)

He is the Managing Director and Co-Founder of West Bridge Capital. He has been investing in India for the last twenty years in both the private and public sectors.

Mr. Deepak Ramineedi (Director)

He is a Principal at the West Bridge Capital. He has been with the company for over 8 years and possesses 10 years of experience in the equities space.

Mr. Utpal Sheth (Director)

He is the Chief Executive Officer at Rare Enterprises. He is also a Commerce Graduate, Cost Accountant and Chartered Financial Analyst from ICFAI.

Upcoming Star Health IPO: The Offer

- Fresh Issue Equity Shares – aggregating up to INR 20,000 million

- Offer for Sale – 60,104,677 Equity Shares, aggregating

- Issue size – INR 30,000 million

- Face value – ₹10

What Are The Competitive Strengths of Star Health Insurance?

Below are some of the major competitive strengths of the Star Health Insurance Company:

- They are the largest private health insurance company in India bearing leadership in the attractive retail health management.

- They possess one of the largest and well spread distribution networks in the health insurance industry in addition to an integrated ecosystem that enables them to continue to access the growing retail health insurance market.

- They possess and offer a diverse product suite having a focus on the innovative and the specialized products.

- The company focuses on the strong risk management with domain expertise that drives a superior claims ratio as well as quality customer service.

- They have made substantial investments in innovative business processes and technology.

- They have consistently demonstrated superior operating as well as financial performance.

- The company boasts an experienced senior management team bearing strong sponsorship.

What Are The Company Strategies of Star Health Insurance?

Below mentioned are the key company strategies that Star health Insurance implements:

- The company continues to leverage and enhance the market leadership in the potential retail health insurance sector.

- They continue to enhance the existing distribution channels and alternatively develop the channels.

- They keep on going with product innovation and offer their value added services.

- They utilize their business digitization for improving the operational efficiencies and the customer service.

Products That You Can Expect From Star Health Insurance

Here are the products that you will find from their portfolio:

- Retail health insurance

- Group health insurance

- Government health insurance

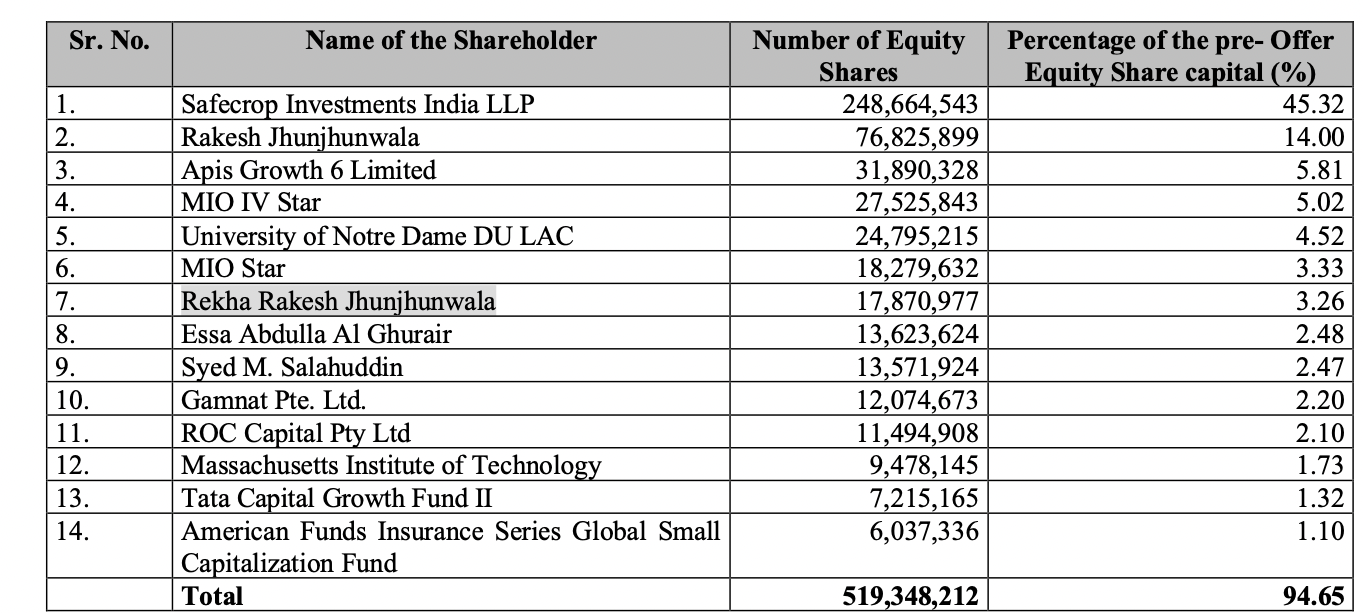

Sales, Distribution And Shareholders of Star Health

How Is Star Health Doing Financially?

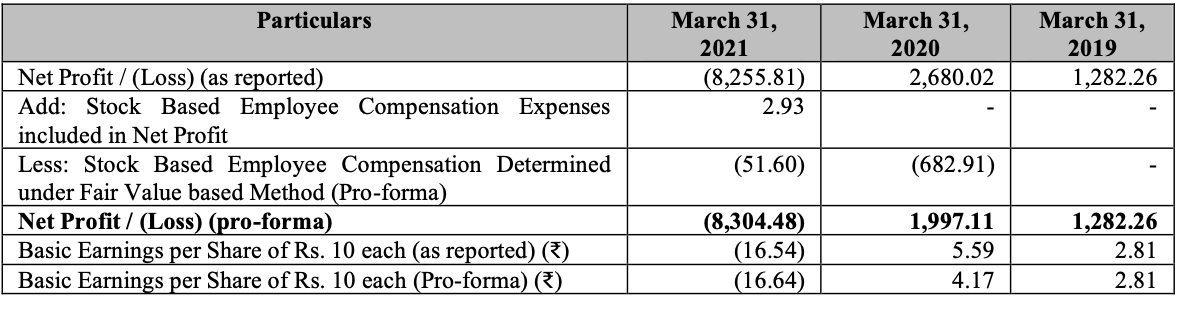

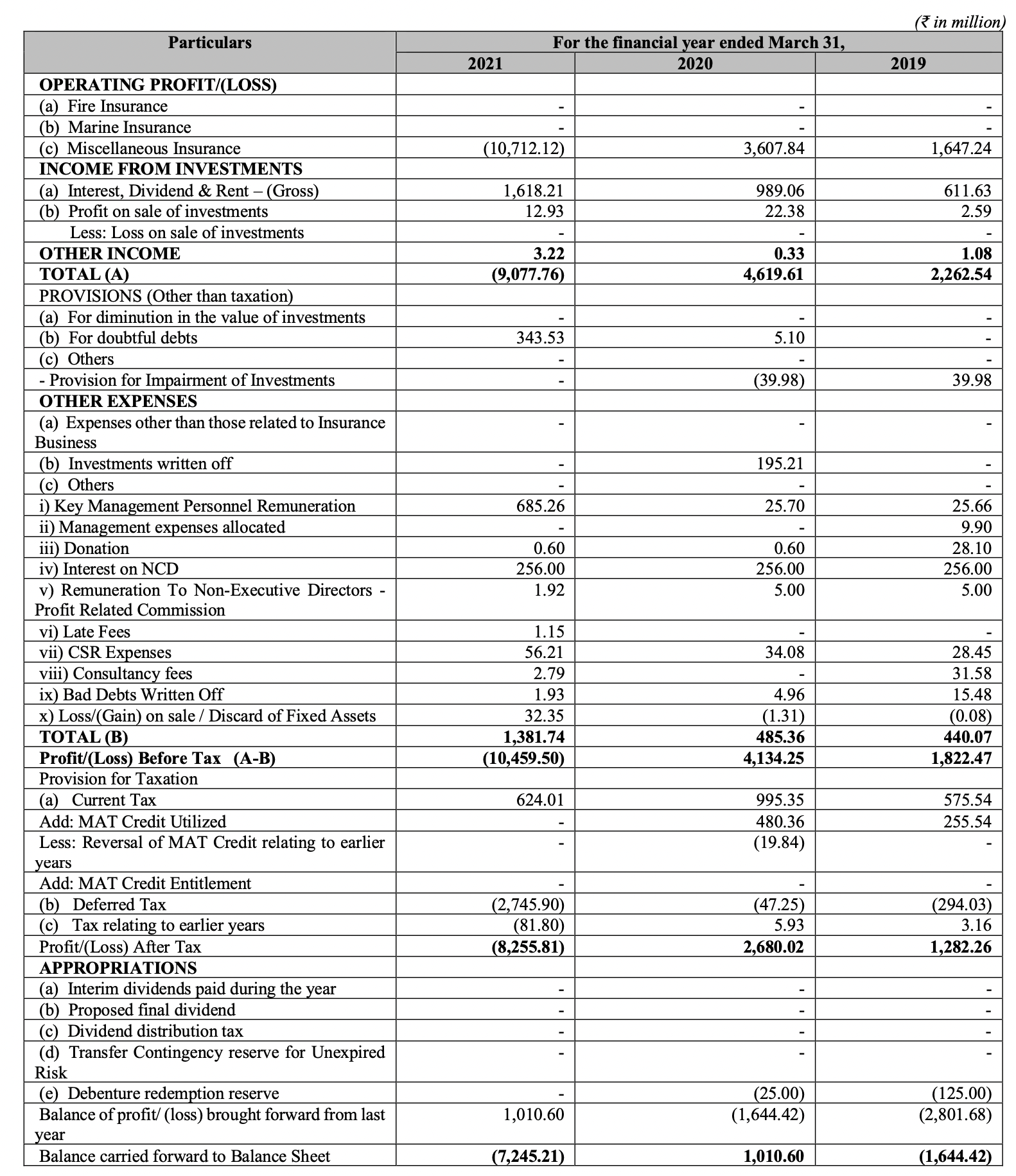

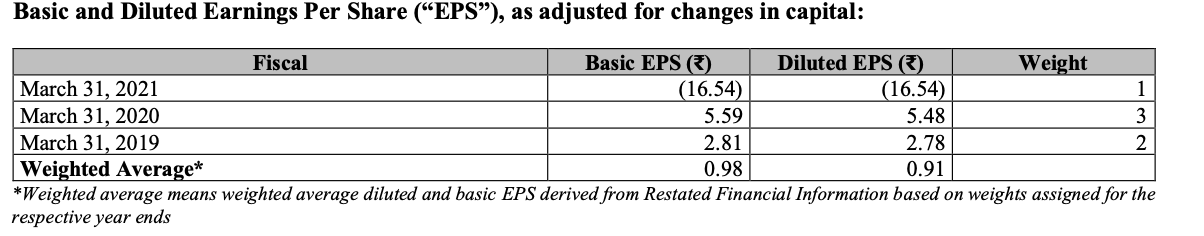

Below is a clear view of the financial performance of Star Health by far that will help you in making a decision on the Upcoming Star Health IPO:

Verdict

The Upcoming Star Health IPO will be a success and this can be stated based on a couple of factors. It can also be forecasted that the IPO can be subscribed for a minimum of 4x-6x because of the influence of Rakesh Jhunjhunwala.

Star Health Insurance is the largest private health insurance company in India and ranks 2nd after LIC (combining private and government health insurance companies) in capturing the industry. The company has a great financial performance (as per March 31, 2020 and March 31, 2019) although there is a loss (as of March 31, 2021) owing to heavy claims from customers for Covid-19 cases which will not affect its financial condition in the long run.

The company’s Board of Directors are highly educated and experienced. The Board of Directors of Star Health are something very few companies have been able to make. Star Health Insurance’s growth has effectively been reflected in the GWP of $3 million in 2007 and $780 million in the Financial Year 2019 under the supervision of Dr. S. Prakash Subbarayan.

The Covid-19 situation has been worse in the previous year and there have been health emergencies. In such a scenario if the government comes out with health insurance schemes, the company will flourish and have great profit thereafter.

Another most striking thing that can be seen is that the company is backed by Rakesh Jhunjhunwala. He along with his company RARE Enterprises holds 18.21% stake in Star Health Insurance.

The company is likely to grow enormously in future and attract a greater customer base. Investing in the company for a long run is the best decision, if you are ready to do so.