Upcoming Tega IPO: How Strong Should Your Trust Be?

- Stocks

Yaseer Rashid

Yaseer Rashid- November 30, 2021

- 0

- 27 minutes read

The Upcoming Tega IPO has already been announced and is about to begin soon. As per the Tega IPO news and the Tega IPO details shared, the Tega Industries IPO date for subscription is commencing from the 1st of December, 2021, and will continue till the 3rd of December, 2021. Tega Industries, the leading polymer-based mill liner producer, has fixed a price band (Tega IPO issue price) at INR 445-453 per share for the public offer. The company is however planning to gather INR 6192.2 million via its public issue (Tega IPO Issue Size), at the upper price band.

The latest Tega IPO is completely an offer for sale or OFS of 1,36,36,478 equity shares by the selling shareholders and the promoters. The investors are allowed to bid for a minimum of 33 equity shares (Tega IPO Lot Size) and thereafter in multiples of 33 shares. The retail investors are permitted to make a minimum investment of INR 14,949 per lot and their upper limit would be INR 1.94.337 for 13 lots. JM Financial and Axis Capital are the book-running lead managers to the issue. The Tega Industries IPO listing date is on the 13th of December, 2021. As stated by the market observers, the Tega Industries IPO GMP today, as of the 30th of November 2021 has raised to INR 310.

Here is a detailed discussion bearing the Tega Industries IPO review.

An Insight Of The Mining Industry

The mining industry is a huge space and it is challenging to give an insight of the complete industry. Thus, we have divided the industry insight into two distinct divisions, viz., Global Mining Industry and Indian Mining Industry.

Global Mining Industry

Back in 2020, the Asia-Pacific had accounted for 71% of the global mining industry which is followed by North America by 9%. The mining industry comprises several organizations, sole dealers and the partnerships that harvest commodities, rocks and various other useful resources such as non-ferrous and ferrous metals, gravel, sand, coal and more from the Earth’s crust. The leading companies in the mining market are – BHP Billiton Ltd, Glencore Plc, Vale SA, Rio Tinto Group, and CRH Plc.

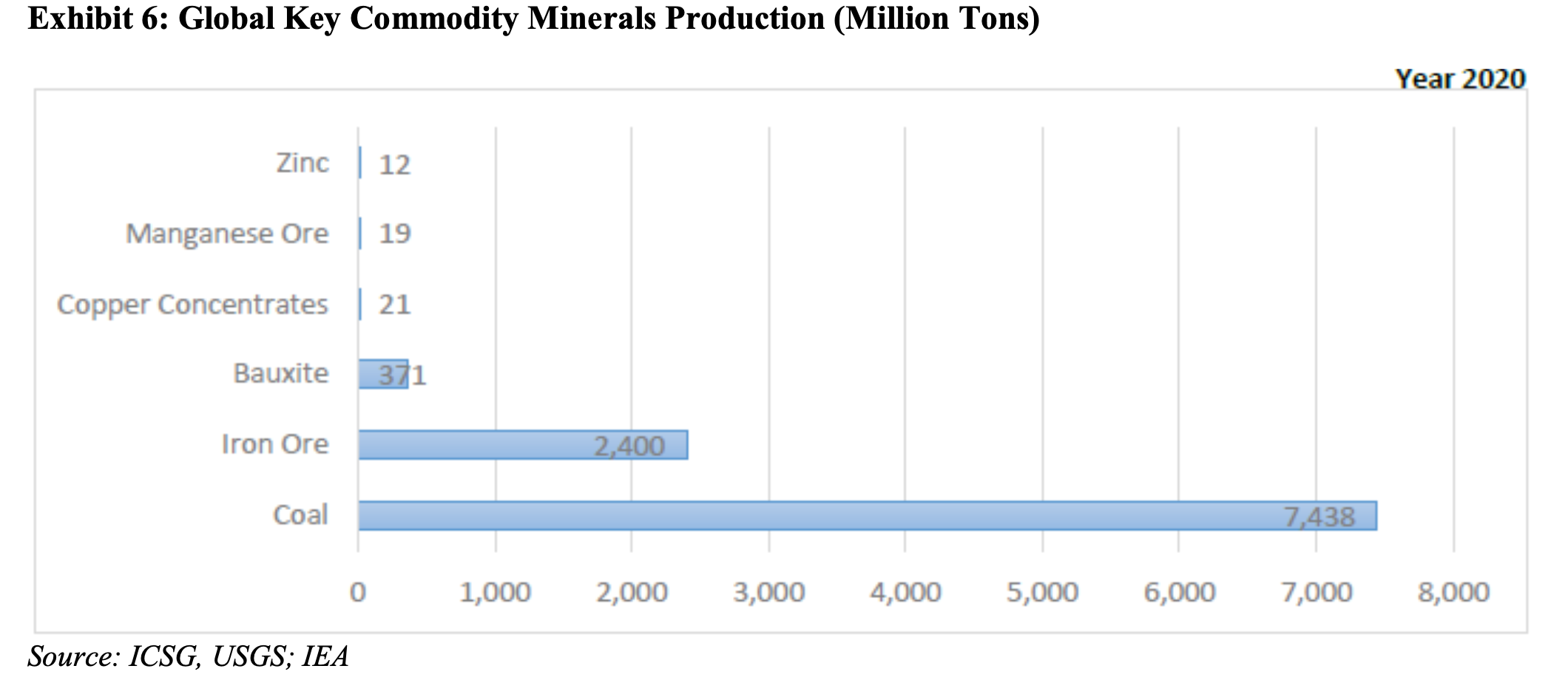

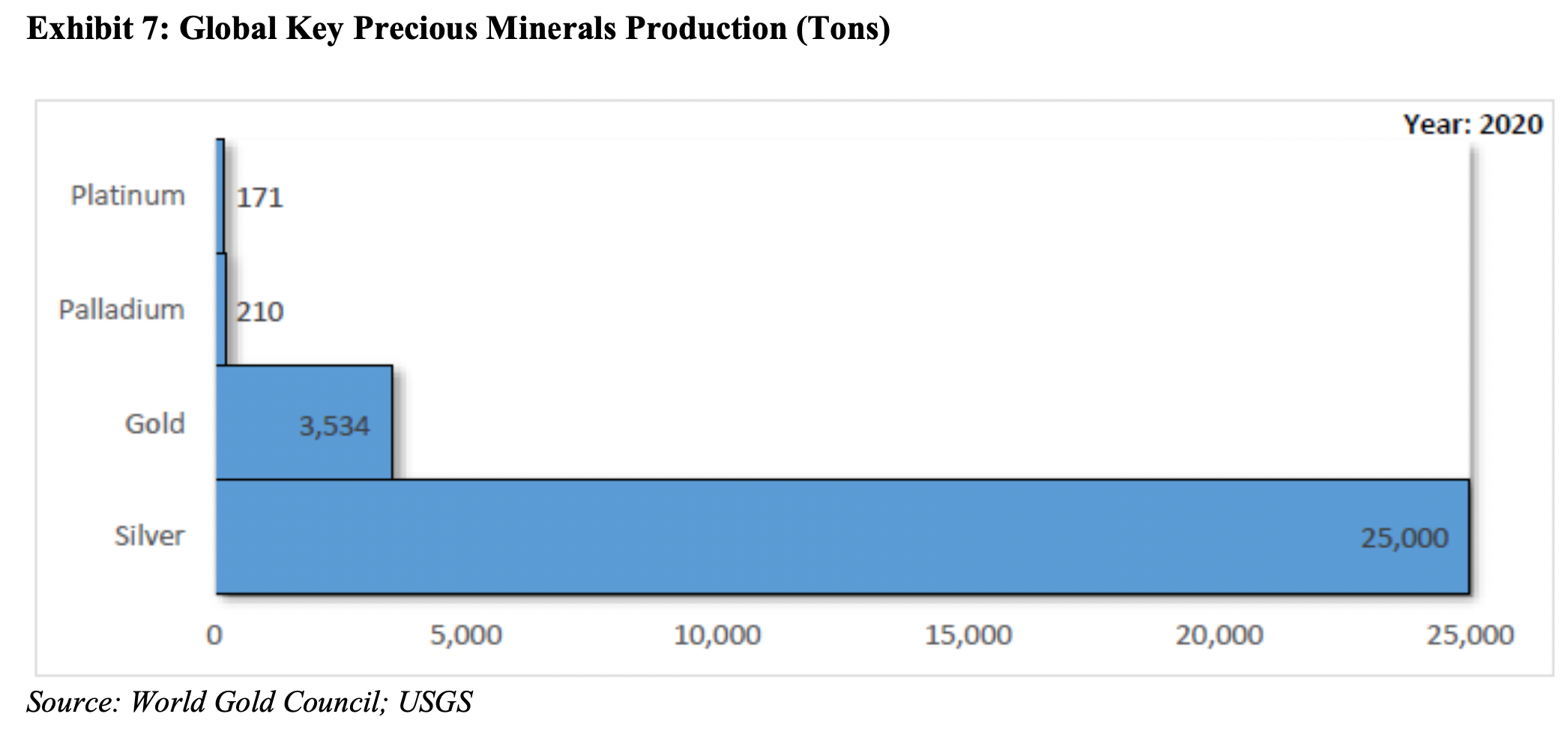

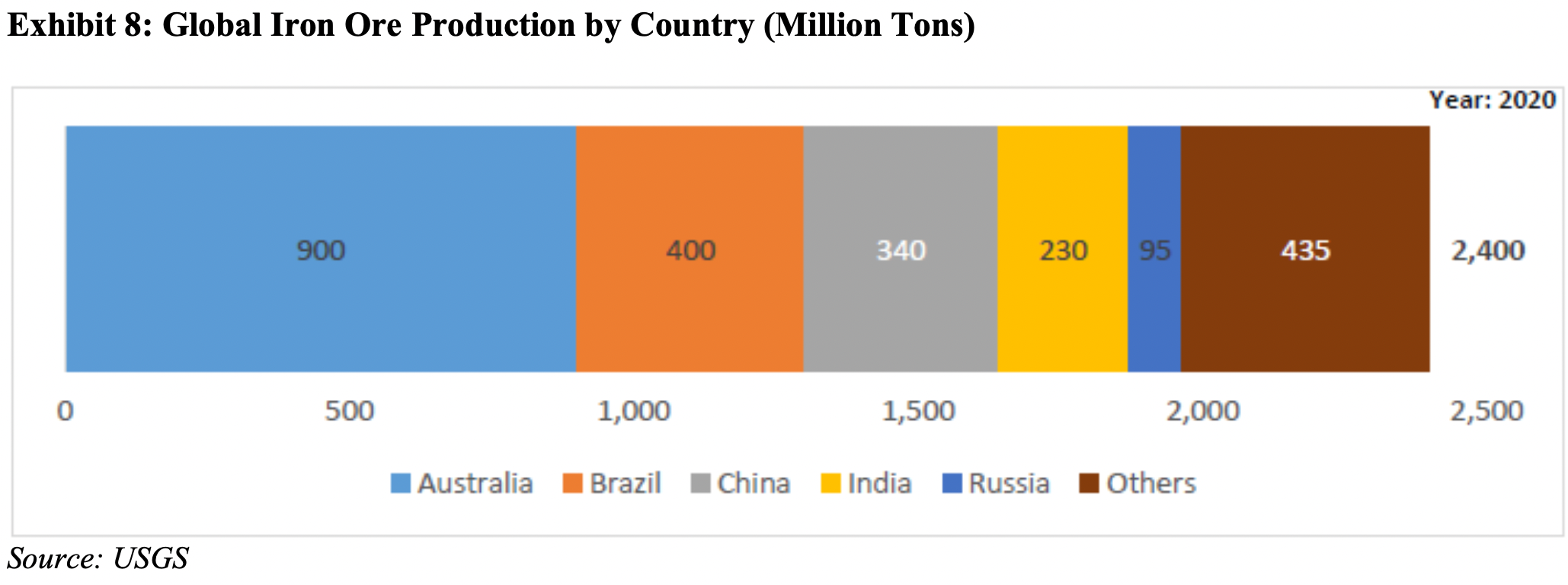

The global commodity mineral production in the year 2020 had been 10.2 billion tons with two largest minerals mined worldwide, viz., coal and iron accounting for 96% of the total production. Silver is the most mined precious metal that accounts for 86% of the total precious metal mined and it is found close to the Zinc deposits as compared to gold that is mostly mined near the copper mines.

The Indian Mining Industry

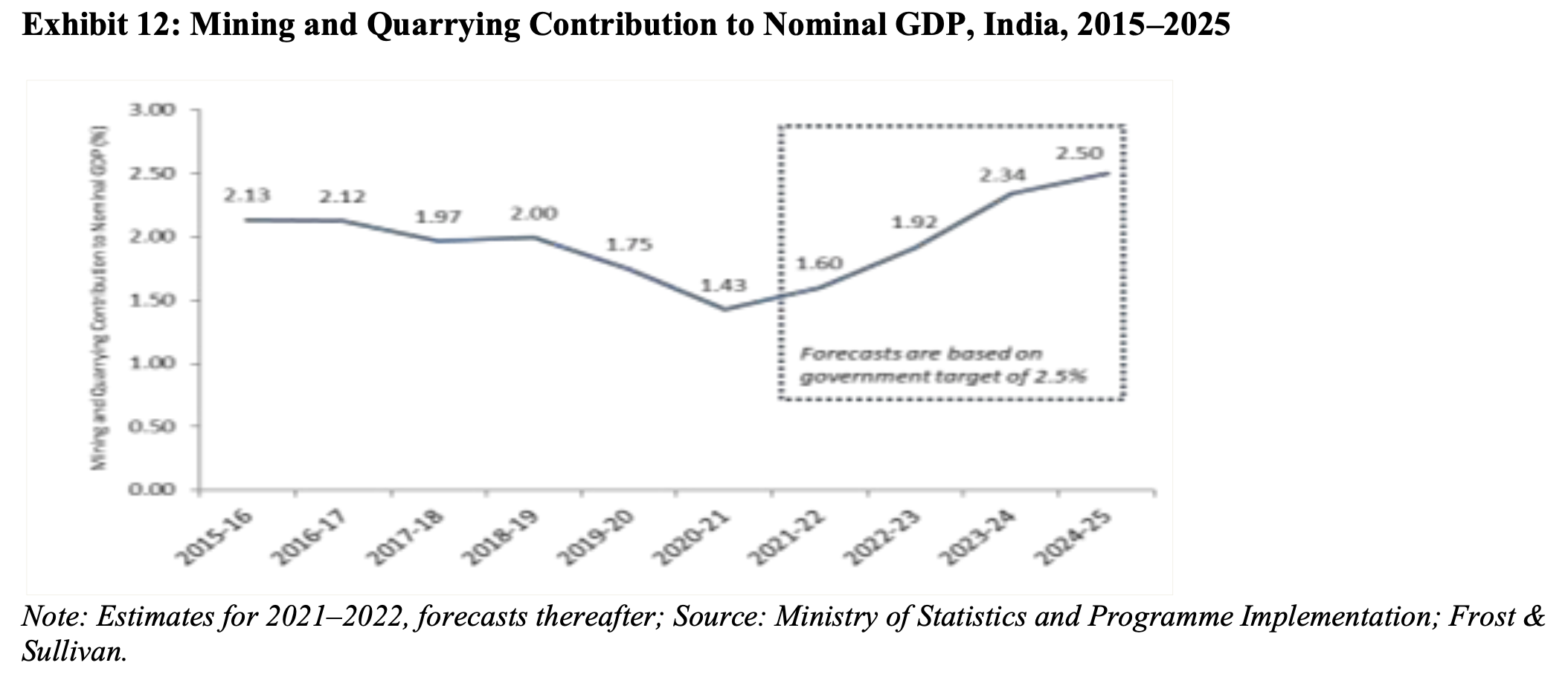

The contribution of GDP in the mining and the quarrying sector in terms of real and nominal GDP has nose-dipped over the last decade. Considering the nominal GDP, the share of mining and quarrying has simultaneously declined from 2.13% in 2015-16 to 1.75% by 2019-20. However, the government is more focussed on raising the share from 1.75% t0 2.50%, as per The Hindu, Financial Express, and India Today. The timeline for the raise to 2.50% commitment is still unclear while it is roughly stated as per assumption that the timeline is possibly 2024-2025, in line with the 2024-2025 vision of the government to become a $5 trillion economy.

Considering the worldwide comparison of the mining shares, for example, the Australian mining sector has accounted for 11.1% of the country’s nominal gross value added for 2019 and 2020. In South Africa, the mining sector has accounted for 7.2% of the country’s 2019 GDP, as stated by the Australian Bureau of Statistics and the Statistics of South Africa. However, these figures reflect the larger mining sector contribution in these two economies.

What Are The Key Trends In The Mining Industry?

Below are the two perspectives of trends currently in position in the mining industry – demand side drivers and supply side drivers. Additionally, there are macroeconomic trends and developments in India.

Demand Side Drivers

The following are the Global Macroeconomic Trends and Developments that are related to the copper and gold mining industries:

- Increasing global shift towards renewables for driving demand.

- The U.S. Electric Vehicle (EV) policies drive copper demand.

- The South African gold mining industry is benefitting from the safe haven demand and the higher metal prices.

Supply Side Drivers

- The production shortages drive the long term gold price rise as well as the near term copper price rise.

- The declining ore grades.

- The extension of the decline in Chilean Copper production in the first quarter of 2021.

- The proposed royalty on the Chile lithium and copper sale.

Macroeconomic Trends And Developments In India

- Indian Mining Structural Reforms 2021

- Opening Up for Commercial Coal Mining

- Targeted Tripling of Gold Production

What Are The Government Spending Plans?

Currently, the government is aiming to spend its funds in three primary ways such as:

- $1.5 Trillion (₹111 Lakh Crore) under National Infrastructure Pipeline

- Target of Raising Public Healthcare Spending Share to 2.5% of GDP

- $26.9 Billion (₹1.97 Lakh Crore) on Production-Linked Incentive (PLI) Schemes

An Insight Of The Global Mineral Processing Industry

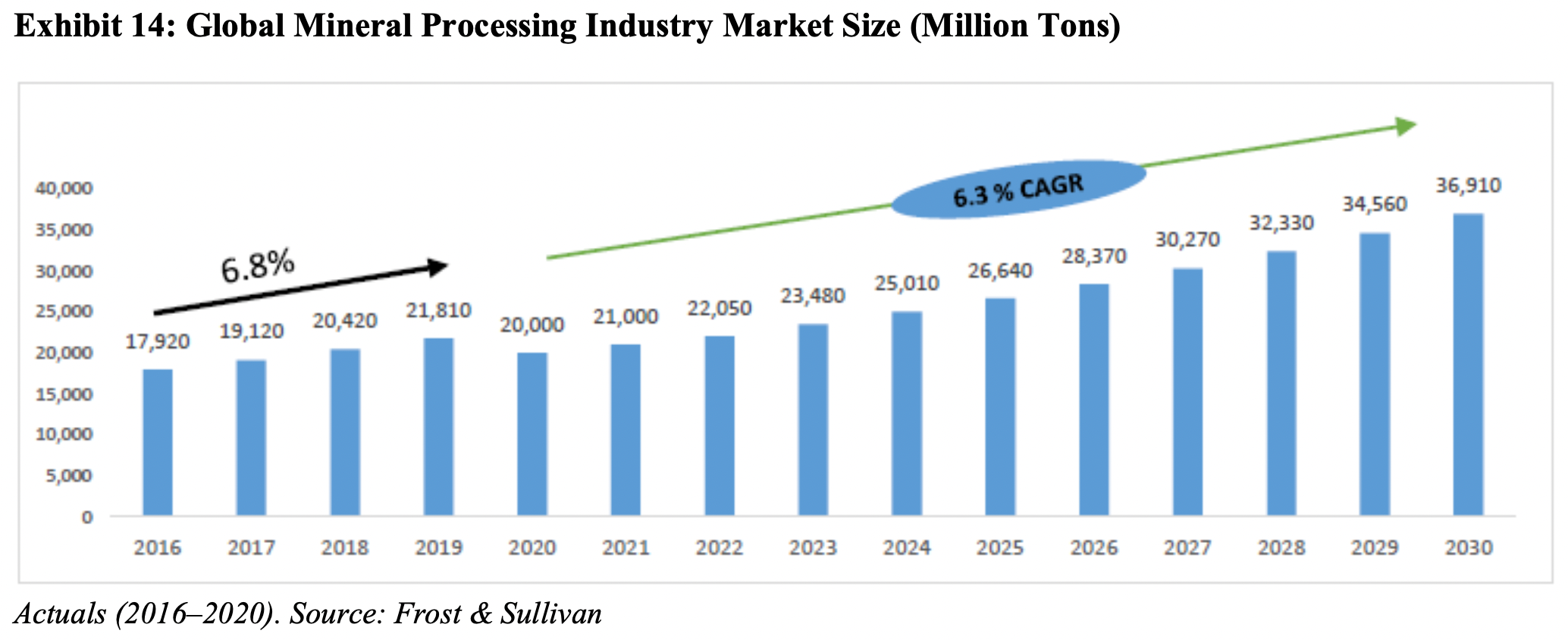

The global screening, crushing and the mineral processing equipment market size had been estimated at $20 billion back in 2020. The market had been flourishing at a CAGR of around 7% until 2019. Owing to the coronavirus pandemic, the overall demand has declined in 2020. The industry is now likely to recover in 2022 and has been forecasted to reach $36.9 billion by 2030 that will be growing at a CAGR of 6.3%.

Overview: Global Mining CapEx

The CapEx spending for the metal ores like gold, copper, iron ore, nickel, coal, zinc and others has been estimated to be $85 billion during 2019. The CapEx spending of gold and copper had been $50 to $55 billion that has accounted for over 60% of the global mining CapEx spending. However, copper has individually accounted for $30-35 billion while gold has reported spending of $25-25 billion. In comparison to all of these, iron ore mining is a more mature industry where the CapEx spending has considerably reduced over the last 4-5 years. Now, the iron ore industry is further impacted through the scrap recycling that has been getting hindered in the global market.

At the same time, coal is also a mature industry and it has been seen that the countries are cutting down the coal consumption specifically in the power sectors. The focus has now shifted to the consumption of clean fuel like nuclear and renewable resources. As zinc and nickel are rare metals, their CapEx spending had been low, as per the (CAPEX S&P Global).

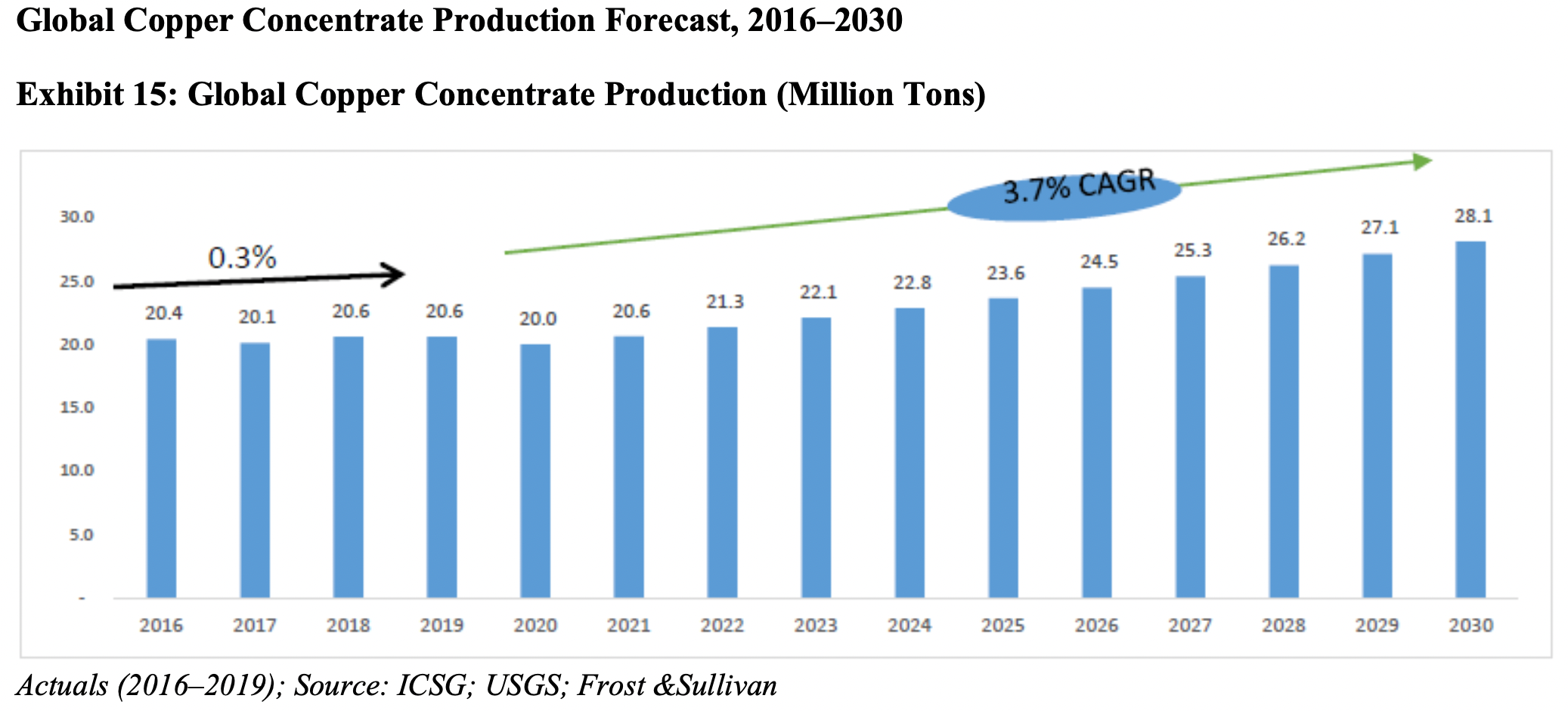

Overview: Global Copper Mining Industry

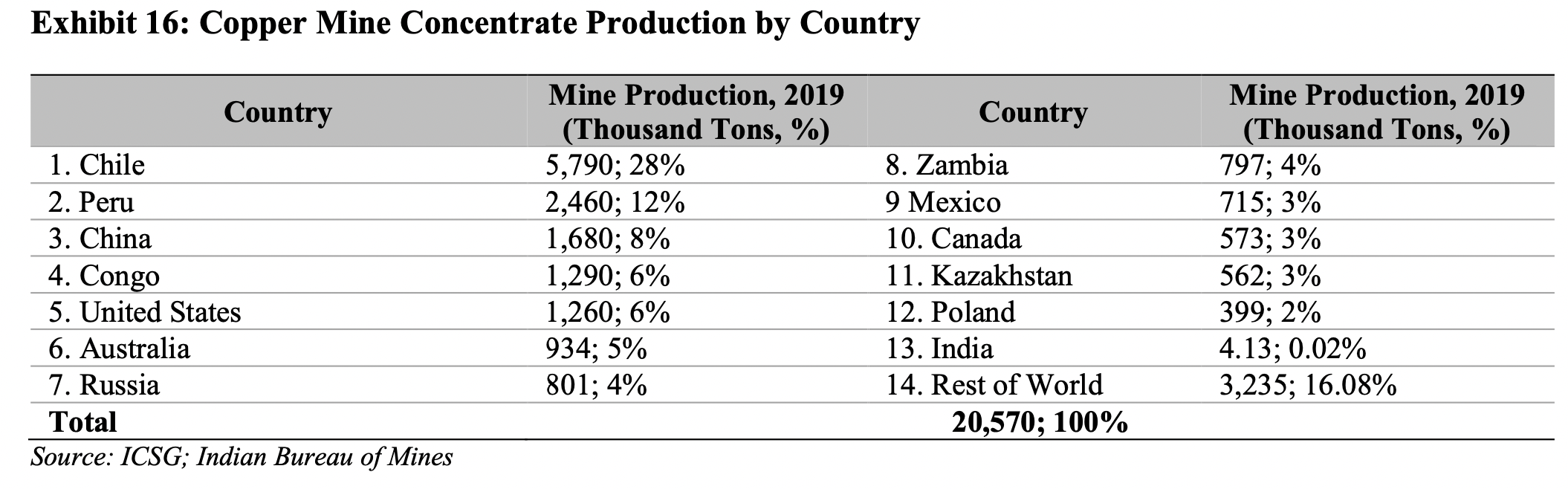

The copper reserves of the world have been estimated to be 870 million tons of the copper content. Chile possesses the highest share that accounts for around 23% of the global assets which is led by Peru and Australia bearing 10% each. While Russia stands at 7%, Mexico and the United states stand at 6% each. Last but not the least, China and Indonesia are at 30% each.

The Company Profile Of Tega Industries

Tega Industries is a leading manufacturer as well as distributor of the specialized “critical to operate” and recurring consumable products for the global mineral mining, beneficiation and bulk solids handling industry, as based on the sales for the calendar year 2020. (Source: F&S Report). On a worldwide basis, they are the second largest producers of the polymer based mill liners as based on the sales for the calendar year 2020. (Source: F&S Report).

The company commenced their operations back in 1978 in India bearing a foreign collaboration with the Sweden based Skega AB. Madan Mohan Mohanka had acquired the entire equity stake of Skega AB in Tega Industries in 2001. The individual promoters of the company are: Madan Mohan Mohanka, Manju Mohanka, Manish Mohanka and Mehul Mohanka. The MD and CEO of the company, Mehul Mohanka has been involved in the company business for the past 18 years and has led the business as a Managing Director and Group CEO for the last 5 years. Back in 2011, the company had received a funding from the Wagner Ltd., which is an entity that has been affiliated with the global private equity firm, TA Associates.

Tega’s product portfolio consists of over 55 mineral processing and material handling products. Considering the average of the past three Fiscal Years that is 2021, 2020 and 2019, the sale of the products comprises 95.08% of their revenue from the operations while their sale of the services and the other operating revenue consists of 2.15% and 2.77% respectively of their revenue from the operations.

The company holds a track record of servicing the leading global mining companies for the longest period. Revenue from the operations from outside India comprises 86.42%, 85.92% and 85.83% of their revenue from operations in Fiscal Years 2021, 2020 and 2019, respectively. In the earlier three Fiscal Years, the company has established its presence in 513, 498 and 479 installation sites in more than 70 countries.

The revenue from the operations outside India comprises South America, North America, Africa and Asia Pacific (South East Asia and Australia), EMER (Europe, Middle East and Russia), that constituted 13.74%, 24.71%, 15.49% 22.62% and 9.85% of their revenue respectively from operations in the Fiscal Year 2021. The company is further expanding their operations in the major markets that includes Australia, South Africa, North America and South America. The company’s focus is on the end-customers such as the mineral processing sites that are involved in the copper and gold ore beneficiation that accounts for 34.92% and 27.25% respectively of its revenues from the products’ sale as an average of the past three Fiscal Years.

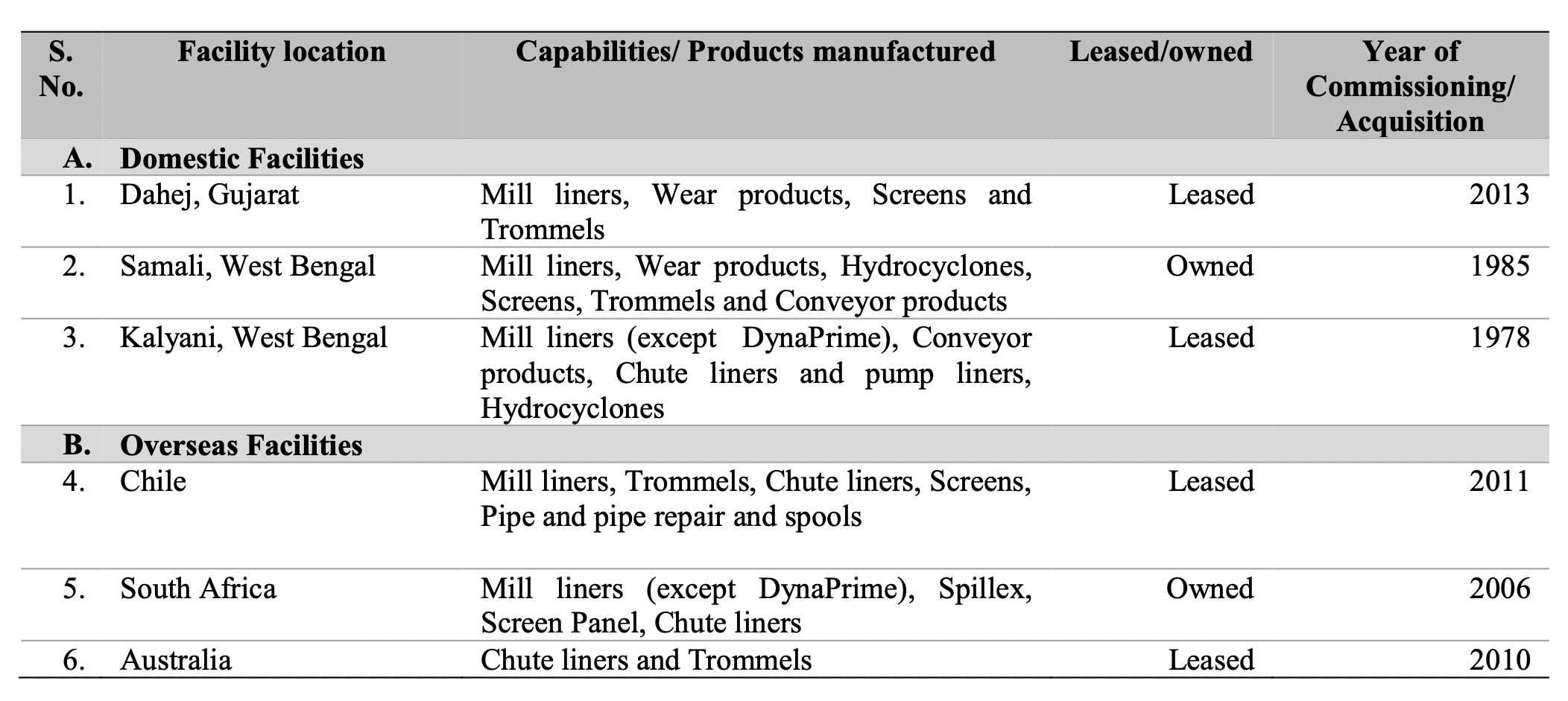

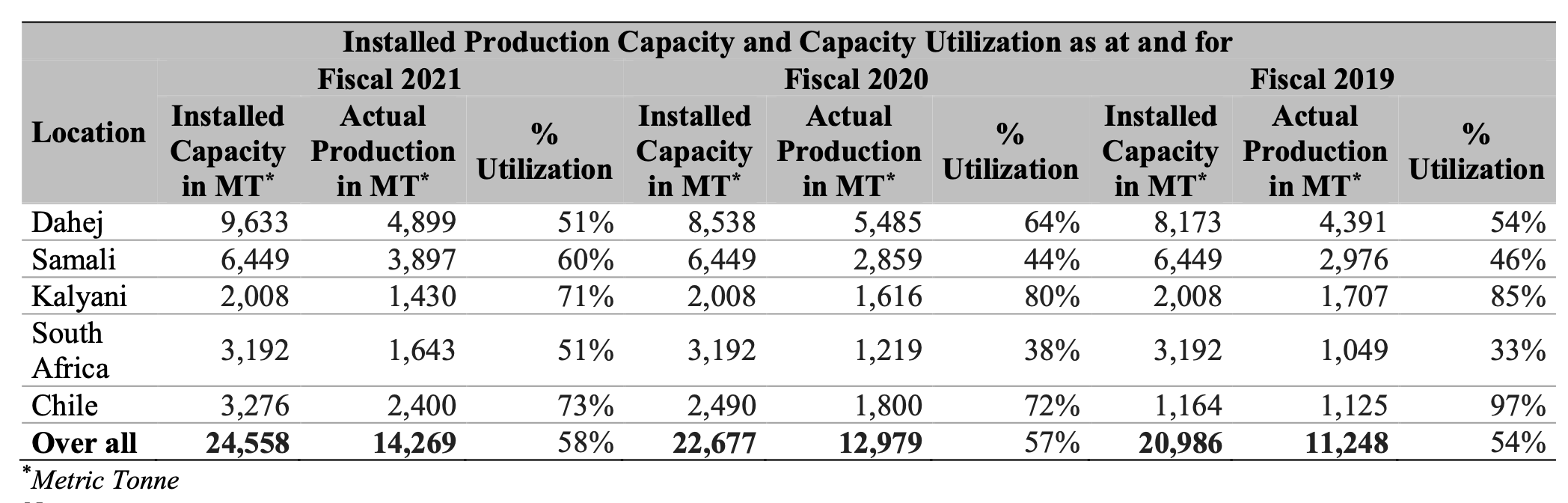

Currently, Tega has six manufacturing sites of which three are in India – one at Dahej in Gujarat and two others are at West Bengal in the locations Kalyani and Samali. The remaining three sites are in the major mining hubs of Chile, Australia and South Africa bearing a total build-up area of 74255 Sq. mts. The company’s facilities in India caters to the overseas and domestic markets across the materials handling and the mineral processing industries.

Their facilities in Australia, Chile and South Africa cater to their respective regional and local mineral processing and materials handling industries. In addition to this, the company’s joint venture in India with the U.K. branch of Hosch Group, Germany has engaged in precision conveyor belt cleaning and serves the various Indian industries. The company also boasts 18 global and 14 domestic sales offices that are located much closer to their key customers and the mining sites.

The Product Portfolio of Tega Industries

The diverse product offering of the Tega Industries constitute the consumables that are required in mineral processing and in the mines. In the usage sequence in the mineral processing value chain following the blasting to flotations, the company’s products include grinding mill liners, chutes and its liners, hydrocyclones, trommels and screens, conveyor products, pumps and floatation parts. The product range of Tega Industries is engineered with the combination of the mineral processing industry, material sciences and mechanical engineering. They utilize their expertise in tribology.

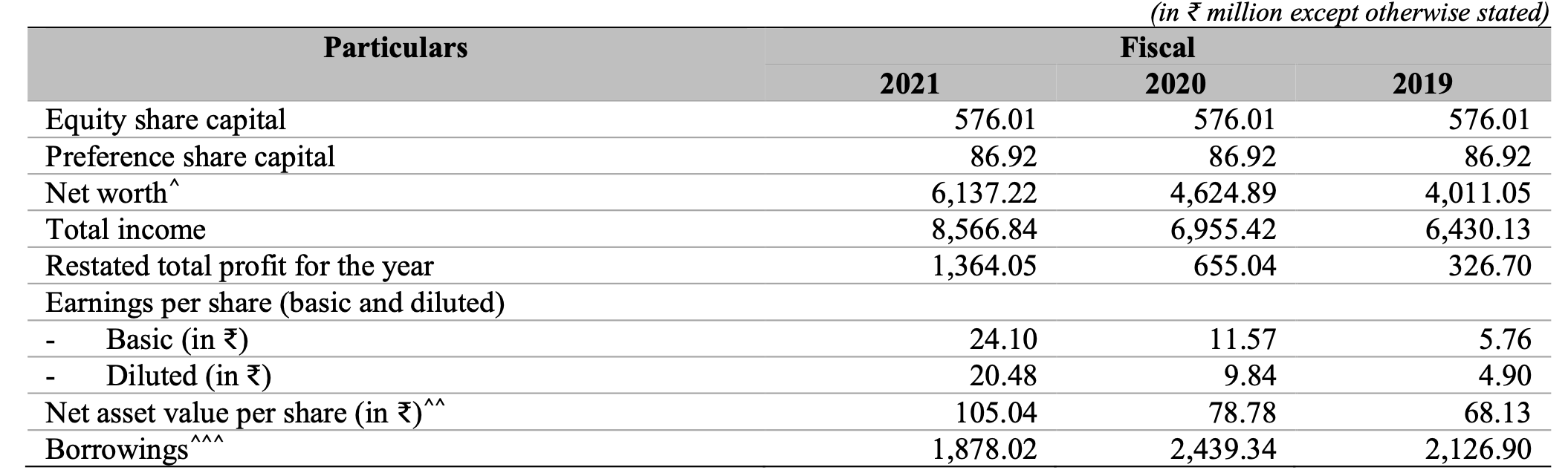

In the Fiscal Years 2021, 2020 and 2019, the company’s revenue from operations had been INR 8,055.22 million, INR 6,848.47 million and INR 6,337.57 million, respectively. The company’s restated total profit for the year was INR 1,364.05 million, INR 655.05 million and INR 326.70 million, respectively. Tega’s EBITDA had been INR 2,386.42 million, INR 1,172.28 million and INR 1,060.03 million for Fiscal Years 2021, 2020 and 2019 that had increased at a CAGR of 50.04%, from Fiscal Year 2019 to Fiscal Year 2021.

What Services Does Tega Industries Offer?

The company’s services segment offers a varied range of services from undertaking the specialized plant audit consultancy service that the company offers to their customers for their classification upgrades and grinding. The company also supplies individual spare parts to the comprehensive solutions that covers the maintenance and the operations. Tega focuses on crafting unique solutions that enhance the performance and the productivity of their customers’ plants and equipment throughout their entire lifecycle.

Tega’s revenue from the sale of services had been INR 131.82 million, INR 133.66 million and INR 191.00 million in Fiscal Years 2021, 2020 and 2019 respectively.

The Manufacturing Facilities of Tega

The following table sets out the details of the manufacturing facilities of Tega Industries:

Who Are There In The Board of Directors Of Tega Industries?

The following are the respected people that occupy the Tega Industries Board of Directors at present.

Madan Mohan Mohanka

He is one of the promoters of Tega Industries. He is also the Chairman and Executive Director of the company. Mr. Mohanka holds a Bachelor’s degree in Science (Engineering) from Ranchi University and as well as a post graduate diploma in business administration from the Indian Institute of Management, Ahmedabad. The best thing is that he has been associated with the company since the company started.

Mehul Mohanka

He is also one of the promoters of the company in discussion. Additionally, he is also the managing Director and Group CEO of the company. He holds a Bachelor’s degree in commerce from the University of Calcutta. He had completed his master’s degree in business administration from the University of Pittsburgh and an advanced management program from the Harvard Business School. Mr. Mehul had been associated with the Indian Chamber of Commerce as a vice president. Additionally, he is also associated with the mining and the construction equipment division of Confederation of the Indian Industry as the chairman. He is also associated with the organization as the co-chair of the national committee on mining. He had also been the Chairman of the West Bengal State Council of the Confederation of Indian Industry. He has been associated with Tega Industries for nearly 20 years and has been instrumental in the diverse functions of the company like the sales and operations.

Syed Yaver Imam

He is the Executive Director of the company and has been designated as the Director of the Global Product Group that he had been pursuant to an agreement dated the 31st of May, 2019 between him and the company. In the past, Mr. Imam had been designated as the Non-Executive Director on Tega’s Board from the 1st of June 2019 to the 31st of March, 2021. The board has also re-designated him as an Executive Director with effect from the 1st of April 2021 in accordance with the applicable law. He possesses a bachelor’s degree in civil engineering from the Jadavpur University and has successfully completed a short term course in mineral processing from the Indian School of Mines, Dhanbad. Mr. Imam has been associated with the company since 2005.

Dhiraj Poddar

He is a Non-Executive Director of the Tega Industries and also a nominee of the Wagner Limited. He holds a bachelor’s degree in Commerce from the University of Delhi and a postgraduate diploma in management from the Indian Institute of Management (IIM) Ahmedabad. Additionally, he has been certified as a Chartered Accountant by the Institute of Chartered Accountants of India. Previously, he had been associated with the Standard Chartered Bank as a director and with the ICICI Securities Limited as an Assistant Vice President of Corporate Finance. He was also associated with the Bharti Telenet Limited and the Gujarat Heavy Chemicals Limited in the past.

Hemant Madhusudan Nerurkar

He is an Independent Director of Tega Industries and has completed a degree course in metallurgy engineering from the University of Poona. He has been associated with Tega since 2014.

Jagdishwar Prasad Sinha

Mr. Sinha is an independent Director of Tega. he holds a Bachelor’s Degree in Mechanical Engineering (Technology) from the Banaras Hindu University as well as a Master’s Degree in the Business Administration from the University of Pittsburgh. He has also successfully completed his term as an advanced leadership initiative fellow from Harvard University. Previously, he was associated with various companies in India and abroad such as The Tata Iron and Steel Company Limited, Tata Timken Limited, Timken India Limited, Schaeffler Technologies AG & Co., Ace Automation Control Equipment Private Limited, Caparo Maruti Limited, and Tudor India Limited.

Madhu Dubhashi

She is an Independent Director of Tega Industries. She possesses a Bachelor’s Degree in Arts from the University of Delhi and a postgraduate diploma in business administration from the Indian Institute of Management, Ahmedabad. Earlier, she had been associated with the Global Data Services of India Limited.

Rudolph Michael Edge

He is an Independent Director of Tega and holds a Bachelor’s Degree in Chemical Engineering (Technology) from the Nagpur University. He had been previously associated with the FLSmidth Private Limited as an Executive Vice Chairman.

Upcoming Tega IPO Offer

Below is the offer presented in the Upcoming Tega IPO.

- Offer for Sale Up to 13,669,478 Equity Shares aggregating up to INR 6192.3 million.

- QIB Category Not more than 6,834,738 Equity Shares aggregating up to ₹ [•] million.

- Non-Institutional Category Not less than 2,050,422 Equity Shares aggregating up to INR 6192.3 million.

- Retail Portion Not less than 4,784,318 Equity Shares aggregating up to ₹ [•] million.

The shareholding in Tega Industries of the promoters include:

- Madan Mohan Mohanka

- Manish Mohanka

- Mehul Mohanka

- Nihal Fiscal Services Private Limited

What Are The Strengths Of Tega Industries?

The following are the strengths of the Tega Industries that might prove to be beneficial in the success of its upcoming IPO.

- The company is the leading producer of the specialized and the critical to operate products bearing high barriers to replacement or substitution.

- The company has been insulated from the mining capex cycles as their products cater to the after-market spends offering recurring revenues.

- The products offered by the company are highly value-added and technology intensive that is backed by strong research and development while focussing on quality control.

- Tega Industries is a long standing market player having marquee global customer base and a rigid global manufacturing and sales capabilities.

Financial Output of Tega Industries

Below chart describes the financial standpoint of the company at the moment.

Verdict

The Upcoming Tega IPO seems to be a win-win. Analysing all the aspects of the company and its IPO offer, it can be stated that the IPO can be subscribed more than 5x-10x. A couple of factors are promoting the winning situation and discussed below.

Tega Industries is a very old company that was established in 1978. Since then the company has been leading the Indian industry. There are no Indian competitors as of now. However, there are a couple of competing companies worldwide that are not that great as Tega. If any company wants to compete with Tega, it has to have a lump sum investment that most of the companies in the field are not ready to make. Tega is also the only provider of the equipment for mining in India. All the PSU companies are very much dependent on Tega for their supplies. The company also has their owned land in West Bengal (Samali) and South Africa, while the other sites are leased for a longer period.

The Board of Directors of the company are well experienced and educated. They possess the capability to lead the company as they have been doing by far. Three of the shareholding promoters viz., Madan Mohan Mohanka, Manish Mohanka, and Mehul Mohanka are family members. There are lesser chances of the company going bankrupt. On the contrary, Tega Industries will see major prosperity as the metal industry and ore industry sees major growth. Considering the financials of the company, it is pretty impressive. So, if you are eager to know if Tega Industries IPO should I buy, here is your answer. The company is good for investments for both speculators and investors. Thus, it is highly advised if you want to go for it.