Upcoming Vedant IPO: How Will The New Manyavar Listings Perform?

- IPO Stocks

Yaseer Rashid

Yaseer Rashid- February 1, 2022

- 1

- 35 minutes read

The Rs 3,149 crore Upcoming Vedant IPO has been announced and it is going to open for the bidders on the Vedant Fashions IPO date, 04th of February, 2022 (Friday). The bidders are eligible to subscribe till the 8th of February, 2022 (Tuesday). The Vedant Fashions IPO price band of the IPO has been fixed at INR 824 to INR 866 per equity share and it will remain 100% offer-for-sale (OFS) in nature.

The public issue is completely an offer-for-sale (OFS) of 3,63,64,838 equity shares by the promoter and existing shareholders. The company focuses on raising INR 3,149.19 crore from its public offer, which is 100% offer-for-sale. As the upcoming Vedant Fashions IPO is completely an offer for sale, the company will not acquire any proceeds from the public issue.

What are the objectives of the issue? The upcoming Vedant IPO aims to make use of the net proceeds for achieving the benefits of listing the equity shares on the stock exchanges and also to carry out the OFS of up to 36,364,838 equity shares by selling shareholders. The Vedant Fashions will permit one bidder to apply for a minimum of one lot and a maximum of 13 lots. Thus, one can invest in this IPO with just an amount of INR 14,722.

The tentative date for the share allocation is on the 11th of February, 2022. The shares of the company will be listed on both the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) likely on the 16th of February, 2022. As per the market observers, Vedant Fashions IPO GMP shares premium has slipped to INR 45 in the grey market on the 31st of January, 2022. Here are the complete Vedant Fashions IPO details.

Clothing Industry Overview

How has been the clothing industry or garments industry doing by far? Well, get to know the overview of the clothing industry in this segment.

The Review Of The Private Final Consumption Expenditure

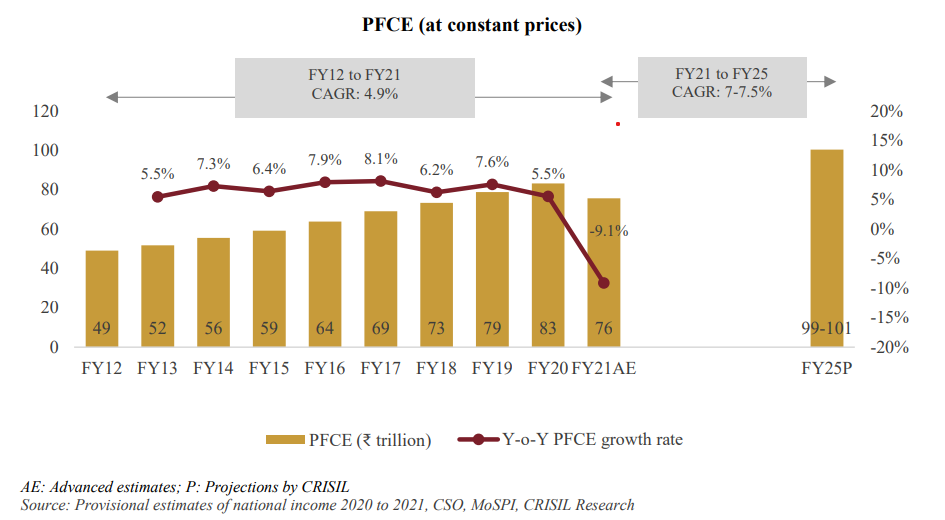

This is the private final consumption expenditure to clock a Compound Annual Growth Rate (CAGR) 7% to 7.5% from Financial Year 2021 to Financial Year 2025. The private final consumption expenditure (PFCE) at constant prices had clocked 4.9% CAGR between the Financial Years 2012 and 2021, maintaining the dominant share in the GDP pie, at 56% or INR 75.6 trillion in the Financial Year 2021.

The PFCE had declined in the Financial Year 2021 to INR 75.6 trillion owing to the Coronavirus Pandemic. In this scenario, the consumption demand had been impacted based on the strict lockdown, limited disposable spending, loss of employment, and the disruption in demand-supply dynamics.

Moving forward, the CRISIL forecasts that the PFCE is likely to grow at a CAGR of 7% to 7.5% over the Financial Years 2021 and 2025. The factors that are contributing to the forecasted growth of PFCE include wage revisions owing to the implementation of the Pay Commission’s recommendations, good monsoons, low inflation and benign interest rates.

The Consumption Expenditure Is Likely To Be Driven By The Discretionary Items

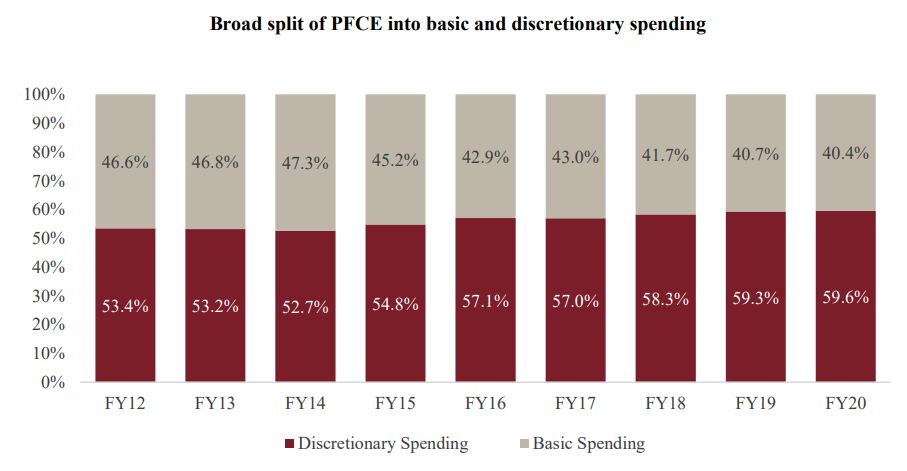

As per the research of CRISIL, the basic items had accounted for 40.4% of the total consumption expenditure of the Indian consumers in the Financial Year 2020. The discretionary items had accounted for the remaining 59.6%. It is noteworthy that the share of the discretionary items in the consumption had increased to 59.6% in the Financial Year (FY) 2020 from that of 53.4% in the Financial Year 2012. The raised spending on discretionary items suggests that the disposable income of households is on the rise.

Footwear & Clothing Expenditure Had Logged Approx 11% CAGR Between The FY 2012 and 2020

The PFCE at the existing rates burgeoned at a CAGR of nearly 12.2% over the Financial Years 2012 to 2020. On further digging, it has been found that the expenditure in clothing and footwear had logged a CAGR of 10.8% during this period. An assessment of the per capita expense on clothing and footwear points out that INR 5,241 had been spent per capita in India just in the Financial Year 2020.

Clothing has accounted for nearly 80% of the total expenses on clothing and footwear at INR 4,190 per capita in the financial Year 2020. Moreover, the per capita expense on clothing has also increased at a CAGR of approx 9% over the Financial Years 2012 and 2020. As the levels of income have improved and consequently the discretionary spending rises, the CRISIL Research anticipates that the expenditure on clothing will also increase further in the future.

Indian Apparel Retail Market: An Overview

Get to know the Indian apparel retail market in the best possible manner.

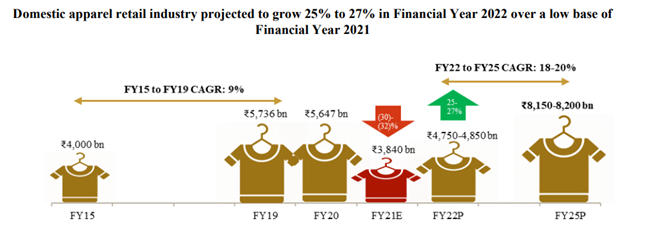

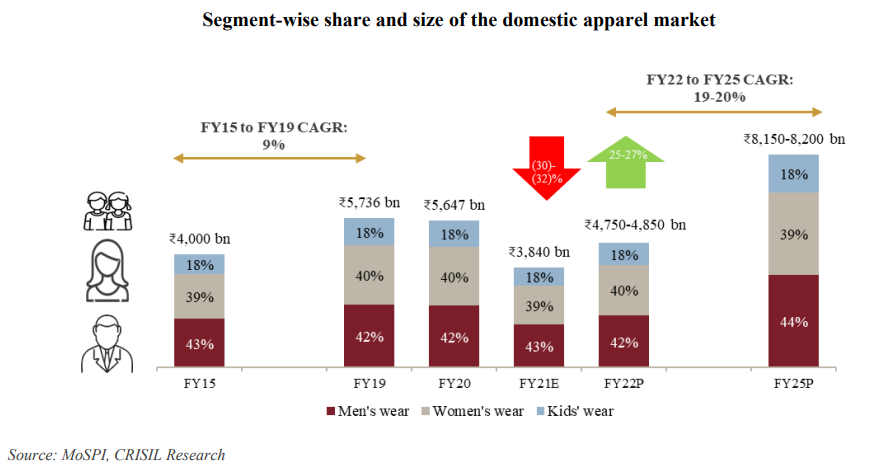

Demand For Apparel Is Anticipated To rebound Sharply In The FY 2022, Supported By A Lively Economy

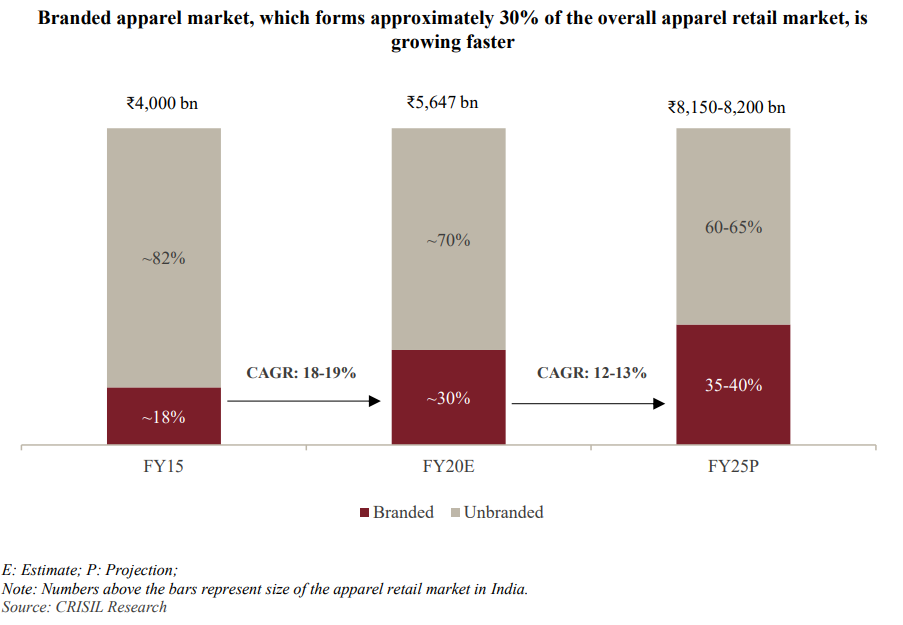

The Ready-Made Garment (RMG) retail market size has been estimated to have grown at a CAGR of nearly 9% to INR 5.7 trillion between the Financial Year 2015 and the Financial Year 2019. Nevertheless, the segment has also faced significant consumption deceleration in the Financial Year 2020. The company had interacted with the apparel manufacturers who indicated that lower inventory orders have been placed by the retailers in the first half of the Financial Year 2020. Therefore, the growth has been estimated to have declined 200 basis points (bps) in the Financial Year 2020.

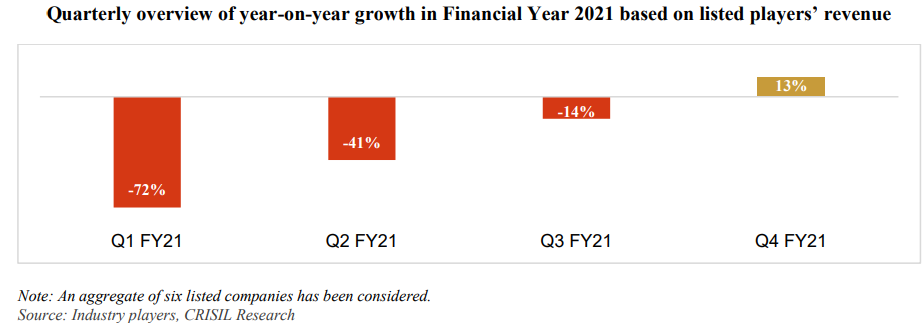

Growth is also estimated to have impacted in the Financial year 2021 owing to the fact that the COVID-19 pandemic had induced the deceleration and also the ban on the sale of the non-essentials in the maximum part of the first quarter. Furthermore, the lower discretionary expenditure and the delays in the mall openings and the lower footfalls had impacted the demand too. The Financial Year 2021 had experienced a decline of 30%-32% owing to the impact of the pandemic.

Factors Supplying To The Growth In Domestic Apparel Retail Market

The long-term growth in the domestic market will be impelled by the rising working population and the income levels, growing preference for RMG over tailor-made garments, and the higher penetration of the organized retail stores and e-commerce.

The Apparel Segments Will Register High Growth Between The FY 2022 And 2025

Men’s Apparel Segment Is Expected To Be Fastest Growing Over The FY 2022-2025

The share of the apparels for men is projected to contribute nearly 44% of the total retail apparel market in the Financial Year 2025.

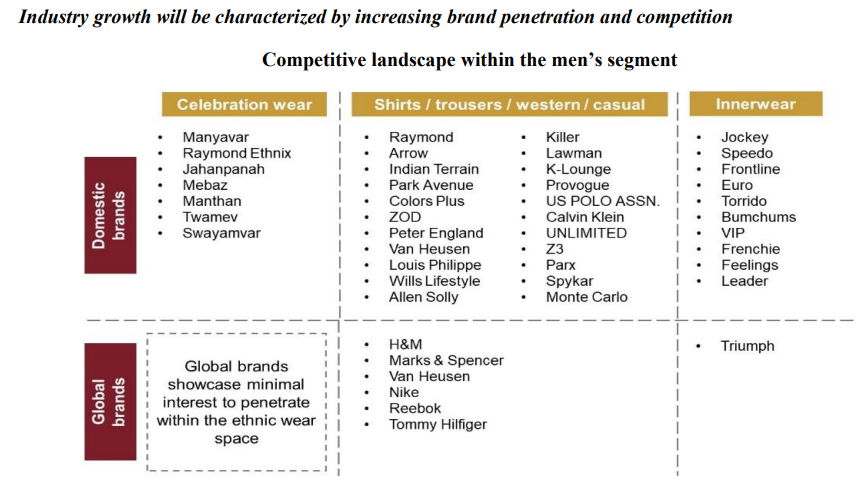

Changing Consumer Lifestyle & A Larger Footprint Will Propel Growth In Organized Apparel Retailing

Business Overview Of Vedant Fashions Limited (Manyavar)

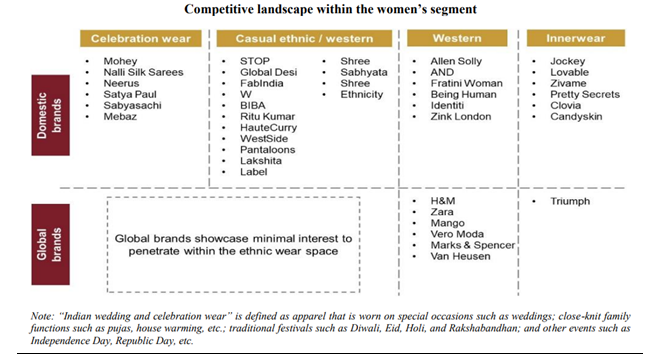

Vedant Fashions Limited has been the largest apparel company in India for men’s Indian wedding and the celebration wear segment in terms of OPBDIT, revenue, Profit After Tax (PAT) for the Financial Year 2020, as stated by the CRISIL Report. According to the report, the “Manyavar” brand is the leader in the category of branded Indian wedding and the celebration wear market having a pan-India presence, as of the financial Year 2020.

The company states that they have established a multi-channel network and has also introduced the brands by identifying the nicks in the under-served and the high-growth Indian wedding and celebration wear category. The company focuses on spreading the vibrant culture of India, the Indian traditions and heritage via their aspirational yet value for money brands at a diverse range of the price points.

They also offer a one-stop destination with diverse product offerings for all the celebratory occasions. The company aims to deliver an aristocratic yet seamless purchase experience to their customers via their aesthetic franchisee-owned exclusive brand stores.

Furthermore, the company is focused on enhancing their leadership position in the organized Indian wedding and celebration wear market as well as establishing their dominance in the premium and the value segments of the Indian wedding and celebration wear market for men via their brands Manthan and Twamev, respectively, and also in the women’s Indian wedding and celebration wear market via their brand “Mohey” that was launched back in 2015.

The company Vedant Fashions Limited mentions that through their diverse portfolio of the differentiated and leading brands, inclusive of their acquisition of Mebaz in the Financial Year 2018, a regional legacy brand catering to the complete family bearing a rich heritage and the established presence in the States of Andhra Pradesh and Telangana.

The company believes that they are able to better cater to the requirements of their customers and the aspirations of the entire family but remain value for money and service the varying financial budgets of their Indian customers. In the Financial years 2019, 2020 and 2021 as well as the three months that ended in June 30, 2021.

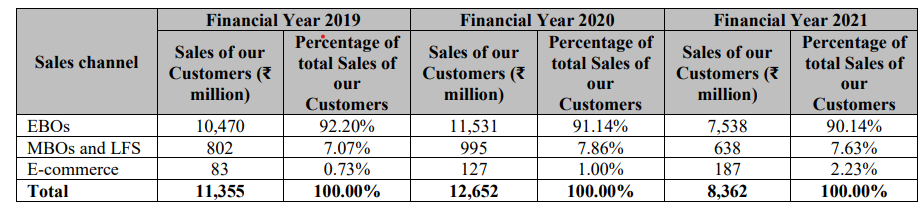

92.20%, 91.14%, 90.14% and 87.79% of the Sales of their customers, respectively, had been generated by the franchisee-owned exclusive brand outlets (their “EBOs”) with the remaining by the multi-brand outlets (“MBOs”), the large format stores (“LFSs”) and online platforms, including their website (www.manyavar.com) and the mobile application.

Vedant states that they are asset-light in respect of their plant, equipment and property that enables them to achieve a high return on the capital employed, basically owing to the nature of their sourcing and manufacturing operations bearing a substantial majority of their sales being generated via their franchisee-owned EBOs.

As a result, the company does not need to invest in developing the manufacturing facilities or a distribution system and by utilizing the economies of scale. They are able to optimize various costs like their production and procurement costs, employee costs and distribution costs, thereby leading to improved profitability.

The omni-channel presence of the company via the EBOs and the online platforms has been designed in such a manner that the products across their brands are made available under one universal platform. Thus, they are able to make their products available to their customers via their preferred mode of payment and shopping.

The success of their franchisee-based model has been proven by the fact that as of the 30th of June, 2021, approx 70% of their franchisees have operated their stores for three or more years, and 61% of the sales of their customers by their franchisee-owned EBOs has been derived from the franchisees bearing two or more stores.

Via their network of over more than 300 franchisees, they possess a track record of commanding a high initial capital commitment from their franchisees. In return, offers all necessary support in connection with the identifying and approving potential locations for all new stores, managing the multi-channel advertising on a national as well as regional levels, the store development and inventory management, supply chain management. The company also offers detailed training programmes for the store staff and the franchisees. They also incur lease costs in connection with the EBOs that are operated by their franchisees on the premises that are leased by them.

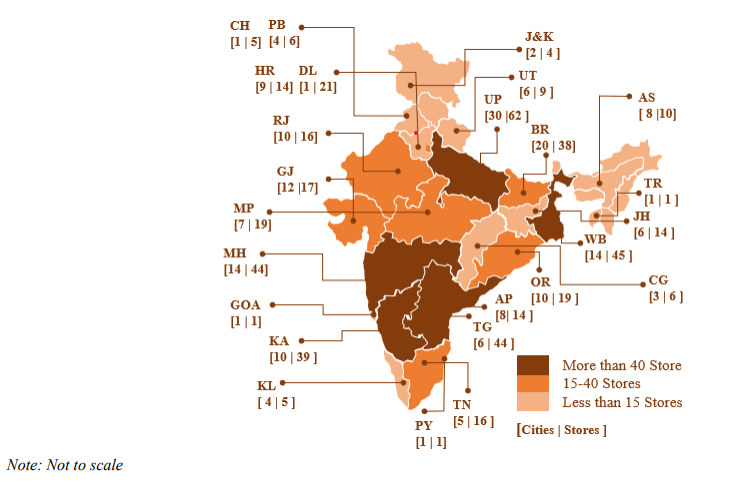

As of the 30th of June, 2021, the company had a retail footprint of 1.1 million square feet covering 525 EBOs including 55 shops in shops that span across 207 cities and towns in India, and the 12 EBOs overseas across the United States, the UAE and Canada. These are the countries having a large Indian diaspora.

For achieving a deeper connection with their consumers, the company utilizes targeted marketing campaigns via the digital and social media, multiplex cinemas, billboards, live events, and television advertisement. Vedant Fashions believe that they have developed a strong brand identity via effective brand advertising and the distinctive marketing campaigns for their brands. The company attempts to connect with their customers at an emotional level via various subtle messages that the customers can easily relate to.

These messages include messaging theme that are completely value-based, embedded around the traditional cultural values like – “Diwali Wali Feeling”, “Shaadi Grand Hogi”, “Pehno Apni Pehchan” “Apno Wali Shaadi” and “Shaadi ka Kharcha Adha Adha”. Some of the campaigns of the company are also based on the specific categories of persons like the groomsmen or specific celebrations and occasions.

The Vedant Fashions Limited is headquartered in Kolkata and is led by their Founder, Chairman and Managing Director, Mr. Ravi Modi, who is a first generation entrepreneur and has proven his flair for the art of brand building as well as retailing with the success of his brands. He is supported by an expert management team whose achievements have been recognized by a number of industry awards that includes the Global Award for Retail Excellence (2020), India’s Retail Champions (Speciality Retail) in 2020, and Best Men’s Ethnic Wear Brand (East) in 2019.

Since 2017, the company has also benefited from the support, guidance and the expertise of the marquee investor, Kedaara Capital, through Kedaara Capital Alternative Investment Fund – Kedaara Capital AIF 1 and Rhine Holdings Limited.

In the Financial Year 2021, 44.22% of the Sales of their customers has been generated by their franchisee-owned EBOs from the Tier-1 cities, 42.05% from the Tier-2 cities and 12.31% from the Tier-3 cities. The remaining 1.42% of the sales of their customers by their franchisee-owned EBOs has been generated from the international markets.

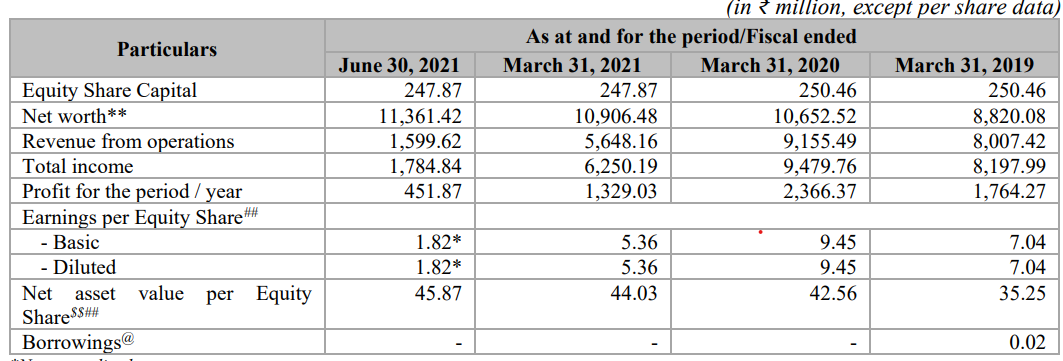

For the Financial Years 2019, 2020 and 2021, the revenue from the operations had been INR 8,007.42 million, INR 9,155.49 million and INR 5,648.16 million, respectively. Vedant Fashion’s EBITDA for Financial Years 2019, 2020 and 2021 had been INR 3,379.54 million, INR 3,987.65 million and INR 2,817.05 million, respectively. The ROCE for the Financial Years 2019, 2020 and 2021 had been 48.24%, 47.80% and 34.07%, respectively.

As per CRISIl, the market for men’s Indian wedding and celebration wear has been estimated to be worth approx INR 133 billion as of the Financial Year 2020 and has been projected to increase to INR 170 billion to INR 180 billion by the Financial year 2025.

Strategies Of Vedant Fashions Limited

The following are the core strategies that Vedant Fashions Ltd. adheres to and believes to have played a great role in their business:

- Expansion of the company footprint within India (pan-India ) and outside.

- Scaling up the company’s emerging brands via increased up-selling and cross-selling initiatives.

- Enhancement of the brand appeal via targeted marketing initiatives.

- Significant potential and space for the growth of the company’s emerging brands.

Upcoming Vedant IPO: Description Of Their Business

As per the CRISIL, the Vedant Fashion’s “Manyavar” brand has been one of the best fashion brands that had pan-India presence as of the Financial Year 2020. The company states that they design, manufacture, market and procurement of a wide portfolio of the ethnic and celebration wear apparel across several brands that the company own.

The company operates a multi-channel retail distribution network across India and also sells their products via the LFS, EBOs, MBOs and the online channel. The company also sells their products in the overseas market via the EBOs and several other online platforms. The below-mentioned table sets forth the sales of their customers, and the percentage of the total sales of their customers contribution from each channel for the Financial Years 2013, 2020 and 2021.

The Brands Owned By Vedant Fashions

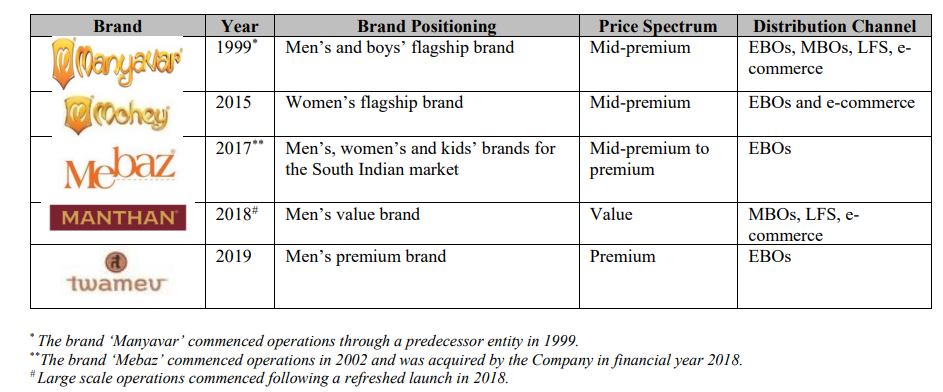

Over the years the Vedant Fashions have established the following brands brands in the men’s and women’s ethnic and celebration wear market:

Manyavar

It is their flagship brand and category leader in the branded Indian wedding and celebration wear market possessing a pan-India presence, as of the Financial Year 2020, as per the CRISIL Report.

Twamev

It is their premium brand in the men’s ethnic and celebration wear market. This brand was launched back in 2019. The products of Twamev are priced between Manyavar and the several other luxury boutique brands. Through this brand Twamev, the company also aims to offer their customers an upscale experience and a premium product.

Manthan

It is the value brand in the celebration wear market for men. The company sells their Manthan branded products via the LFSs, MBOs and the online channels after the refreshed launch back in 2018. The company aims to cater to the demands of a sizeable number of the mid-market weddings and the several other celebrations via this brand.

Mohey

This premium brand had been launched by Vedant Fashions Limited back in 2015 to cater to and develop the company’s presence in the ethnic and celebration wear market for women. As per CRISIL, the Mohey brand is considered to be the largest brand by the number of stores, bearing a presence across India focusing primarily on the Indian wedding and celebration wear market for women, as of the Financial Year 2020.

The Mohey branded products mix comprises a range of sarees and lehengas. The company has planned to develop and grow their Mohey brand for achieving a leadership position of their Manyavar brand in the ethnic and celebration wear market for men.

Mebaz

It is an established one-stop shop heritage brand that commenced its operations back in 2002 and had been acquired by Vedant in the Financial Year 2018. As of the Financial Year 2021, Mebaz possessed a strong market presence in the states of Andhra Pradesh and Telangana, as stated by CRISIL.

The EBO network of Vedant Fashions Limited is integral to their business operations and sales from EBOs comprise the largest portion of the sales of their customers for the Financial Years 2019, 2020 and 2021. They had opened their very first EBO back in 2008 in Bhubaneshwar and as of the 30th of June, 2021, it had an aggregate of more than 1.1 million square feet of EBO retail space across 193 towns and cities in India and 8 cities globally.

The following is a virtual representation of an outlet of their EBO retail network. The below map sets forth the geographic distribution of their EBO retail network across India as of the 30th of June, 2021.

Online Channel

The online channel of the company comprises their website that is www.manyavar.com, their mobile application and the leading e-commerce platforms via which their customers can view their digital catalog, select a product or products from their myriad product offerings and then place an order online.

Awards & Accolades Received By Vendant Fashions

Over the years, the company had received various awards and accolades of which the most notable ones include:

- Retail Marketing Campaign of the Year (Offline) at the Global Awards for Retail Excellence 2020 for our campaign #TaiyaarHokarAaiye.

- Company of the Year (Retail) at the Zee Business Dare to Dream Awards 2019.

- Best Men’s Ethnic Wear Brand (East) – Times Business Awards 2019.

- IMAGES Most Admired Fashion Brand of the Year – Men’s Indian wear 2019.

- Most Admired Fashion Brand of the Year (Men’s Indian Wear) at the Images Fashion Awards, Mumbai 2017.

- ‘Highest JobCreator’ award at the ET Bengal Corporate Awards, Kolkata 2016.

- National Retailer of the Year at the Indian Retail Awards 2015.

Who Are In The Board of Directors Of Vedant Fashions?

The following individuals are currently ruling the Vedant Fashions Board of Directors:

Ravi Modi

He is the Chairman and Managing Director of Vedant Fashions. He had studied Commerce from St. Xavier’s College, Calcutta University. He had been associated with the company since its inception. He possesses over two decades or twenty years of experience in the garment industry. He is responsible for overseeing the designs and the marketing functions of the company in association with the senior management who is responsible for implementing strategy in terms of such functions.

Mr. Modi had been awarded Entrepreneur of the Year in Trading Business – Retailer at the Entrepreneur Awards 2016 that was organized by the ET Now and Franchise India. He had been a finalist at the Entrepreneur of the Year Award, 2016 by Ernst Young. He has also received an award – “Bravery and Entrepreneur Award and Certificate of Honor as the Top Entrepreneur of India by the Parwaz Media Group back in 2015.

Additionally, in the same year, he had also been awarded the Emerging Leader Award at the CMA Management Excellence Awards, 2015. Mr. Modi had also been awarded the Retail Leadership Award at the Awards for Retail Excellence at the Asia Retail Congress organized by ET Now, in 2013 and the Jewels of Rajasthan award in 2012 presented by the Maneesh Media Agency.

The other awards and accolades that he had been honored with includes:

- Young Retailer of the Year award at the Asia Retail Congress, 2012.

- Commended as amongst the Retail Icons of India by the Images Group in 2019.

- Appointed as the co-founder and trustee of Ashoka University.

- Appointed as one of the trustees of the Manas Foundation.

- Recognized by the Forbes India in August 2017 as one of the thirteen business leaders who have built big businesses without relying on the external investors – Bootstrapped Bosses.

- Recognized by several online platforms such as YourStory, International Retail Forum and CEO Insights India for his work.

Shilpi Modi

She is the full-time director of the company. She had studied Commerce from Allahabad University. She had been associated with Vedant Fashions Limited since its inception. Possessing over two decades of experience in the garment industry, she successfully handles the product lifecycle and digital strategy of the company. Together with the senior management of the company, she is responsible for the implementation of the strategy in respect of such functions.

Sunish Sharma

He is a nominee director of the company and holds a Bachelor’s degree in Commerce (Hons.) from the University of Delhi as well as a post-graduate diploma in computer aided management from the Indian Institute of Management (IIM), Calcutta. The IIMC had also awarded Mr, Sunish Sharma the Dr. Jogendra Kumar Chowdhury Gold Medal. He had also passed the final examination that had been held by the Institute of Cost and Works Accountants of India (currently known by the name Institute of Cost Accountants of India). He is a qualified cost accountant.

Earlier he had worked with McKinsey & Co. for six years. When he left the organization, he held the position of engagement manager. He had also worked with the General Atlantic Partners Private Limited for eight years where he was in the position of Managing Director. Additionally, he is the Co-CEO and managing partner of Kedaara Capital. He possesses extensive private equity investment experience in business services and technology, healthcare, financial services and consumer sectors.

Mr. Sharma is also the co-founder of Ashoka University. He had been one of the authors of the NASSCOM-McKinsey Report on “Strategies to achieve the Indian IT industry’s aspiration”. He had been featured on the list of the “Asia’s 25 most influential people in private equity” by the Asian Investor magazine published in the year 2013 and too on the list of “Hottest Young Executives” in the Business Today magazine published in the year 2011. He had also served as one of the directors on the Board of Directors of Spandana Sphoorty Financial Limited.

Manish Mahendra Choksi

He is an Independent Director on the Board of Directors. He holds a Bachelor’s Degree in Chemical Engineering from the Houston University as well as a Master’s degree in Business Administration from the University of Houston, USA. Currently, he is the non-executive director (Vice Chairman) on the Board of Directors of the Asian Paints Limited. He has been associated with Asian Paints since 1992 where he has held several positions across the functional departments.

He is also a member of the board of directors of Unotech Software Private Limited and Germinait Solutions Private Limited. Additionally, he is an independent director on the Board of MSL Driveline Systems Limited. He is also a member of the global advisory board of Chiratae Ventures (formerly known as IDG Ventures India), a technology focused venture capital firm.

Abanti Mitra

She is an Independent Director on the Board of Directors of Vedant Fashions Limited. She holds a post graduate diploma in Rural Management from the Institute of Rural Management, Anand. Her expertise spans over 21 years across various roles. Currently, she is a Director in the Positron Consulting Services Private Limited, that focuses on fund raises (debt, equity and private equity funds), operations and policy reviews and due diligence.

She holds prior experience as a manager at the ICICI Bank Limited and as a management executive at Micro-Credit Ratings International Limited. She is also an independent Director on the Board Of Directors of Spandana Spoorthy Financial Limited and Criss Financial Limited.

Tarun Puri

He is an Independent Director on the Board of Directors of Vedant Fashions. He holds a Bachelor’s Degree (Hons.) in Mechanical Engineering from the Birla Institute of Technology and Science, Pilani, Rajasthan, India, and a post graduate diploma in management from Indian Institute of Management (IIM) Calcutta, India.

He has worked with the Unilever group of companies and Nike, Inc. He served his last position as the Vice President, Global Sales Lead (Women’s) Category Sales at Nike, Inc. and has been associated with Nike since 2007, including being the Managing Director (MD) for Nike India Private Limited. Before that, Tarun had been in Unilever Thai Trading Limited where he served as the Regional Vice President, Hair X Brand, South Asia & South East Asia, based out of Thailand.

Upcoming Vedant IPO: The Offer

The following is the offer for sale (OFS) for the upcoming Vedant IPO:

Parameters |

Details |

|---|---|

|

Issue Size

|

36,364,838 Eq Shares of ₹1 (aggregating up to ₹3,149.19 Cr)

|

|

Offer for Sale

|

36,364,838 Eq Shares of ₹1 (aggregating up to ₹3,149.19 Cr)

|

What Competitive Strengths Of Vedant Fashions Limited Should You Consider?

The following are the competitive strengths of the Vedant Fashions that you must not overlook if you want to purchase the Upcoming Vedant IPO shares:

- The company is the market leader in the Celebration Wear market of India.

- It is the largest and growing Indian wedding and celebration wear market.

- Possesses an omni-channel network of seamlessly integrated business.

- Possesses a technology-based strong supply chain and inventory systems.

- The company comprises an experienced and professional leadership team.

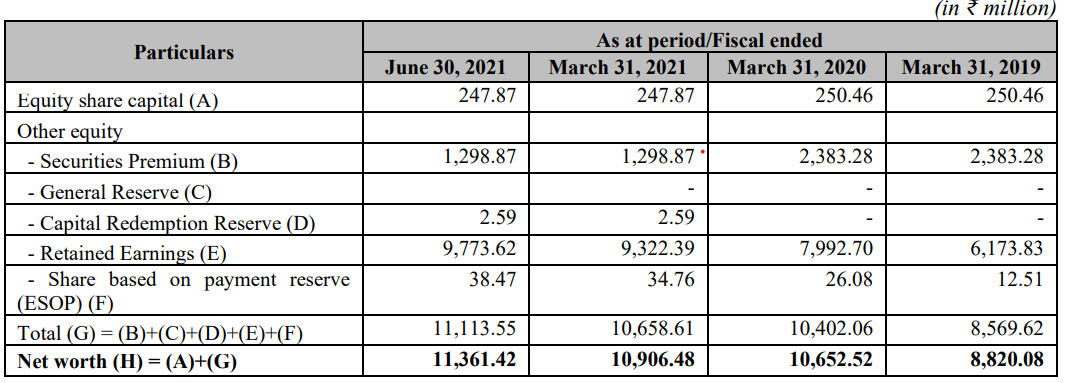

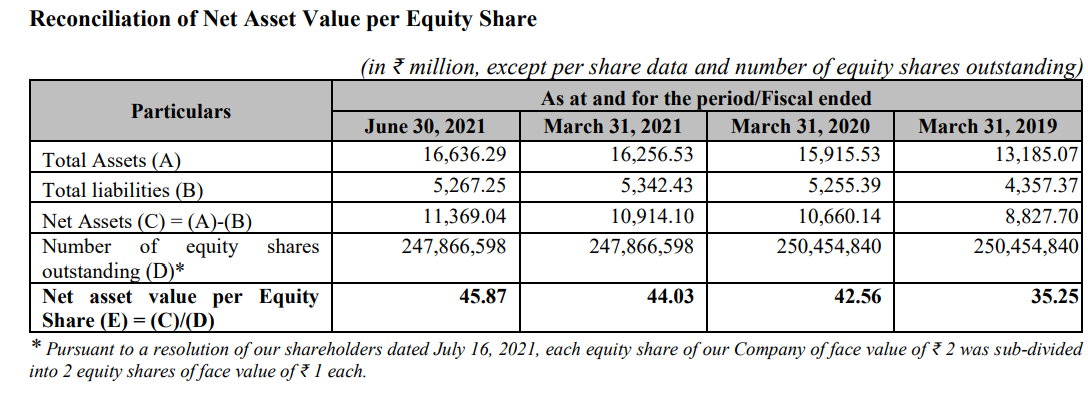

How Financially Strong Is The Company?

The below charts depict the financial strength or weakness of the company:

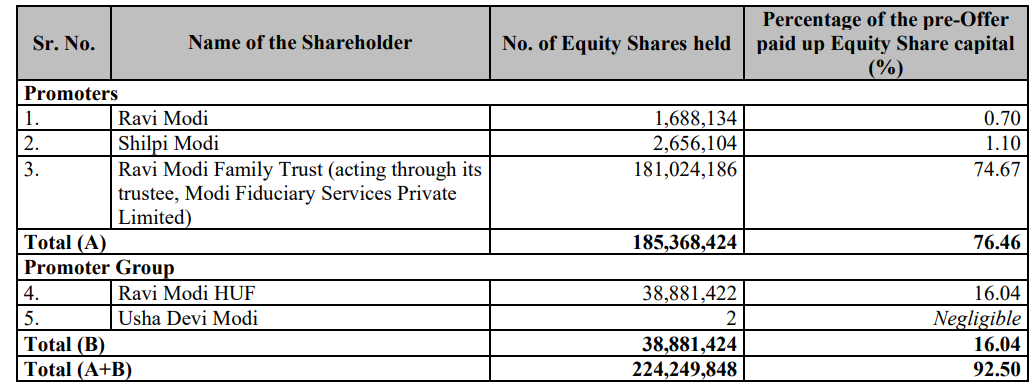

Who Are The Shareholders Of The Company?

Verdict

The upcoming Vedant IPO (Manyavar IPO) seems to offer mixed feelings about its success. It can be anticipated that the IPO may be subscribed 2x-3x or below. The reasons for mixed feelings have been discussed next.

Vedant Fashions Limited is a family based company which means that most of the individuals in the Board of Directors (BOD) belong from the same family. There are a couple of independent directors in the BOD, but the decision making probably is mostly done by the directors who are family members.

Coming on to the work of the company, the company is indulged in seasonal based work which mostly revolves around various celebrations pan India. Thus, they attract people only during the festivities and that is the only time they are actually making money. Considering investment, the company offers both low returns and low risk for investing.

One of the great things about the company that has been seen is that the company is continuously striving to expand its outlets. The company has a good grip over India in terms of its outlets and additionally, it is also looking forward to expanding its business. Out of all the sub-brands that it has launched, most of them mainly focus on men’s wear.

Moving on to the prices, the products are not at all from the affordable range. Prices of each product are pretty expensive and thus are not at all pocket-friendly for the low to average salaried persons. From this, it can be stated that Vedant Fashions is originally selling brand not clothes.

The Balance Sheet (Financial) seems pretty decent where the Equity Per Share (EPS) is also good. However, it is not at all good for the listing gains.

1 Comment

nice post very helpful